On Tuesday, US retail sales data, known as “terrorist data,” attracted much attention from the market. According to data from Investing.com, the US May retail sales data will drop by 0.7% from the previous month. Economists also generally expect the monthly rate of US May sales retail sales to decline, which is the first decline since February, reflecting the Retail sales have slowed after an exceptionally strong 10.7% month-on-month increase in March. In addition, this week is Super Central Bank Week. In addition to the Fed’s meeting on interest rates on Wednesday, the Bank of Japan and the Swiss National Bank will also announce interest rate resolutions. In addition, China will also hold a press conference on the operation of the national economy of the National Bureau of Statistics of China on Wednesday, when a series of heavy economic data will be released.

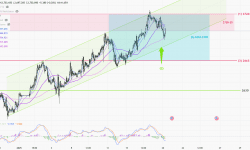

On Tuesday (June 15) in the Asian market in early trading, spot gold was basically stable, and the price of gold is now at around $1866 per ounce; gold prices fluctuated sharply in the overnight market. The price of gold fell by more than 1.7% on Monday, mainly because some investors were concerned that the Fed might outline the path to curtailing its expansionary monetary policy at its two-day meeting this week. Spot gold closed at US$1,865.96 per ounce on Monday, down US$11.65 or 0.61%. It once hit a low of US$1,84.52 per ounce during the session, which was a drop of US$33 from the daily high of US$1,877.74 per ounce, but then rebounded from the low to US$1,860 per ounce above.

场外式黄金/白银交易由 Max Online 提供。 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 场外式黄金/白银并非受证券及期货事务监察委员会(「证监会」)监管,因此买卖场外式黄金/白银将不会受到证监会所颁布的规则或规例所约束,包括(但不限于)客户 款项规则。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。