1月中國新建住宅價格環比跌幅放緩,大城市出現一定程度的穩定,但儘管北京方面努力重振需求,但全國下降的趨勢仍在持續。根據國家統計局週五公佈的數據,12月新建住宅價格較上季下降0.4%,1月較上季下降0.3%。中國一直在加強遏制房地產低迷,包括命令國有銀行在「白名單」機制下增加對住宅項目的貸款。 上海等更多大城市也放寬了限購措施以吸引購屋者。 上個月,一線城市房價季減 0.3%,降幅小於 12 月 0.4%,部分原因是減少首付等額外支持措施。在國家統計局調查的70個城市中,上海環比漲幅最大,上漲0.4%,其餘三個一線城市——北京、廣州、深圳——房價降幅小於大多數二線和二線城市。三級中心。1月房價季減的城市數量也有所減少,但整體市場仍處於明顯的下跌趨勢,買家情緒依然十分疲軟。房價年減0.7%,創10個月來最大跌幅。 儘管 2023 年 1 月的統計基數較低,但由於 COVID-19 的干擾,價格比去年同期下降了 1.5%。 華寶信託經濟學家聶文表示,房價下跌可能會持續。「整個房地產市場可能需要一年多的時間才能完全恢復和反彈。」聶說。央行2月9日公佈的數據顯示,1月家庭貸款(主要是房貸)攀升至9,801億元,遠超過12月的2,221億元。不過,聶說,人們並不是用這類貸款買房,而是用於個人消費。他補充說,只有當收入預期改善時,居民才會進行中長期投資,包括購買房產。由於槓桿過高的開發商發生了一系列違約,自 2021 年以來,房地產市場一直陷入低迷,一直難以穩定。因此,政策制定者繼續推出措施提振市場信心。 該國央行週二宣布有史以來最大幅度的基準抵押貸款利率下調,不過分析師認為,鑑於現有抵押貸款持有人要到明年才能受益,此次下調對房價的影響有限。中原地產分析師張大偉表示:“房地產行業仍處於逐步觸底的過程中,購房者的收入和信心以及整體需求需要一段時間才能恢復。”

China’s new home prices slowed their month-on-month declines in January with the biggest cities seeing some stabilisation, but the nationwide downward trend persisted despite Beijing’s efforts to revive demand.New home prices fell 0.3% month-on-month in January after dipping 0.4% in December, according to calculations based on National Bureau of Statistics (NBS) data on Friday.China has been ramping up measures to arrest a property downturn, including ordering state banks to boost lending to residential projects under a “whitelist” mechanism. More big cities including Shanghai have also eased purchase curbs to lure homebuyers.Last month, home prices in tier-one cities fell 0.3% on month, smaller than their 0.4% decline in December, partly due to additional support measures including a reduction in down-payments.Among 70 cities surveyed by NBS, Shanghai saw the biggest month-on-month increase with a rise of 0.4%, while the remaining three tier-one cities – Beijing, Guangzhou and Shenzhen – posted smaller home prices declines than most tier-two and tier-three centres.The number of cities that saw monthly price falls in January also decreased, but the overall market remained on a clear downtrend with buyer sentiment still very weak.From a year earlier, home prices fell 0.7%, marking the sharpest drop in 10 months. That was despite a low statistical base in January 2023 when prices dropped 1.5% year-on-year due to COVID-19 disruptions.Nie Wen, an economist at Hwabao Trust, said home price declines could persist.”It may take more than a year for the entire property market to fully recover and rebound,” Nie said.Central bank data released on Feb. 9 showed household loans, mostly mortgages, climbed to 980.1 billion yuan in January, far more than 222.1 billion yuan in December.However, Nie said people are not using such loans to buy homes, but rather for personal consumption.Residents will invest in the medium to long term, including buying property, only when their income expectations improve, he added.The property market has struggled to stabilise having languished since 2021 due to a series of defaults among overleveraged developers.As a result, policymakers have continued to roll out measures to boost market confidence.The country’s central bank on Tuesday announced its biggest ever reduction in the benchmark mortgage rate, although analysts believe its impact on home price will be limited given existing mortgage holders will not benefit until next year.”It will take some time for homebuyers’ incomes and confidence, and overall demand to recover in the property sector, which is still in the process of gradually bottoming out,” said Zhang Dawei, an analyst at property agency Centaline.

The expectation of the Fed’s interest rate cuts continues to support the fundamentals of the gold price. However, since the market kept delaying the rate cuts schedule without significant economic news, gold was traded sideways above 2020 last week. More news is expected this week, with the US announcing durable goods orders, 4Q GDP, PCE inflation, and manufacturing PMI. Regardless of whether the data is better or worse than expectations, the daily price fluctuations of gold should be widened toward around the $20 range. Considering the current market sentiment, unless these data significantly exceed expectations, it will not be easy for gold to break free from the current sideway sentiment. Therefore, we can continue to take advantage of the 2015-2040 range this week.

