非農數據不如過往但依舊強勁

美國勞工統計局的數據顯示,美國上個月新增就業崗位43.1萬個,增速低於2月份修正後的75萬個,也低於彭博社共識預測的49萬個,但在緊張的勞動力市場中仍然是一個實質性的增長。數據雖然低於過去幾個月的就業指標,但依然顯示出了強大通脹以來就業人數增長的巨大慣性,也為美聯儲采取更為積極的貨幣政策來遏制通脹提供了數據上的基礎。

俄烏戰爭目前已經陷入持久戰階段,雙方都有陷入戰爭泥潭的風險,4月1日,烏克蘭軍隊陸軍航空兵越過邊境襲擊了俄軍的儲油倉庫,這是烏克蘭軍隊自開展以來的第一次較大規模戰術性反擊,也是1945年二戰勝利以來第一次俄羅斯本土遭到主權國家軍隊的武裝襲擊。與此同時,這一行為也像徵著雙方戰事尚未進入分出勝負的階段。

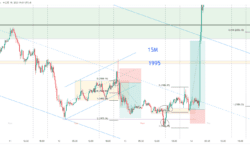

本週現貨黃金越過1900線以上並且持續震盪上行,週五非農數據公佈以後逐漸走向下方,尾盤以1921收市。本周行情預計主題為震盪市場,重要區間為1900-1950.

技術分析:

上週前半部價格升至處於布林帶上軌道,從1891升至最高1950位置,中期觸及高點後反轉向下,進入下軌道區間,價格回調至1922位置,目前在1922位置向上浮動,總體呈現小幅震盪上行態勢,日內主要觀察價格觸及中軌道線關鍵位置1930。

本週重要數據:

週一:22:00 美國2月耐用品訂單月率終值(%)

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.