Gold prices continue to fluctuate near record highs. Early last week, the market was again driven by uncertainty over Trump’s tariff policy, hitting a new high of 2942. It was pushed toward 2863 by stronger-than-expected US inflation data on Wednesday, but the price rebounded quickly to 2940 before the U.S. session on Friday. As the peace talks began between Russia and the US, the geopolitical situation eased, profit taking/short-selling hit the market where the gold prices closed below 2900 near 2880.

The gold market will still be under the influence of Trump’s new economic policy this week. However, unless a more aggressive policy is introduced, the market is starting to adapt to the current market condition after nearly four weeks of news turmoil. With the prospect of a truce between Russia and Ukraine, it should be difficult for gold prices to hit a new high in the short term.

>

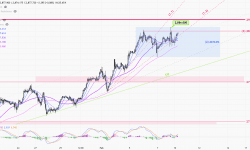

1-hr chart(above) > Monday is a U.S. holiday, the price should be bounded by the range of 2780-2910 (1). Later this week, a wider range can be expected between 2865-and 2942, and wait for the breakout before the next round of major trends.

>

Daily chart(above) > The 10-day moving average (3) dip-buying strategy mentioned last week is still valid. Note that last Friday’s sharp one-day pullback reflects the bear is starting to take control of the market, and it is important to be careful of a significant correction in the market this week. The breakout of the 10 days MA(3) will be the start of a bearish trend on the daily chart.

P. To

金價繼續在高位震蕩。上週早段市場再次受關稅政策的不確定性推動,創出新高2942。但週三美國公佈較強的通脹數據,令金價在週中調整至全週最低2863;金價在週五美盤前反彈至2940,但隨著地緣局勢舒緩,俄烏有望停戰的消息影響下,週未收盤前市場出現明顯獲利平倉,回到貼近全週最低2880附近收市。

雖然本週金市將繼續受特朗普新政策主導,但除非有更激進的政策推出,否則經過接近4週的消息震蕩,市場開始漸漸適應。加上俄烏停戰有望,金價短線應難以再創高。

>

1小時圖(上圖) > 週一美國假期,預期早段以區間2780-2910(1)為主。本週較後期把握2865-2942為操作區間,等待突破出現下輪走勢。

>

日線圖(上圖) > 上週提及的10天移動平均線(3)逢低買入策略仍然有效。但留意上週五的單日大幅回落反映沽空開始主導市場,本週必須小心市場出現明顯調整。轉勢關鍵是失守10天線(3)。

P. To

Triggered by Trump’s 25% tariffs on Canada and Mexico, Gold tested new highs last week. Although the tariffs were delayed for a month just hours after they were deployed, the news sent shockwaves to the market, pushing gold prices above last week’s highs early in the U.S. session on Monday. The upward momentum accelerated with the upward support accelerated from line (1) to (1.1), which rose to 2880 on Wednesday’s session. The market turned quiet as it waited for Friday’s US employment data, and the rally slowed slightly to (1.2). Although the Jan. non-farm jobs were smaller than expected, Friday’s U.S. data wasn’t bad at all, with the December figure being revised up to 300,000 and the latest unemployment rate revised down to 4.0% from 4.1% in the previous month. The pressure was on gold before the weekend.

The gold price continues to trade around its all-time high, hovering near 2880 with no signs of retreating. It is still imperative to keep an eye on the latest tariff policy developments in the United States and the responses of various countries. Fed Chairman Jerome Powell will have a hearing on Tuesday, and the US will release inflation data for January on Wednesday.

>

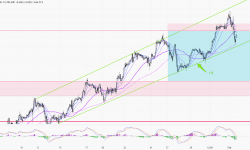

1-hour chart(above) > Although the upward trend slowed from (1.1) to (1.2) just before the weekend, there was no reversal signal in the 1-hour chart, and the price continued to stick to the all-time high of 2880. See if the price can break out from the resistance at 2880(3) in the next 12 hours, and if it fails to break up, the price will be sideway between 2833-86 early this week.

>

Daily Chart(above) > Gold prices temporarily showed S-T resistance at 2880, but the turnaround signal is still nowhere to be seen. An S-T long-entering point can be set at the 10-day moving average (4).

