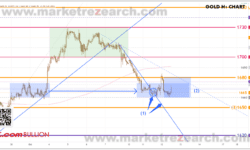

上週三跌穿1843前底後,週四美盤回測此區域再跌至上週低位1819。1825這區域在4H圖都算是明顯的互換位,所以在週五美盤出現了一段向上反彈的力量,去到1847前高附近後,昨天美盤在升段的0.618反彈,不過仍未能升穿此區打破結構。15M圖看見週初在1830-1847 內橫行震盪,急升急跌後做出收窄三角,巿場未有明顯方向,都是要等爆邊企穩才可確定。雖然原先方向是向下,但始終在4H級別的支持位反彈,價格有機會彈高少少才延續下跌,所以本週佈署可留意三個位,1830/1847/1860會否有力量反彈。假若今晚直接打穿1830橫行底,要小心是否假突破,就算想向下做淡,最好等企穩或明顯打穿1825這區域會較好。近期阻力183718461860近期支持18301825-18201812K.Lam

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

黃金基本面前景:

週一: 美國股市和債市將因總統日休市,交易活動可能繼續低迷。

週二: 標普全球將發佈美國2月份製造業和服務業PMI初值。這兩個行業的總體採購經理人指數(PMI)預計將上升,但仍低於50,

週三: (週四凌晨)美聯儲將公佈上次政策會議的記錄。值得關注的是,一些政策制定者是否認為美聯儲有必要重新考慮加息50個基點, FEBWATCH目前顯示加息50個基點的概率正在增加。

週四: 公佈對第四季度國內生產總值(GDP)的第一次修正值。及美聯儲首看的通貨膨脹指標–個人消費支出物價指數(PCE),將受到投資者的密切關注。如果開高,會令市場預期美聯儲加大加息力度,這會使金價進一步下降。

CFTC倉位分析:

本週CFTC數據遇上駭客襲擊仍未更新。已經連續第三週仍未修復。

CME FEBWATCH:

根據芝加哥商品交易所集團(CME Group)的美聯儲觀察工具,市場預期3月22日政策會議後加息25個基點的概率降至81.9%,加息50個基點的概率升至18.1%。

週一:

美股今日休市,沒有關鍵數據

週二:

22:45 美国2月Markit制造业PMI初值

22:45 美国2月Markit服务业PMI初值

週三:

沒有關鍵數據

週四:

03:00 美聯儲公佈2月貨幣政策會議紀要。

06:30 FOMC永久票委、紐約聯儲主席威廉姆斯就遏制通脹問題發表講話。

21:30 美國至2月18日當周初請失業金人數(萬人)

21:30 美國第四季度實際GDP年化季率修正值

週五:

23:00 美国2月密歇根大学消费者信心指数终值

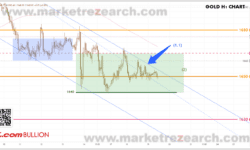

上週佈署價格若回到1896-1900後出現發力反彈,價格便大機會延續跌勢,找尋阻力位做淡會有利。結果週四美盤升穿1886的雙頂去到1890後,馬上出了大陰燭,吞沒了整支陽燭(1H 圖)。雖然比預期早了發力反彈,但出現這個轉勢訊號,其實已經可以確認回調完結,繼續做淡。5M 圖可看見大陽燭升穿1886後,因為阻力變支持,拉回1886並出現短暫停頓,之後再大陰燭跌穿。進取的交易者應該這裏便進場了,但若想等方向更明確的話,可等價格跌穿1880打破結構。上方入不到巿的話,到了週五歐盤也有另一機會,價格回到上升通道底加前底的互換附近,出現了一段反彈力量,在美盤時段回調到該跌段0.618加前底阻力時,也是一個好時機。(15M 圖)週五反彈後出現收窄三角沒有明確方向,直到昨天星期二晚CPI公佈後,價格出現較的震盪,在1843-1970出現了幾次急升急跌。從圖表上亦可看做上破下跌通道後又馬上拉回,方向仍是睇跌為主,但由於早前震盪較大,TP不宜過遠和以保護倉位為主。現價剛穿了1850,可留意1853,1850有沒有機會,若價格未打穿通道就發力反彈,可能仍會在道震盪。近期阻力18531860-186118651870近期支持18501840-1843K.Lam

