Fundamental Analysis for the Week of May 17th – 21st:

1. Expectation towards inflation has basically been fully reflected in the market, therefore should not continue to support the price of gold at its current level.

2. The Fed is less likely to change its easing policy, so there should be more stability in the market.

3. The Dollar Index is currently stable, and as the monetary easing policies maintain for further periods, it may continue to trend down, providing short term support for gold.

4. In terms of the epidemic in India, as the market continues to digest its effects on the Indian economy, if there is a decline in the number of daily new cases of Covid-19, market participants will favour riskier assets, and thus the momentum for a gold price increase will weaken.

Based on the factors above, we expect high volatility for this week. Long positions should be adjusted to control the overall risks.

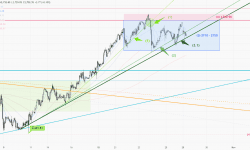

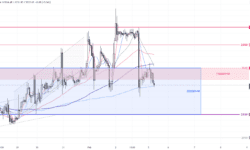

Fundamentals will dictate the gold price for this week, and both fundamentals and technical factors should be taken into account during the latter half of the week. On the upside we see 1,850 as an important level while investors should pay attention to the 1,820 and 1,800 levels on the downside.

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。