基本面:

本週基本維持震盪走勢,疫情擔憂重點支持金價

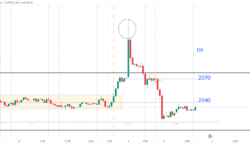

本週黃金價格基本維持了震盪走勢,價格在1765-1797之間。本週尾盤出現連續突破下降,但被1760區間支撐,未有明顯向下突破趨勢。

目前價格主要被基本面的疫情憂慮主導,本週印度疫情的情況加劇,將會在下周形成對金價的強力背景支撐甚至比形成新的上漲趨勢,1760整數位應該可以得到堅守。此外美債收益率短期回落調整也給金價支撐。不過仍然有很多因素對金價上漲不利,如美國經濟近期的強勢表現,美國股市的強勢表現,拜登基建法案的預期,以及美國10年期債券收益率長期走高的預期。

與此同時,下周同樣需要關注的是美聯儲利率決議以及拜登政府對富人加稅的相關決議。加稅議案可能使資金流入債市從而支撐金價。 5月7日的非農數據根據之前的初請失業金人數等數據推測會比較樂觀,可能對金價形成壓制。

總之,下一周基本面要關注全球疫情變化和拜登政府加稅信息,以及美國政府的基建撥款等相關新聞。

技術面:

價格目前處於低位回落後向上再啟動的趨勢,受基本面影響,價格很大可能在周一熱點交易時間高開高走,目前指標指示價格處於震盪區間低位,MACD動能在賣方區間,K線位置拉低了10日均線向下,尚未有起色。週一重點防禦基本面影響,同時留意5日/10日均線再次交叉後的走向。

交易建議:

目前的震盪區間1760-1800可能在周一被向上突破,如果突破未發生則表明阻力支撐雙向均具有較強動能,可考慮繼續在此區間多空交易。如向上突破1800,且基本面疫情信息嚴重則可以考慮做多。止盈1820.如果向下突破1760可考慮做空,止盈1750.

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.