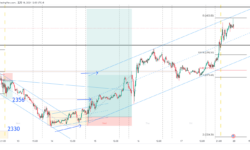

国际金价上周初突破前高2431,在周一亚盘创出历史新高2450,但随后未有买盘承接,市场将焦点集中在香港时间周四凌晨的美联储会议记录,周三美盘先失守2400 ,随后消息公布后再跌穿关键支持2380(1),一直回落至周五最低2325。本周重点关注周四及周五的美国第一季度GDP及通胀数据。

1小时图 – 金价在上周跌穿关键支撑2375(1)后,整体趋势已经转弱,现时支撑在前周四的2318-28(2)支撑区,今天(周一)是美国假期,预期波金动会比预窄幅,未来24小时可短暂控制2325-50(4)操作。1小时图仍以下跌趋势为主,本周必须关注下降锁定线(3),若金价能上破此阻力,上周的下跌趋势即将结束。

日线图 – 短线可控制阻力20天移动平均线(6),上升支撑线(5)???暂时完全可作参考,但未算。趋势仍以下跌趋势为主,图表上未有出现转势讯号,日线图本周第一目标可定在50天移动均线(7) – 2314。

P. To

國際金價上週初突破前高2431,在週一亞盤創出歷史新高2450,但隨後未有買盤承接,市場將焦點集中在香港時間週四凌晨的美聯儲會議記錄,週三美盤先失守2400,隨後消息公佈後再跌穿關鍵支持2380(1),一直回落至週五最低2325。本週重點關注週四及週五的美國第一季度GDP及通脹數據

1小時圖 – 金價在上週跌穿關鍵支持2375(1)後,整體趨勢已經轉弱,現時支持在前兩週的2318-28(2)支持區,今天(週一)是美國假期,預期波金動會比預窄幅,未來24小時可短暫把握2325-50(4)操作。1小時圖仍以下跌趨勢為主,本週必須留意下降阻力線(3),若金價能上破這阻力,上週的下降趨勢將會完結。

日線圖 – 短線可把握阻力20天移動平均線(6),上升支持線(5)???暫時可作參考,但未算完全形成。趨勢仍以下跌趨勢為主,圖表上未有出現轉勢訊號,日線圖本週第一目標可定在50天移動均線(7) – 2314。

P. To

The survey showed new home prices will fall by 5.0% in 2024, compared with a 0.9% drop expected in the last survey in February. Prices are likely to remain unchanged in 2025, compared with a 0.5% rise predicted in February. The poll, conducted between May 10 and 17, may only partially take into account the government support measures announced on Friday to stabilize the housing market.Beijing has pledged up to 1 trillion yuan ($138 billion) in funding and loosened mortgage rules and local governments will buy “some” apartments, in what many analysts say is the government’s strongest move yet to turn around the industry. However, questions remain about the latest measures, particularly whether they were overly enforced and how the government can help clear out the trillions in housing inventory.Since the real estate market fell into crisis in 2021, Chinese authorities have launched wave after wave of policy support measures to boost demand, but with little success. Property sales are likely to contract 10.0% in 2024, up from the 5.0% forecast in the previous survey, while investment is expected to fall 10.0% from the 6.1% forecast in the previous survey, the survey showed.

调查显示,2024 年新房价将下降 5.0%,而 2 月的上次调查预计将下降 0.9%。 与 2 月预测的上涨 0.5% 相比,2025 年价格可能保持不变。 这项民意调查于5月10日至17日期间进行,可能仅部分考虑了政府周五宣布的稳定房地产市场的支持措施。北京承诺提供高达1兆元(1,380亿美元)的资金,并放宽抵押贷款规定,地方政府将购买「部分」公寓,许多分析师表示,这是政府迄今为止为扭转该行业的最强劲举措。 然而,关于最新措施的问题仍然存在,特别是执行过度以及政府如何帮助清理数万亿的房屋库存。自2021年房地产市场陷入危机以来,中国当局推出了一波又一波的政策支持措施来提振需求,但收效甚微。 调查显示,2024 年房地产销售可能萎缩 10.0%,幅度高于先前调查预测的 5.0%,而投资预计将从先前调查预测的 6.1% 下降 10.0%。

調查顯示,2024 年新房價將下降 5.0%,而 2 月的上次調查預計將下降 0.9%。 與 2 月預測的上漲 0.5% 相比,2025 年價格可能保持不變。這項民意調查於5月10日至17日期間進行,可能僅部分考慮了政府週五宣布的穩定房地產市場的支持措施。北京承諾提供高達1兆元(1,380億美元)的資金,並放寬抵押貸款規定,地方政府將購買「部分」公寓,許多分析師表示,這是政府迄今為止為扭轉該行業的最強勁舉措。然而,關於最新措施的問題仍然存在,特別是執行過度以及政府如何幫助清理數萬億的房屋庫存。自2021年房地產市場陷入危機以來,中國當局推出了一波又一波的政策支持措施來提振需求,但收效甚微。調查顯示,2024 年房地產銷售可能萎縮 10.0%,幅度高於先前調查預測的 5.0%,而投資預計將從先前調查預測的 6.1% 下降 10.0%。

Gold has started its rebound after a series of important U.S. economic data went worse than expected since the beginning of this month, and the US inflation data slowed further last week has accelerated the upward momentum. The price rose to a one-month high of 2422 on Friday, with the week ending near 2414. Note that the price of silver also broke through the 2020 high of US$30 on the same day, reflecting that the precious metals market is strengthening and the bullish trend should resume very soon.