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

黃金基本面前景:

美聯儲官員的較鷹派講話,導致上週黃金和美股都走低。惟俄烏戰火可能重燃,導致金價始終未有大跌,及得以站穩。

本週最重要的數據是週二晚9時半公佈的CPI,市場預期調低至6.2%。其實近數次的CPI走低,都受到同比的基數效應所影響(即去年同期的CPI都相對較高),調低市場預期,意味著公佈的數據好於預期的機會減低。因此,若出現差於預期的CPI,市場會認為美聯儲延長加息週期的可能性較高,即會導致金價受創。

另一方面,俄烏戰火可能重燃導致金價的不確定性增加。但傾向利好金價。

因此,本週的金價,週一、二(CPI數據前)相對波動較少。

在CPI公佈後,宜低位吸納。

CFTC倉位分析:

本週CFTC數據遇上駭客襲擊仍未更新。已經連續第二週仍未修復。

筆者感覺是次駭客襲擊時間上的呼合,可能和俄烏戰火可能重燃有關,因此,估計黃金和原油的好倉會增加。

CME FEBWATCH:

根據芝加哥商品交易所集團(CME Group)的美聯儲觀察工具,市場預期3月22日政策會議後加息25個基點的概率高達90.8%,加息50個基點的概率有9.2%。

本週關鍵價位:

1833.5-1856.8-1864.5-1886-1900-1906

週一:

21: 00 美聯儲理事鮑曼在銀行業大會上發表講話。

週二:

21:30 美國1月未季調CPI年率

週三:

00:00 2023年FOMC票委、達拉斯聯儲主席洛根出席一場活動的問答環節。

00:30 2023年FOMC票委、費城聯儲主席哈克就美國經濟前景發表講話

03:05 FOMC永久票委、紐約聯儲主席威廉姆斯在紐約銀行家聯盟的活動上發表講話。

21:30 美國1月零售銷售月率

週四:

21:30 美國至2月11日當周初請失業金人數

21:30 美國1月PPI年率

週五:

沒有關鍵數據

上週初由上升通道演變做橫行,加上開始出現LOWER HIGH ,動能明顯衰減。到週二歐盤時向下跌穿橫行和上升通道底部,但美盤時段到了1900後突然發力抽上,去返上升通道頂再發力反彈向下。1900會有這反彈力量,可能這位置是其中升段的0.618, 明顯的支持阻力互換位和價格是齊頭數的關係。反彈後亦變了一個闊版的上升通道,可能因為這幾個條件,所以有不少交易者在這位置佈署買升,做了一波上升的力量。

到了週四美盤時段,

大陰燭跌穿前底打破結構,回測了前橫行底再發力向下,打破了很多重要

支持位。現在方向已變得明確,尋找阻力位做淡倉會較為有利。現價1875,仍在小型上升通道中震盪,本週佈署可留意1896-1900這區域的阻力,這是最近跌段的0.618和前底阻力位,另外是1910的下跌發力位加上升通道底。假如這兩個位出現發力反彈下跌,有機會延續跌勢。