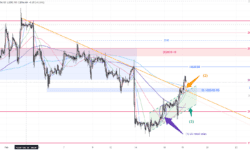

1hr chart – Last week, the daily price fluctuations of gold expanded from a narrow range at the beginning of the week to a broader USD 25 range (1) near the week’s end. The market dynamics should be similar to last Fri. on data release days this week. The resistance zone around 2035-2040 is still valid, and the day trading strategy should continue to be based on the range of 2015-40.

Daily Chart – After the rejection of 2041 on Friday, the rebounding cycle from the bottom of the downward channel(3) is getting close to an end. Short-selling near 2040 in the next 1-2 days will be ideal if the gold price is to touch 2040 again. Once the price falls below the 20-day ma(4) near the end of this week, the adjustment target can be set at 2010 or even lower for next week.

S-T ressitance 3

2045

S-T ressitance 2

2040

S-T ressitance 1

2035

Market price

2031

S-T support 1

2030

S-T support 2

2025

S-T support 3

2018-20

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

美联储减息继续在基本面上支持金价,但由于近期市场对减息预期一再推迟,加上上周未有重要消息公布,黄金上周在高位横行震荡,而走势窄幅。 本周消息较多,二、三、四、五,美国分别将公布耐用品订单、季度GDP、PCE通胀及制造业PMI。 不论数计据是好或坏,金价的单日波幅将会扩大,回到单日高/低约20美元水平。 以现时市场气氛情绪,除非数据大幅超出预期,否则短期内金价很难摆脱好淡争持局面,初步预期本周继续密食区间2015-40。

1小时图 – 金价上周的单日波幅由周初的窄幅上落一直扩大(1),周五的单日波幅扩大至约25美元,预期本周数据公布日的单日动态应该相近。 2035-40的阻力区仍然有效,短线操作继续以2015-40为蓝本。

日线图 – 金价上周五上试2041之后,始于下降通道(3)底部的反弹周期已接近完成。 把握未来1-2日金价再次上试2040的机会,只要价格在本周尾段跌穿20天MA(4),调整目标可定在2010或更低。

短线阻力 3

2045

短线阻力 2

2040

短线阻力 1

2035

现价

2031

短线支持 1

2030

短线支持 2

2025

短线支持 3

2018-20

P. To

风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。高度的杠杆可为阁下带来负面或正面的影响。阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。因此,阁下不应将无法承受损失的资金用于投资。投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。市场资料仅供参考,我们绝不保证分析内容的准确性。

美聯儲減息繼續在基本面上支持金價,但由於近期市場對減息預期一再推遲,加上上週未有重要消息公佈,黃金上週在高位橫行震蕩,而走勢窄幅。本週消息較多,二、三、四、五,美國分別將公佈耐用品訂單、季度GDP、PCE通脹及制造業PMI。不論數計據是好或壞,金價的單日波幅將會擴大,回到單日高/低約20美元水平。以現時市場氣氛情緒,除非數據大幅超出預期,否則短期內金價很難擺脫好淡爭持局面,初步預期本週繼續密食區間2015-40。

1小時圖 – 金價上週的單日波幅由週初的窄幅上落一直擴大(1),週五的單日波幅擴大至約25美元,預期本週數據公佈日的單日動態應該相近。2035-40的阻力區仍然有效,短線操作繼續以2015-40為藍本。

日線圖 – 金價上週五上試2041之後,始於下降通道(3)底部的反彈週期已接近完成。把握未來1-2日金價再次上試2040的機會,只要價格在本週尾段跌穿20天MA(4),調整目標可定在2010或更低。

短線阻力 3

2045

短線阻力 2

2040

短線阻力 1

2035

現價

2031

短線支持 1

2030

短線支持 2

2025

短線阻力 3

2018-20

P. To

从4小时图看,13/2和15/2美国出了重要数据后,金价大跌后出现力量反弹,变成一个较大的下跌通道。 虽然通道方向是下跌,但通道底亦算是支持的一种,而且出了明显的反弹力量,所以短线可以寻找一些支持位等回调买上。 从1小时图看,1995是前面小型震荡的顶部,算是明显的支持位,在这布署入市会较有利,入市后第一关先看前顶2008,升穿后看2030大阴烛的发 力位,到达通道顶后可留部份仓位试试能否升穿。 现价2035,向上做的空间不大,因为已接近通道顶和2052的阻力,但可留意15分钟图的小下跌通道顶,这位置刚好是近期升段的0.618。 向下布署的话,则留意2052附近有否反弹力量,第一关睇返2030,之后2008。 若有力量直接上破,则等待回调向上做会较有利。K.LAM风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。 高度的杠杆可为阁下带来负面或正面的影响。 阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。 可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。 因此,阁下不应将无法承受损失的资金用于投资。 投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。 市场资料仅供参考,MAX Online 绝不保证分析内容的准确性。

