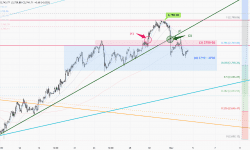

After reaching a new high of 2195, the gold price stayed sideways between 2155-85(1) last week. This week’s only major event will be the Fed meeting. Following the slight rebound in US core CPI data last week, expect the post-Fed meeting announcement to lean towards a hawkish stance, which could have a bearish impact on the gold price.

1-hr Chart – The gold price is still bounded within the range of 2155-85 (3), and it is currently trading under the S-T resistance line (2) that has been in place for the past few trading days. If the critical support level of 2147-2150(1) is breached, the next downside target can be set around 2120(4).

Daily Chart – Structurally, there hasn’t been any significant change on the daily chart, with the upward channel(5) remaining valid. The gold price is still standing above the previous high of 2147(7). If the buying support from the previous high of 2147(7) is cleared, a major correction toward 2120 should occur and pay attention to the next support at the 20-day MA(6).

|

S-T ressitance 3 |

2168 |

|

S-T ressitance 2 |

2160 |

|

S-T ressitance 1 |

2155 |

|

Market price |

2152 |

|

S-T support 1 |

2147-50 |

|

S-T support 2 |

2140 |

|

S-T support 3 |

2130 |

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.