近期阻力

1886

1896

1900

近期支持

1862

1850K.Lam

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

黃金的價格在森林體系崩潰後表面上已經和美元沒有關系,但是當美元作為國際上最常用的結算貨幣時,國際上絕大部分貿易包括黃金都是使用美元結算的,所以黃金在一定程度上依然受到美元匯率變動的影響,當美元匯率上升時黃金價格有一定機率會受壓下跌;而美元的匯率受到其國內的經濟狀況和國際貨幣市場的影響。美國國內經濟狀況可以透過其公佈的主要經濟指標來了解,公佈的主要經濟指標包括:國民生產及收入,工產生產及訂單,就業與失業等等。各種數據的重要性取決於當前市場的焦點。市場並不會只關注一樣數據,在不同的時間市場的焦點也不相同。在以往的匯率市場一些貿易數據比較受到關注,如凈資本流入、國內生產總值等。但現時部份數據的影響力已經大減,因為美元憑藉自己作為國際結算貨幣來瘋狂印錢,使投資者漸漸發現其實有很多的經濟數據並不會真正影響到市場。屢創新高的貿易赤字和凈資本流入也未能提供炒作的餘地,因為大家都不意外會出來這樣的結果。現在市場上依然有參考價值的指標是與通貨膨脹有關的數據如消費者物價指數、生產者物價指數等。美國非農數據是除了通脹外可以對黃金價格造成最大影響的數據;美國非農業人口就業數據是就業報告的一種,可以反映出當時製造行業和服務行業的發展及其增長。非農與黃金之間存在一定程度的負相關關係,因為數據能夠反映出美國的勞動力增長規模,所以美聯儲在實施貨幣政策時會把這數據作為參考因素之一。此報告會在每月的第一個星期五由勞工部公佈,一般用來當作當月經濟指標的基調。美國非農數據公佈前,市場會在計算後得出下次公佈數據的預期值和有可能的前值修正。在新公佈數據的實際數值是否符合預期以及和前值對比,會對黃金及美元造成不同的影響。以下為各個經濟情景:

情景

美元指數

黃金價格

Gold traded in a tight range yesterday. The overall daily movement was pretty much like the day before – pulling back before the day’s end.; the price climbed to the day-high 1660 in the early session and retraced back to the opening price of 1650 before the day’s end.

The S-T trend is still controlled by the S-T downtrend resistance (1.1) that was mentioned yesterday. Overall, the market is bearish. However, the short-selling before 1650 is still relatively weak. Due to the lack of momentum, expect the price to remain within 1640-65(2) until it escapes.

The pullbacks before the day’s end on the second consecutive day have created another bearish signal on the daily chart. Wait for the signal; a new round of selling should only begin if the price close below 1650 on the daily chart; before that, the price should continue to wander around 1650.

S-T Resistances:

1665

1660

1655

Market price: 1651

S-T Supports:

1650

1645

1640

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。

Gold had pullback before the day’s end yesterday. The market opened at 1642 back from the weekend. The price has kept moving higher in the Asian and European sessions. It hit the day-high 1668 at the US session opening, then the price retraced. The day ended at 1650, up by USD8 after all.

The downtrend on the 1-hour chart slowed down yesterday after the price jumped above the trendline(1), shifting the S-T downtrend from (1) to (1.1). Before the next break, expect the price to settle in between 1640-65(2) for now.

Overall the trend is still bearish, and a new bearish signal(3) has appeared after the pullback from 1668 yesterday. The resistance at 1665(4) & the 20 days MA(5) are blocking all the climb for now. Once the price clears the support at 1640, gold should be able to consolidate further.

S-T Resistances:

1670

1665

1660

Market price: 1659

S-T Supports:

1655

1650

1645

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。

Gold touched a new 1-week low yesterday. The day began at 1667, and the price was traded between 1660-71 throughout the Asian & European sessions. A rapid jump to the day-high 1684 occurred at the US session, but the price got pull-back led to the day ending at 1665, down by USD 2.

The S-T selling trend originated from 1710 has ended yesterday after the price climbed above the downward trendline(1). Waiting for the US Fed. Minutes later today, the price is settling in a tight range between 1660-80(2).

Gold’s pull-back from 1684 yesterday has created a selling signal(4) on the daily chart. The trend on the daily chart remains bearish, and the resistance at the 20-day MA(5) remains in effect.

S-T Resistances:

1680

1676

1670

Market price: 1667

S-T Supports:

1665

1660

1655

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。