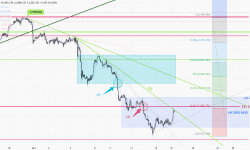

Spot gold closed at US$1815.25 per ounce, down US$21.85 or 1.19%. The highest intraday hit US$1843.58 per ounce and the lowest US$1813.13 per ounce. As of Tuesday, gold prices have risen for five consecutive trading days, which is the longest rise since January 5. Excluding the volatile food and energy prices, the core CPI increased by 3% over the same period in 2020 and 0.9% month-on-month. Higher data may put pressure on the Fed to raise interest rates early, and this concern has led to a sell-off of interest rate-sensitive technology stocks this week. The report should be good for gold prices, because gold is seen as an inflation hedge; however, some analysts pointed out that rising inflation may force the Fed to raise interest rates faster than expected.

The U.S. Energy Information Administration (EIA) announced that crude oil inventories fell by 427,000 barrels last week, compared to the market’s original forecast of 2.817 million barrels. During the period, gasoline inventories increased by 378,000 barrels, which is expected to decrease by 600,000 barrels. As for distillate oil inventories, a decrease of 1.733 million barrels is expected, and the market is expected to decrease by 1.08 million barrels. In addition, the United States imports an average of 5.5 million barrels of crude oil per day, an increase of 37,000 barrels on a weekly basis. Although the decrease in US crude oil inventories was lower than expected, it had little impact on oil prices. Oil prices in New York temporarily hovered at the level of US$65/barrel.

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。