調查顯示,2024 年新房價將下降 5.0%,而 2 月的上次調查預計將下降 0.9%。 與 2 月預測的上漲 0.5% 相比,2025 年價格可能保持不變。這項民意調查於5月10日至17日期間進行,可能僅部分考慮了政府週五宣布的穩定房地產市場的支持措施。北京承諾提供高達1兆元(1,380億美元)的資金,並放寬抵押貸款規定,地方政府將購買「部分」公寓,許多分析師表示,這是政府迄今為止為扭轉該行業的最強勁舉措。然而,關於最新措施的問題仍然存在,特別是執行過度以及政府如何幫助清理數萬億的房屋庫存。自2021年房地產市場陷入危機以來,中國當局推出了一波又一波的政策支持措施來提振需求,但收效甚微。調查顯示,2024 年房地產銷售可能萎縮 10.0%,幅度高於先前調查預測的 5.0%,而投資預計將從先前調查預測的 6.1% 下降 10.0%。

Gold has started its rebound after a series of important U.S. economic data went worse than expected since the beginning of this month, and the US inflation data slowed further last week has accelerated the upward momentum. The price rose to a one-month high of 2422 on Friday, with the week ending near 2414. Note that the price of silver also broke through the 2020 high of US$30 on the same day, reflecting that the precious metals market is strengthening and the bullish trend should resume very soon.

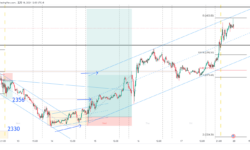

1-hr chart – The upward trend accelerated last week from the support line (1) to (1.1). Gold cleared all the short-selling orders near the previous high of 2430 early in the Asian session on Monday reaching a new high of 2440. While the resistance of 2430(2) is cleared, a new round of buying should be triggered in the next 48 hours, and the target in the early part of this week can be set at 2450 or even higher. Notice, the key support is now at 2430. If the gold price returns below 2430, the current upward momentum will slow down, and the trend will reverse.

Daily Chart—Last Friday was the first time gold prices closed above 2400, showing that buying orders above 2400 are starting to dominate, the first signal for gold prices to break higher. Gold fluctuated by about US$150 during the consolidation period in the past month(3). The M-T target can be set near 2580(3), a 1:1: ratio. As long as the price stays above 2431 on the daily chart, the S-T target can be set at 2448.

P. To

国际金价自本月初一连串重要美国数据做差后,正式开始反弹。 而上周美国通胀数据进一步放缓后,上升速度加快。 周五升至近一个月高位2422,全周收盘在2414。 留意白银价格在上周五亦终于升穿2020年高位30美元,反映贵金属市场走势正在转强,短线操作可继续以上升为主。

1小时图 – 金价的上升趋势在上周加快,由支持线(1)加快至(1.1)。 周一亚盘金价已清除前高位2430的沽空单,创出历史新高2440。2430(2)阻力清除后,未来48小时将会触发新一轮买盘(多单),本周早段目标可定 在2450或更高。 风险需留意,现时关键支持在2430,若金价回到2430以下,短线升势将会放慢,趋势由升转跌。

日线图 – 上周五是金价首次收盘在2400之上,反映2400以上的买盘正开始主导,是金价向上突破的第一个讯号。 而金价在过去1个月调整了大概150美元(3),只要金价在日线图能成功收盘在2431之上,以1:1量度,中线目标可定在2580附近。 而短线目标则可定在2448。

P. To

國際金價自本月初一連串重要美國數據做差後,正式開始反彈。而上週美國通脹數據進一步放緩後,上升速度加快。週五升至近一個月高位2422,全週收盤在2414。留意白銀價格在上週五亦終於升穿2020年高位30美元,反映貴金屬市場走勢正在轉強,短線操作可繼續以上升為主。

1小時圖 – 金價的上升趨勢在上週加快,由支持線(1)加快至(1.1)。週一亞盤金價已清除前高位2430的沽空單,創出歷史新高2440。2430(2)阻力清除後,未來48小時將會觸發新一輪買盤(多單),本週早段目標可定在2450或更高。風險需留意,現時關鍵支持在2430,若金價回到2430以下,短線升勢將會放慢,趨勢由升轉跌。

