There Is Hesitation In The Gold Price Trend

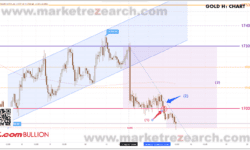

On Friday (July 23) Asian market in early trading, gold is now reported at around US$1,808 per ounce. Gold prices closed at US$1806.50 per ounce on Thursday, an increase of US$3.14 or 0.17%. The European Central Bank’s easing stance has boosted gold prices. Gold prices fell to a low of 1,792.65 US dollars per ounce on Thursday, but then rebounded strongly from the low by more than 15 US dollars to a high of 1808.03 US dollars per ounce. The European Central Bank announced on Thursday that it would maintain its monetary policy unchanged. However, the central bank revised its forward-looking guidance on interest rates and adopted a more dovish stance to achieve its inflation target. An analyst on a well-known financial website wrote an article to analyze the short-term prospects of gold prices. In the article, he explained that the near-term prospects of gold prices remain neutral and have a slight downward trend because gold prices are closer to the key support zone rather than the resistance zone. At the same time, the relative strength index (RSI) on the daily chart continues to be flat around 50, confirming the indecision of gold trend. On the downside, the first support for the price of gold is at the level of $1,800 per ounce, and then at $1,790 per ounce (100-day moving average).

The European Central Bank Keeps The Status Quo Unchanged

The European Central Bank kept the three key interest rates unchanged and revised its forward guidance to reflect expectations of rising inflation, while maintaining the scale of its asset purchase plan. President Lagarde said that the inflation outlook is still far below the target, and the inflation rebound is expected to be temporary; the forward-looking guidelines will be adjusted to emphasize the commitment to maintain an easing stance.

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。