價格低位震盪,非農後暫無新趨勢動力

週一(7月11日),現貨黃金重新走低,跌向上週創出的2021年9月以來低點1732.17美元/盎司,美元指數再創近20年新高,對以美元計價的黃金需求造成壓力。面對如此強勢的美元,其他經濟體想通過“反向貨幣戰爭”——抬高本幣兌美元匯率——來抵抗通脹壓力顯得心有餘力不足。

美國經濟在6月份增加了37.2萬個工作崗位,私營部門就業人數回升至新冠大流行爆發前水平以上,而全國失業率仍保持在3.6%的歷史低位。這份強勁的報告可能強化美聯儲繼6月份之後在本月再次加息75個基點點的決心。

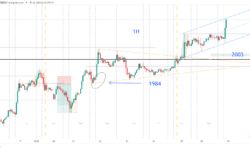

除了上週五受到非農數據影響,現貨黃金產生較大波動以外,上周至本週價格下跌到1730區間後一直維持窄幅低位震盪,價格波動較小,本週二開始價格維持在1734區間,本週將持續維持較小浮動,價格應在1720-50區間。

技術分析:

上週價格產生較大跌幅,布林帶產生較大幅度的軌道線,本週以來維持震盪低位,布林線帶較為平整,價格圍繞中線窄幅運動,沒有產生趨勢。

本週重要信息:

週三:20:30 美國6月CPI年率未季調(%)

週四:20:30 美國6月PPI年率(%)

週五:20:30 美國6月零售銷售月率(%)

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.