非農數據顯示通脹依舊嚴重

上週五晚間公佈非農就業數據增加39萬,低於前期,但高於預期,失業率與前期相當為3.6%。數據公佈後造成黃金價格短線下挫。數據也顯示美國經濟通脹情況尚未得到有效緩解,也得以繼續支持美聯儲鷹派政策。

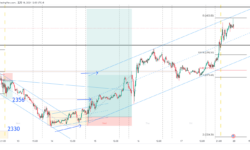

上週黃金價格由低位衝高回落,最低價格1820區間,最高升至1873,受非農數據影響後,週末價格回落,尾盤以1850價格收盤,呈現下跌態勢。

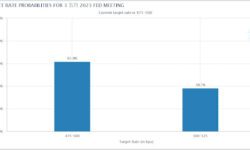

美聯儲理事和副主席接連表態,為了有效控制物價的上漲壓力,美聯儲將繼續堅定不移的奉行加息政策。除此之外,鑑於通脹造成的美國經濟過熱,是美國人的生活成本加劇,直接造成了拜登政府支持率顯著下降,也說明了通脹情況必須被打壓下去的必要性。可以預見的是,在未來的議息會議上,美聯儲將會繼續加息50個基點甚至以上。

鑑於通脹情況依舊嚴重,美聯儲以及美國政府部門將會繼續以利率為槓桿壓制通脹,美元指數可能進一步升高進而是黃金承壓。本週主要基調可能為承壓下行,價格有可能進一步下探1800整數區間。

本週基本策略:

逢低做空,主要看齊目標1820-1800區間。週一開盤後需留意跳空低開。

技術分析:

上週前期價格始終呈現上漲趨勢,最高至1873位置。受非農數據影響,週五價格開始回落。價格也在周五向下刺穿布林先中軌線進入下降趨勢。之後價格連續下跌,接連刺穿布林帶下線,下降趨勢動能較為明顯。

本週重要信息:

週五:20:30 美國5月CPI年率未季調(%)

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.