Gold pulled back from its recent high last week, rejected by 2078 early during Monday’s US session. It cleared the 2050(1) support on Wed., triggering a round of selling and falling to an early weekly low of 2030. The price stayed within the range of 2035-2050, waiting for the release of US job data. When the data was announced, there was an increase in volatility; however, the closing price didn’t show any significant changes.

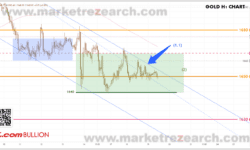

1-hour chart – Gold price is still fluctuating within the range of 2035-2050 after the US job data. In the past 48 trading hours, an S-T support has formed, and traders can consider utilizing the triangle pattern(2). Expect a breakout within the next 24 hours. The key event for this week will be the release of US core inflation data on Thursday.

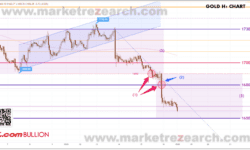

Daily chart – A strong US job data last Friday has led to a strong US dollar punching the gold prices lower. On the other hand, it also reinforced expectations of an early interest rate cut, indicating a potential “soft landing” for the US economy, lifting the gold price up. The market as a result still lacks a clear direction. The 20-day MA(4) remains critical; and the previously mentioned upward support line (6) is still valid, and attention should be given to the larger triangle pattern on the daily chart (5) this week. Within the next 5-7 days, it is crucial for gold to break above the resistance zone of 2070-2080; if it fails to do so, the price will escape the upward support (6), and the overall structure on the daily chart will enter a sideways pattern.

|

S-T ressitance 3 |

2055-1 |

|

S-T ressitance 2 |

2050 |

|

S-T ressitance 1 |

2046 |

|

Market price |

2045 |

|

S-T support 1 |

2044 |

|

S-T support 2 |

2039-40 |

|

S-T support 3 |

2035 |

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.