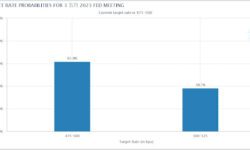

週一(8月8日),現貨黃金反彈,因美元指數失去了在上週五(8月5日)美國非農就業數據公佈後獲得的部分漲幅。投資者期待本週即將公佈的美國7月通脹數據,找尋關於美聯儲鷹派政策前景的新線索。美國前財政部長薩默斯表示,他擔心總體通脹放緩可能促使美聯儲得出結論,認為政策已經奏效。諾貝爾獎獲得者克魯格曼也警告說,現在不是美聯儲改變方向的時候。

美聯儲理事鮑曼上週六(8月6日)表示,她支持美聯儲7月加息75個基點,並且應考慮在即將召開的9月政策會議上維持現行加息步伐,以使通脹回落。

價格自上週開始延續了上漲趨勢,受非農數據影響後一度翻轉下跌至1760區間後再度反轉向上,目前在1780區間,上漲動能強勁,預計本週將繼續維繫上漲趨勢,目標1800整數。

技術分析:

本週開市以來繼續維繫上漲趨勢,上漲過程流暢。在非農數據後價格恢復了向上動能,進入布林帶上軌道區間,上升動能較為明顯和強烈。目前連續刺穿上軌道線,有望進一步上漲激發新一輪的上漲行情,目標價格1800。

本週重要信息:

週三:20:30 美國7月CPI年率未季調(%)

週四:20:30 美國7月PPI年率(%)

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.