日線圖 – 上週五是金價首次收盤在2400之上,反映2400以上的買盤正開始主導,是金價向上突破的第一個訊號。而金價在過去1個月調整了大概150美元(3),只要金價在日線圖能成功收盤在2431之上,以1:1量度,中線目標可定在2580附近。而短線目標則可定在2448。

P. To

上周一早段跌穿2356后,沿着下跌通道去到前横行顶2330停下,并开始减速仍成小横行。 上周提及价格有可能在2330反弹延续升势,当15M图在欧盘时段出现higher low 和higher high 时,看上是一个不错的入市时机,当然, 价格有可能到2356时会反弹延续向 下,所以这是一个减仓和拉保本的位置,2378也是同一概念。现价2414,下个阻力位2430,但从4H或日图看上升的动能仍然强劲,未有减速的型态出现,已有长仓的可推止赚或等细图出力量反弹破结构才减仓。未有仓位或短线的,唯有等价格到2430后,看看有否出现力量反弹或假突破,但止赚目标可能最远只到2400因为大方向仍然看上。 看上的一系等升穿2430企稳再找机会,一系下周一在未到大位前回调到上升通道底附近留意有否机会,但由于已接近大位,向上做风险会较高和 要积极保护仓位。K.LAM风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。 市场资料仅供参考,MAX Online 绝不保证分析内容的准确性。

Indonesia’s April trade surplus was slightly higher than expected at $3.56 billion, as imports were lower than expected, Statistics Indonesia data showed on Wednesday.Southeast Asia’s largest economy has reported a merchandise trade surplus every month for the past four years, but the surplus has been narrowing recently due to weak exports. For more than a year, the resource-rich country’s exports have been hurt by falling commodity prices and weak global trade. Exports in April increased by 1.72% year-on-year to US$19.62 billion, lower than economists’ expectations of 4.57%. Although weaker than expected, Indonesia’s exports expanded in April for the first time in 11 months.Affected by falling global coal prices, coal shipments fell 19.26% to $2.61 billion in April from the same period last year despite higher export volumes. Coal is Indonesia’s largest export product. Imports grew by 4.62% to US$16.06 billion, while economists predicted an annual growth rate of 8.69%.April trade data reinforced expectations from Permata Bank economist Josua Pardede that Indonesia will continue to see a decline in its trade surplus and a widening of its current account deficit this year, but only to a limited extent. Pardede said: “As inflation expectations remain low, considering that the external balance is controllable and the Indonesian rupiah exchange rate remains stable, we believe that Bank Indonesia may maintain the BI interest rate at 6.25% at the Bank Indonesia meeting in May.”Bank Indonesia will hold its monthly monetary policy review next week. The central bank unexpectedly raised interest rates in April to support the rupiah currency after it fell to a four-year low against the dollar. Governor Perry Warjiyo said last week that the central bank may not need to raise interest rates further as the currency stabilizes and capital inflows return.

印尼统计局周三公布的数据显示,由于进口量低于预期,印尼 4 月贸易顺差为 35.6 亿美元,略高于预期。过去四年来,这个东南亚最大的经济体每个月都报告商品贸易顺差,但由于出口疲软,顺差最近一直在缩小。 一年多来,由于大宗商品价格下跌和全球贸易疲软,这个资源丰富国家的出口受到了损害。 4月出口年增1.72%至196.2亿美元,低于经济学家预期的4.57%。 尽管低于预期,但印尼 4 月的出口扩张是 11 个月来的首次。受全球煤炭价格下跌影响,尽管出口量增加,但 4 月煤炭出货额仍较去年同期下降 19.26% 至 26.1 亿美元。 煤炭是印尼最大的出口产品。 进口成长4.62%,达160.6亿美元,而经济学家预测的年增率为8.69%。4 月的贸易数据强化了 Permata 银行经济学家 Josua Pardede 的预期,即印尼今年将继续看到贸易顺差下降和经常帐赤字扩大,但幅度有限。 Pardede表示:「由于通膨预期依然低迷,考虑到外部平衡可控,印尼盾汇率保持稳定,因此我们认为印尼央行可能会在5月份的印尼央行会议上将BI利率维持在6.25%。」 。印尼央行将于下周举行月度货币政策审查。 在印尼盾兑美元汇率跌至四年低点后,央行于四月出人意料地升息以支撑印尼盾货币。 总裁佩里·瓦尔吉约(Perry Warjiyo)上周表示,随着货币稳定且资本流入回归,央行可能不需要进一步升息。

