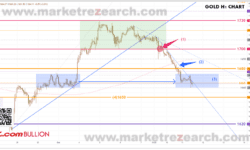

Gold rebounded from the new 2-year low. The price has been consolidating during the Asian and European sessions after the market opened at 1628 yesterday. Once the news from BOE hit the market, the surge began. At the US session opening, buying came into the market and cleared the resistance at the trendline(1). The price jumped to the day-high at 1662, with the day ending at 1659, up by USD 31.

The S-T bearish trend has ended as the price trades again above the critical 1650 support. Before it clears the current resistnace at 1660, the price is now trapped in the tight range of 1650-60(1). If the market picks up the bullish momentum later in the European and US sessions, the upside target can again be set at the upper limit of the 1660-90 range.

The gain yesterday formed a clear reversal signal. The following key resistance is now sitting at 1665(4); once it’s clear, the upside target can be set at the upper limit of the downtrend channel(5) or the 20-day MA (6).

S-T Resistances:

1676

1665

1660

Market price: 1653

S-T Supports:

1650

1640

1630-28

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.