P. To

國際金價上週再試新高,走勢由上週一特朗普對加拿大、墨西哥加徵25%關稅開始。雖然關稅在推出後數小時隨即延遲1個月執行,但消息為市場帶來劇烈震蕩,令金價在週一美盤突破上週的高位。上升動力開始加快,上升支持由支持線(1)加速至(1.1),在週三交易日升至2880。隨後市場等待週五的美國就業數據,升勢略為放慢至(1.2)。週五的美國數據相對做好,雖然1月的非農業新增職位比預期小,但12月的數據被上調至30萬、同時最新失業率由上月的4.1%下調至4.0%,令金價受壓。

現時金價繼續貼近歷史高位,在2880附近小平徘徊,未有回落跡象。週未過後必須留意美國最新的關稅政策發展及各國回應,風險主提將繼續主導市場。本週二聯儲主席鮑威爾將有聽証會、而週三美國將公佈1月份的通脹數據。

>

1小時圖(上圖) > 雖然上升趨勢在週未前由(1.1)放緩至(1.2),但1小時圖未有轉勢訊號,價格繼續貼近歷史位2880。留意價格在未來12小時能否站穩2880(3)之上,若未能往上突破,本週早段的價格將在2833-86盤整。

>

日線圖(上圖) > 金價暫時在2880出現短線阻力,但轉勢訊號仍未出現,繼續以買多為主,短線調整目標可留意10天移動均線(4)。

P. To

Following the decline from the previous week, the gold price tested the low near 2730 early last week. The market started to focus on the meetings of various central banks, 1st The Bank of Canada cut interest rates by 1/4%, followed by the Federal Reserve keeping interest rates unchanged, and then the ECB cut interest rates by 1/4 percentage point, led the price to rebound. The decline in global interest rates attracted gold buying, causing the gold price to cross the high of 2790. Driven by Trump’s tariff policy, the risk premium surged before the weekend, pushing gold prices to hit a new high of 2,817 during the U.S. session on Friday. But the price fell back to close at 2798, the week was up by $28.

Due to the weekend risk premium, the gold price hit a record high of 2817 on Friday, but the strong US dollar on Monday put pressure on the gold price. Last week’s US GDP and PCE inflation data, both reflected that the US economy keeps going strong, along with the tariff policy introduced by Trump over the weekend has further raised inflation expectations. Interest rates will remain high in the S-T just like Powell declared after the Fed. meeting last week, and gold prices will face pressure on the fundamental side.

In COMEX, the number of open interest(OI) has fallen after it reached 59k contracts on January 24. When gold prices hit a new high last week, both the trading volume and OI have reduced, reflecting investors are cautious in long-buying at current levels. The focus this week will be Friday’s U.S. employment data, as long as the numbers remain strong, gold prices will be under pressure once again.

>

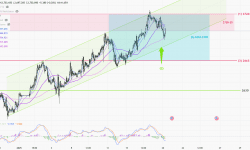

1-hour chart(above) > The resistance above 2790 is still strong as the gold price failed to stabilize above 2790 back from the weekend. However, gold prices are still in the S-T rising channel(1). The price action will change to sideway only if the price falls below the support line(1). Notice that the upper resistance area is now at 2790-2800(5).

>

Daily chart > Although there was a clear selling before the market closed last Friday, the reversal signal has not yet appeared. Gold is still running in an upward trend along with the 10-day ma(6), wait for it to break where the bear will kick in.

P. To

金價上週先跌後反彈突破。承接前週收盤回落,上週早段價格先試最低2730,隨後市場開始將焦點集中在各央行會議;先有加拿大央行減息1/4厘、緊貼有美聯儲維持利率不變、再有歐洲央行減息1/4厘,環球利率回落吸引買盤入市,令金價突破高位2790。投資市場受特朗普關稅政策帶動,週未前風險溢價飇升,週五金價在美盤創出歷史新高2817。但最終回落到2798收市,全週上升28美元。

因週未的風險溢價,金價在週五創出歷史新高2817,但週一美匯強勢令金價明顯受壓。上週美聯儲議息會議,主席鮑威爾明確表示短期內無需減息、上週的美國GDP及PCE通脹數據,都反映美國經濟仍然強勁。而週未特朗普推出的關稅政策,更令通脹預期升溫,短期內息率將繼續維持高位,金價在基本面利淡。

參考美國期金未平倉合約數據,數字在1月24日做出近期持倉新高59萬張後已開始回落,而當金價上週創歷史新高,無論成交量及未平倉合約都繼續減少。反映投資者在高位買盤審慎,有轉弱跡象。本週重點會是週五的美國就業數據,只要公佈數字比較預期好,金價將再度受壓。

>

1小時圖(上圖) > 週未過後金價未能站穩前高位2790之上,反映2790之上阻力仍然強勁。但金價現時仍在短線的上升通道(1)之中,關鍵只要本週能跌穿支持線(1),金價將開始橫行震蕩2720-90(4)。留意上方阻力區在2790-2800(5)。

>

日線圖(上圖) > 雖然上週五收市前有明顯沽空盤,但轉勢訊號仍未出現,日線圖一直沿10天移動平均線(6)上行,走勢仍處於上升趨勢當中。耐心等待,金價跌穿10天線(6),才是金價轉勢回落的第一個訊號。

P. To

Gold price was pushed to a one-month-high by better-than-expected PPI and core CPI US economic figures last week. However, it was rejected by 2720 and the price has begun to consolidate before the market close on Friday. Israel and Palestine started to exchange hostages after reaching a ceasefire agreement, easing tensions in the Middle East, which put pressure on gold prices as markets opened on Monday. Today is a U.S. holiday, but the market will focus on the new president’s policies post-inauguration, believing that news will steer investment markets in the coming week. Whether gold prices will attempt new highs remains to be seen, with a key resistance level at 2720.

