黃金昨日繼續上升。開市在1794附近,全日整體在1790-1800之間震蕩,直至收市前突破1800阻力,全日收市在1801,上升約5美元。

1小時圖合付預期,短線趨勢區間1785-1808(1)仍然有效,未來48小時價格將繼續在消化性三角(2)內整固。在過去24小時,剛形成短線上升支持線(3),若金價繼續推高突破短線上方阻力1808,上方目標可設在阻力線(2.1)。

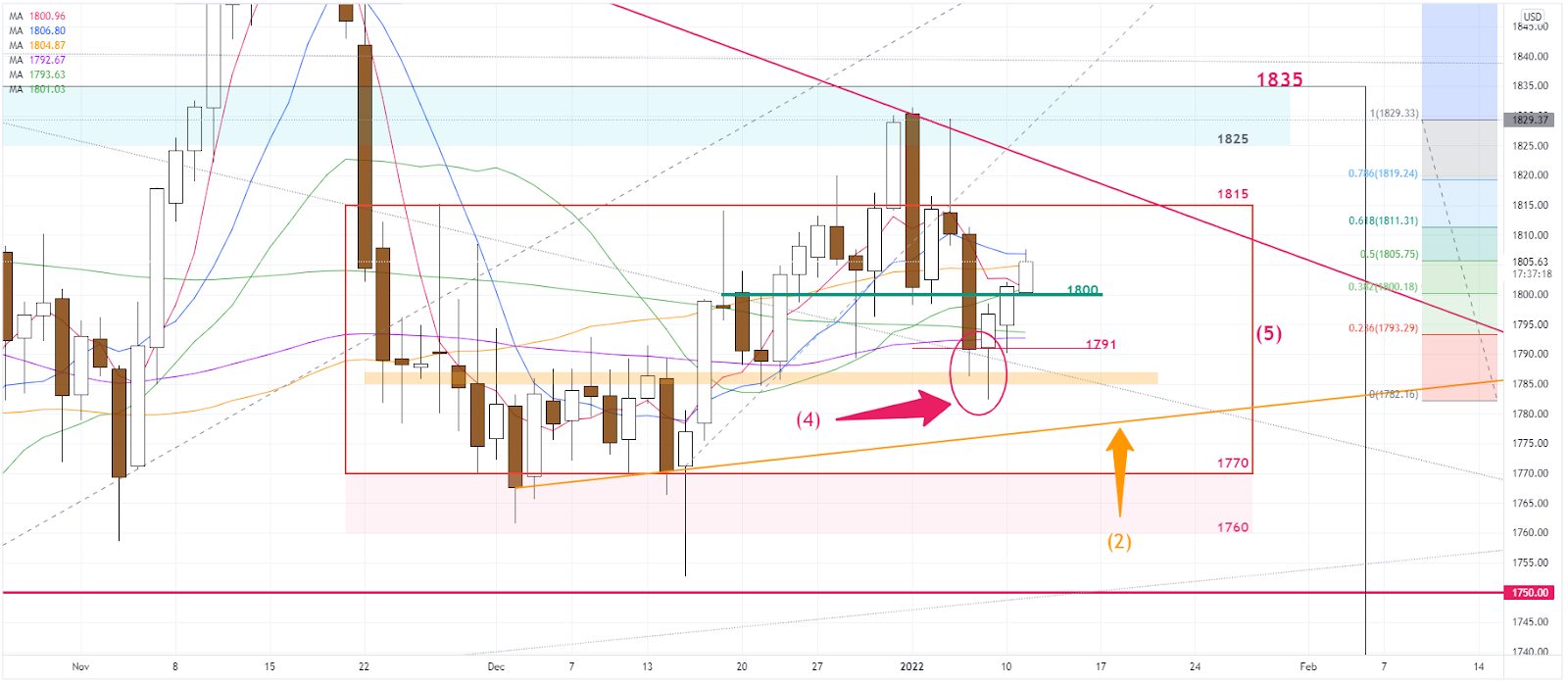

日線圖 – 如昨日所提及,黃金在上週五見底(4),引發了昨日反彈。暫時價格企穩在1800之上,目標可定在1815中線1770-1815(5)區間頂部。

短線阻力:

1820-22

1815

1808-10

現價:1805

短線支持:

1800

1795

1790

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.