4月非農高於預期,加息抑制金價

現貨黃金本週價格突破1900,最高達到1910位置,伴隨著美聯儲加息50基點以及4月非農就業數據的影響,價格在達到高點後轉折向下,最低位置1850. 鑑於美聯儲連續的鷹派表現,今年美聯儲對美元的加息尚未完成,現貨黃金後市總體依舊看跌。

美聯儲本周宣布上調聯邦基金利率區間0.5個百分點至0.75%-1.00%,這是近22年來最大幅度的一次加息。但美聯儲主席鮑威爾在新聞發布會上明確排除了在今後即將召開的貨幣政策會議上加息75個基點的可能性,這限制了金價跌勢。不過鮑威爾也明確表示,美聯儲已經考慮的加息“不會令人愉快”,因為這會迫使美國人為住房抵押貸款和汽車貸款支付更多費用,並可能降低資產價值。他和他的同事決心恢復物價穩定,即使這意味著採取的措施會導致企業投資和家庭支出下降,以及經濟增長放緩。

美國4月新增非農就業人口42.80萬,高於預期的增加38萬,為2021年9月以來最小增幅,但前值下修至增加37萬;失業率持平前值3.60%,高於預期值0.1個百分點;平均時薪年率符合預期值5.50%,低於前值0.1個百分點。

本週現貨黃金沒有明顯的動能產生推力向上,從基本面的層面上主要看空,價格看齊1850位置。

本週交易策略:

本週基本交易格調主要考慮做空,週一需留意可能突然出現的跳空低開等向下行情。因為缺乏明顯的向上動能,之前買單可以考慮獲利離場。看空價格主要指向1850. 如果出現向上行情,可考慮突破1900以後進場買入。

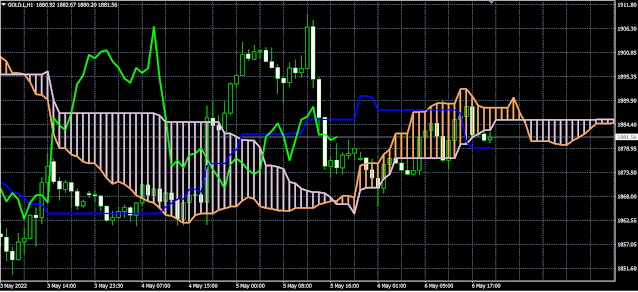

技術分析:

上週價格主要受市場環境影響較大,包括美聯儲加息和非農數據等影響,都在一定程度上打壓了黃金價格。在一目均衡圖上,價格在前期突破了雲層向上後折返向下,在後期收盤階段一直處於雲層之中,沒有明顯趨勢產生,週尾以1881.56收盤。呈現下降趨勢。

本週重要數據:

週三:20:30 美國4月CPI年率未季調(%)

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.