>

1-hr Chart(above) > The overall trend of gold prices was in line with our expectation last week, bounded by the range of 2665-2720. Despite the price being rejected by 2720(1) again, the S-T trend is still running within an upward channel(2), and remains bullish for now. Keep an eye on whether gold prices can break out from the upward channel(2) this week; once it falls below the upward channel, it would be the first sign of a possible trend reversal!

>

Daily Chart(above) > Gold prices tested the 2720 resistance for the third time last week, but this time, unlike the previous two attempts where prices rapidly fell within 24 hours after reaching the top, seems like, the market has already adjusted to prices above 2700. This week, the trend of gold prices will be influenced by the new U.S. President and his policies, so keep an eye out for any announcements. If gold prices can break through the 2720 resistance, it will trigger a new round of long-buying, with the next target at 2790. The support below lies at the ascending support line (4) and the 100-day moving average (5).

P. To

上週二、三分別公佈美國生產物價指數及核心通脹數據,兩項數據都比上月放緩,亦同時比市場預期更好,令金價由週二開始往上,直到週四重上1個月高位2720。剛過去週未,以/巴在達成停火協議後開始交換人質,中東局勢進一步緩和,令金價週一開市受壓。週一是美國假期,市場正等待美國新總統上任後的政策,未來一週投資市場相信會以消息主導。金價會否再試新高,仍待確認,關鍵阻力在2720。

>

1小時圖(上圖) > 金價上週走勢整體合乎預期,在2665-2720(3)區間內震蕩。雖然金價正受阻於關鍵阻力2720(1),但整體趨勢仍在上升通道(2)當中,所以現時操作仍以上升操作為主。留意本週金價能否脫離上升通道(2),跌穿上升通道後,會是見頂轉勢的第一個訊號!

>

日線圖(上圖) > 金價在上週第三次測試2720阻力,但留意這次不如上兩次到頂後24小時內急速回落,市場相對已適應2700以上價格。本週金價走勢將被美國新總統及其新政策主導,留意任何消息公佈。若金價能沖破2720阻力,將觸發新一輪買盤,上方目標在2790。下方支持在上升支持線(4)及100天移動均線(5)。

P. To

本周价格在2639-2608内窄幅震荡,周五欧盘出了第二顶后形成横行区,15M图可见,出力量破结构后,向下试横行底是不错的入市位。现价2620,周五美盘时段价格虽然延续细图的下跌动能,但仍未跌穿上升通道或横行底2608,价格仍然有机会震住上。下周仍是先看横行顶底有没有反弹可做,价格未穿2608 的横行底,仍要当横行倾向上去做,如能上破横行顶,就留意横行1:1的2670,也是大跌段的0.618会否反弹。K.LAM风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。高度的杠杆可为阁下带来负面或正面的影响。阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。因此,阁下不应将无法承受损失的资金用于投资。投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。市场资料仅供参考,MAX Online 绝不保证分析内容的准确性。

The downtrend in gold prices continued last week after turning back from the previous week’s high of 2726.The decline accelerated after the Fed’s interest rate meeting on Wednesday, failing to support at 2630(1) and falling back to a near three-month low near 2585.Then on Friday, US inflation data came down slightly, causing gold to bounce back above 2600 to close the week at 2622 (down $25 from the previous week).

As mentioned 2 weeks ago, there will be significant profit taking above 2700 while the year came close to the end. After the Fed’s meeting, the market fundamentals began to change again. Fed Chairman Powell indicated that the number of interest rate cuts will be reduced in 2025, from the previously expected 4 times to 2 times; next year’s relatively high inflation and high-interest rate environment will bring support to the US dollar while keeping gold prices under pressure. The new U.S. President’s tariff policy will be the dominate factor to lead the gold price next year.

>

1-Hour Chart (Above) > Gold price rebounded after hitting 2583 late last week, forming a S-T bottom. Expect the rebound top near 2650. The market should be relatively quiet this week, take 2580-2650 as the trading range for now until the market develop further this week.

>

Daily Chart (Above) > Gold was rejected by 2700 twice on the daily chart, forming a double top pattern (3). Short selling should control the market as it cleared the support by the double top neckline (3.1) last week. After the current S-T rebound, the downtrend should resume and expected the price to return to around 2540-50 in the next 2 weeks. M-T operating range would be 2535-2730(4).

P. To