1-hr chart – The upward trend accelerated last week from the support line (1) to (1.1). Gold cleared all the short-selling orders near the previous high of 2430 early in the Asian session on Monday reaching a new high of 2440. While the resistance of 2430(2) is cleared, a new round of buying should be triggered in the next 48 hours, and the target in the early part of this week can be set at 2450 or even higher. Notice, the key support is now at 2430. If the gold price returns below 2430, the current upward momentum will slow down, and the trend will reverse.

Daily Chart—Last Friday was the first time gold prices closed above 2400, showing that buying orders above 2400 are starting to dominate, the first signal for gold prices to break higher. Gold fluctuated by about US$150 during the consolidation period in the past month(3). The M-T target can be set near 2580(3), a 1:1: ratio. As long as the price stays above 2431 on the daily chart, the S-T target can be set at 2448.

P. To

国际金价自本月初一连串重要美国数据做差后,正式开始反弹。 而上周美国通胀数据进一步放缓后,上升速度加快。 周五升至近一个月高位2422,全周收盘在2414。 留意白银价格在上周五亦终于升穿2020年高位30美元,反映贵金属市场走势正在转强,短线操作可继续以上升为主。

1小时图 – 金价的上升趋势在上周加快,由支持线(1)加快至(1.1)。 周一亚盘金价已清除前高位2430的沽空单,创出历史新高2440。2430(2)阻力清除后,未来48小时将会触发新一轮买盘(多单),本周早段目标可定 在2450或更高。 风险需留意,现时关键支持在2430,若金价回到2430以下,短线升势将会放慢,趋势由升转跌。

日线图 – 上周五是金价首次收盘在2400之上,反映2400以上的买盘正开始主导,是金价向上突破的第一个讯号。 而金价在过去1个月调整了大概150美元(3),只要金价在日线图能成功收盘在2431之上,以1:1量度,中线目标可定在2580附近。 而短线目标则可定在2448。

P. To

國際金價自本月初一連串重要美國數據做差後,正式開始反彈。而上週美國通脹數據進一步放緩後,上升速度加快。週五升至近一個月高位2422,全週收盤在2414。留意白銀價格在上週五亦終於升穿2020年高位30美元,反映貴金屬市場走勢正在轉強,短線操作可繼續以上升為主。

1小時圖 – 金價的上升趨勢在上週加快,由支持線(1)加快至(1.1)。週一亞盤金價已清除前高位2430的沽空單,創出歷史新高2440。2430(2)阻力清除後,未來48小時將會觸發新一輪買盤(多單),本週早段目標可定在2450或更高。風險需留意,現時關鍵支持在2430,若金價回到2430以下,短線升勢將會放慢,趨勢由升轉跌。

日線圖 – 上週五是金價首次收盤在2400之上,反映2400以上的買盤正開始主導,是金價向上突破的第一個訊號。而金價在過去1個月調整了大概150美元(3),只要金價在日線圖能成功收盤在2431之上,以1:1量度,中線目標可定在2580附近。而短線目標則可定在2448。

P. To

上周一早段跌穿2356后,沿着下跌通道去到前横行顶2330停下,并开始减速仍成小横行。 上周提及价格有可能在2330反弹延续升势,当15M图在欧盘时段出现higher low 和higher high 时,看上是一个不错的入市时机,当然, 价格有可能到2356时会反弹延续向 下,所以这是一个减仓和拉保本的位置,2378也是同一概念。现价2414,下个阻力位2430,但从4H或日图看上升的动能仍然强劲,未有减速的型态出现,已有长仓的可推止赚或等细图出力量反弹破结构才减仓。未有仓位或短线的,唯有等价格到2430后,看看有否出现力量反弹或假突破,但止赚目标可能最远只到2400因为大方向仍然看上。 看上的一系等升穿2430企稳再找机会,一系下周一在未到大位前回调到上升通道底附近留意有否机会,但由于已接近大位,向上做风险会较高和 要积极保护仓位。K.LAM风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。 市场资料仅供参考,MAX Online 绝不保证分析内容的准确性。

Indonesia’s April trade surplus was slightly higher than expected at $3.56 billion, as imports were lower than expected, Statistics Indonesia data showed on Wednesday.Southeast Asia’s largest economy has reported a merchandise trade surplus every month for the past four years, but the surplus has been narrowing recently due to weak exports. For more than a year, the resource-rich country’s exports have been hurt by falling commodity prices and weak global trade. Exports in April increased by 1.72% year-on-year to US$19.62 billion, lower than economists’ expectations of 4.57%. Although weaker than expected, Indonesia’s exports expanded in April for the first time in 11 months.Affected by falling global coal prices, coal shipments fell 19.26% to $2.61 billion in April from the same period last year despite higher export volumes. Coal is Indonesia’s largest export product. Imports grew by 4.62% to US$16.06 billion, while economists predicted an annual growth rate of 8.69%.April trade data reinforced expectations from Permata Bank economist Josua Pardede that Indonesia will continue to see a decline in its trade surplus and a widening of its current account deficit this year, but only to a limited extent. Pardede said: “As inflation expectations remain low, considering that the external balance is controllable and the Indonesian rupiah exchange rate remains stable, we believe that Bank Indonesia may maintain the BI interest rate at 6.25% at the Bank Indonesia meeting in May.”Bank Indonesia will hold its monthly monetary policy review next week. The central bank unexpectedly raised interest rates in April to support the rupiah currency after it fell to a four-year low against the dollar. Governor Perry Warjiyo said last week that the central bank may not need to raise interest rates further as the currency stabilizes and capital inflows return.