The downward trend is still dominating. Keep an eye out this week for the US CPI and the Fed. Meeting.

Gold took advantage of better-than-expected employment data in the US market last Friday, finally escaping the 2020-40(1) zone. The price hit a daily low of 1994 and closed at 2004 before the weekend, experiencing a $24 drop throughout the day.

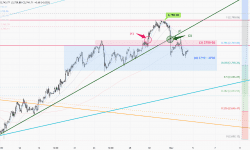

1-hour chart – After experiencing extreme volatility last Monday, gold prices have been claimed throughout last week. Following the 2020(1) support level breach, prices have stepped to the next range of 2000-20(2). The support level is now at 2000, with a short-term rebound target around 2018-20. Until a bottoming signal emerges, the initial downside target is around 1980, with the key focus on Wed’s Federal meeting.

Daily chart – After breaking out of the ascending channel (4) last Friday, we can expect a round of selling in S-T. The resistance is currently at 20 MA(5), while the downside target is around 1978(7) for a 50% retracement. Last Monday’s topping signal(6) continues to dominate the daily chart trend and needs to be digested further in the market. The basic structure needs to be adjusted toward near 1910-40.

|

S-T ressitance 3 |

2047 |

|

S-T ressitance 2 |

2038-40 |

|

S-T ressitance 1 |

2030-31 |

|

Market price |

2021 |

|

S-T support 1 |

2017 |

|

S-T support 2 |

2007-10 |

|

S-T support 3 |

2000 |

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.