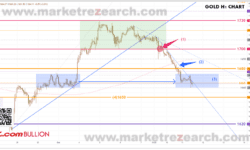

Gold bounced but failed to break out from the range. The day began at 1664 yesterday. The price was bounded by a tight 1660-65 range early in the Asian session. It reached the early peak of 1677 at the EU session after Putin’s speech. At the US Fed. The announcement, gold has rebounded quickly from the 1653 day-low to the weekly high of 1688. The day eventually ended at 1673, up slightly from yesterday.

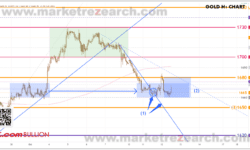

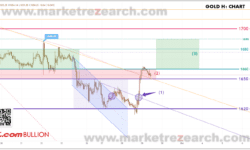

Market reaction was mixed after the US Fed. Meeting. The price is still controlled by the S-T 1660-80(1) range in the 1-hour chart; v can continue to take advantage of this range before it escapes.

The buying support below 1665(2) remains effective as gold hasn’t been able to close below it in the daily chart. It will be the first sign of the price going down if it closes below 1665 on the daily chart. On the other hand, if the price fails to sink below 1665 in the next 48 hours, a jump toward 1700 may begin.

S-T Resistances:

1680

1670

1665

Market price: 1661

S-T Supports:

1660

1650-52

1640

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.