Canada’s Wildfires Caused Timber Futures To Surge More Than 7% On Wednesday

According to media reports, British Columbia, Canada, entered a state of emergency at midnight local time on the 20th due to raging wildfires. As the province is the largest timber export province in the United States, the market is worried that the wildfire may have an impact on timber supply. Timber futures, which have been “declining” recently, soared by more than 7% on Wednesday to US$584.50, a record of 2020. The biggest one-day increase since April in late June, due to the impact of the fire, the two main railways in British Columbia were temporarily interrupted. The two railways lead to the Port of Vancouver and are mainly responsible for transporting export goods. Although the railway has returned to normal at present, the railway operation is very slow, which may affect the American timber supply side. Canadian forestry company Canfor said that due to the extreme wildfires in western Canada affecting the supply chain, the company will reduce the capacity of Canadian sawmills starting Monday.

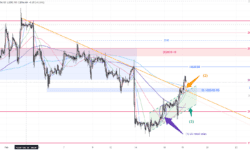

The Price Of Gold May Fall By Another 30 Dollars

On Thursday (July 22) in the Asian market in early trading, spot gold has just declined short-term, and the price of gold is approaching the $1,800/ounce mark, and currently the lowest is hitting $1800.05/ounce. A well-known financial information website recently wrote an article on Thursday to conduct a forward-looking analysis of the gold trend in the day. On Wednesday (July 21), the price of gold fell to a low of more than a week for the second consecutive trading day. Due to the recovery of risk willingness, the stock market and US bond yields rebounded, inhibiting safe-haven buying of gold. Spot gold closed at US$1803.36 per ounce, down US$6.80 or 0.38%. It was written in the article that the price of gold once touched $1,79.00 per ounce on Wednesday, but found solid support in this area. The financial information website said that it is currently waiting for the price of gold to fall below $1,787.00 per ounce. If it falls below this level, the price of gold may fall further to the next bearish target of $1,770.00 per ounce.

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。