印尼統計局週三公佈的數據顯示,由於進口量低於預期,印尼 4 月貿易順差為 35.6 億美元,略高於預期。過去四年來,這個東南亞最大的經濟體每個月都報告商品貿易順差,但由於出口疲軟,順差最近一直在縮小。一年多來,由於大宗商品價格下跌和全球貿易疲軟,這個資源豐富國家的出口受到了損害。4月出口年增1.72%至196.2億美元,低於經濟學家預期的4.57%。 儘管低於預期,但印尼 4 月的出口擴張是 11 個月來的首次。受全球煤炭價格下跌影響,儘管出口量增加,但 4 月煤炭出貨額仍較去年同期下降 19.26% 至 26.1 億美元。 煤炭是印尼最大的出口產品。進口成長4.62%,達160.6億美元,而經濟學家預測的年增率為8.69%。4 月的貿易數據強化了 Permata 銀行經濟學家 Josua Pardede 的預期,即印尼今年將繼續看到貿易順差下降和經常帳赤字擴大,但幅度有限。Pardede表示:「由於通膨預期依然低迷,考慮到外部平衡可控,印尼盾匯率保持穩定,因此我們認為印尼央行可能會在5月份的印尼央行會議上將BI利率維持在6.25%。」 。印尼央行將於下週舉行月度貨幣政策審查。 在印尼盾兌美元匯率跌至四年低點後,央行於四月出人意料地升息以支撐印尼盾貨幣。總裁佩里·瓦爾吉約(Perry Warjiyo)上週表示,隨著貨幣穩定且資本流入回歸,央行可能不需要進一步升息。

澳洲财长查尔默斯周日表示,预计本周的联邦预算将有助于缓解该国顽固的高通膨,因为许多澳洲人仍在应对生活成本压力。澳洲储备银行经济学家预测,第一季消费者通膨率为 3.6%,到 6 月将升至 3.8%,并保持在这一水平直至年底,凸显了本土通膨挑战。 自2022年5月以来,央行透过升息425个基点至12年高点4.35%来应对持续高企的通膨。查尔默斯表示,将于周二公布的预算将「主要关注通膨,但不是唯一关注点」。 他补充说:“预算将是一个负责任的预算,它将缓解生活成本压力,并将投资于澳大利亚制造的未来。”官员周二表示,预算将重点关注住房问题,因为近年来租金上涨、利率上涨和生活成本飙升,加剧了全球本已最难负担的房屋租赁市场。 查尔默斯表示,政府将在预算中制定一条负责任的中间道路,尽管采取了更多支出措施,但仍有望实现第二次盈余。

Australian Treasurer Chalmers said on Sunday that this week’s federal budget is expected to help ease the country’s stubbornly high inflation as many Australians continue to deal with cost-of-living pressures.Economists at the Reserve Bank of Australia forecast that consumer inflation would rise to 3.8% in June from 3.6% in the first quarter and remain at that level until the end of the year, highlighting local inflation challenges. Since May 2022, the central bank has responded to persistently high inflation by raising interest rates by 425 basis points to a 12-year high of 4.35%.Chalmers said the budget due to be published on Tuesday would be “primarily, but not exclusively, focused on inflation”. “The budget will be a responsible budget that will ease cost of living pressures and invest in the future of Australian manufacturing,” he added.Officials said on Tuesday the budget would focus on housing as rising rents, rising interest rates and soaring costs of living in recent years have exacerbated what was already the world’s most unaffordable rental market. Chalmers said the government would chart a responsible middle path in a budget that would put it on track for a second surplus despite more spending measures.