上周美国新申请失业救济人数意外下降,显示2月就业成长可能保持稳健。 美国劳工部周四表示,截至 2 月 17 日当周,初请失业金人数减少 12,000 人,经季节性调整后为 201,000 人。 路透社调查的经济学家预测最近一周将有 218,000 人申请失业救济。 尽管年初进行了引人注目的裁员,但初请失业金人数仍徘徊在历史低点。 COVID-19 大流行期间和之后寻找劳动力的困难通常导致雇主不愿意减少员工人数。 尽管联准会大幅升息,但经济持续扩张,工人生产力也有所提高。 周三公布的美联储1 月30 日至31 日会议纪要显示,官员们仍然认为劳动力市场“紧张”,但一些官员“指出,最近的就业增长集中在少数几个行业,他们认为,这些行业就业前景 面临下行风险。” 自2022年3月以来,联准会已将政策利率调高525个基点至目前的5.25%-5.50%区间。 初请失业金人数数据涵盖了政府针对二月份就业报告中的非农就业数据对企业进行调查的时期。 1 月经济增加了 353,000 个就业机会。 索赔报告显示,在截至 2 月 10 日的一周内,在第一周援助(招聘的替代指标)后领取福利的人数减少了 27,000 人,至 186.2 万人。

上週美國新申請失業救濟人數意外下降,顯示2月就業成長可能保持穩健。美國勞工部週四表示,截至 2 月 17 日當週,初請失業金人數減少 12,000 人,經季節性調整後為 201,000 人。 路透社調查的經濟學家預測最近一周將有 218,000 人申請失業救濟。儘管年初進行了引人注目的裁員,但初請失業金人數仍徘徊在歷史低點。 COVID-19 大流行期間和之後尋找勞動力的困難通常導致雇主不願意減少員工人數。 儘管聯準會大幅升息,但經濟持續擴張,工人生產力也有所提高。週三公佈的美聯儲 1 月 30 日至 31 日會議紀要顯示,官員們仍然認為勞動力市場“緊張”,但一些官員“指出,最近的就業增長集中在少數幾個行業,他們認為,這些行業就業前景面臨下行風險。” 自2022年3月以來,聯準會已將政策利率調高525個基點至目前的5.25%-5.50%區間。初請失業金人數數據涵蓋了政府針對二月份就業報告中的非農就業數據對企業進行調查的時期。 1 月經濟增加了 353,000 個就業機會。索賠報告顯示,在截至 2 月 10 日的一周內,在第一周援助(招聘的替代指標)後領取福利的人數減少了 27,000 人,至 186.2 萬人。

市场受美国数据影响,金价先跌后反弹。早段美国核心通胀月率比预期高,令金价早段失守影响守2000年关键支撑回到贴近1980附近。周四周四美公布倒退的零售销售数据,令金价回到2000(1)以上,2013年全周收盘。本周较重要的消息只有周四凌晨(HKT)的美国议息会议记录…虽然预计不会有任何突破性内容,继续以“观察数据”、“更多证据”及“降息时间表将比市场慢”等利淡主导主导,届时相信将为金价带来短暂下压。

1小时图-自上周四金价重回2000以上,过去24小时刚刚形成了短线的上升通道(3)。中国假期过后今早亚盘开市,金价已突破上周触发的回调(2)及阻力区(2.1)。买盘有加速迹象,现时已上脱通道(3),短线目标可定在上周二高位2028(4),下一日标在阻力区(5)。本周一美国假期,相信市场成交偏静,而本周交易区暂定在2000-40之间。

日线图 – 上周回调的下跌通道(7)仍然有效,上方20MA(6)会有短线阻力。整体结构在上周美国公布的通胀数据后已由横行震荡(8)转为下跌调整(7) 。

短线阻力 3

2030

短线阻力 2

2023

短线阻力 1

2020

现价

2018

短线支持 1

2015

短线支持 2

2010

短线支持 3

2008-10

P. To

风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。高度的杠杆可为阁下带来负面或正面的影响。阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。因此,阁下不应将无法承受损失的资金用于投资。投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。市场资料仅供参考,我们绝不保证分析内容的准确性。

行業調查顯示,隨著買家需求增強,英國待售房屋價格六個月來首次出現年度上漲,該調查進一步顯示了英國房屋市場穩定的跡象。2 月房屋要價年增 0.1%,這是自 2023 年 8 月以來的首次年度上漲。價格較 1 月上漲 0.9%,與 2 月 1.0% 的 10 年平均漲幅基本一致。經過放緩之後,英國房地產行業近幾個月有所回升,因預期英國央行今年將降低借貸成本,抵押貸款利率下降。2024 年前六週的協議銷售額年增 16%,與新冠病毒大流行之前的 2019 年相比增長 3%。 英國央行官員表示,儘管去年底經濟陷入衰退,但在降息之前,他們需要看到通膨壓力緩解的進一步證據。 房地產網站 Rightmove表示:“雖然抵押貸款市場已經恢復穩定,但越來越多的跡象表明,貸款機構進一步降低利率的空間正在縮小,並且利率將在不久的將來穩定在較高水平。” 週一的調查與英國房地產市場改善的其他跡象相呼應。英國皇家特許測量師學會本月報告稱,新買家詢價出現近兩年來最大增幅。 抵押貸款機構 Nationwide 和 Halifax 都報告一月份房價上漲。