上週黃金早段時間進入跌勢,在美聯儲公佈議息會議結果前當晚再試低位1621,在美聯儲公佈加息結果後黃金跌幅收窄,因在發佈會上鮑叔暗示未來有可能加息幅度超過預期,具體步伐要留意經濟數據指標。

所以,當上週五美國公布強勁的非農數據新增就業人數時,數字遠超於市場預期,另外失業率亦高過預期。好壞不一的就業數據令市場認為美聯儲會在12月放慢加息步伐,美元指數出現大幅度下跌,在上週五一度下跌近2%,為金價提供上升動力,金價一度大升至45美元左右。升至1675水平位置。投資者需要留意本週四的美國10月份cpi 數據公布,因市場擔憂通脹持續可令聯儲局將在十二月份再次加息,令金價走低。

週一(11月7日)亞洲時段,現貨黃金出現輕微跌幅,截至北京時間下午三時,金價位於1673美元/安士左右。並金價回吐上週五的部份升幅。

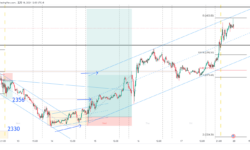

技術分析:

現貨黃金多次在1615的位置徘徊並獲得支撐後,加上數據公布後,上週五一度升至1673水平位置,回到5日,10日,21日平均線上方。現時金價徘徊在1666至1681的位置,初步阻力位為1680,如升穿阻力位後,有機會升至1710位置。建議保守者持觀望態度。

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.