Gold price rallied from a 3-month low last week. The US core inflation rate came in higher than expected, causing the gold price to break below the critical support level of 2000 and drop close to 1980. However, the release of the disappointing US retail sales data pushed the gold price back above 2000 (1) on Thu., ending the week near 2013. The main event on the economic calendar this week will be the release of the US Fed. Meeting minutes on Wed. Not expecting any surprising content, the dominant factors will remain to be “observing the data,” “waiting for more evidence,” and “the timing of rate cuts being slower than market expectations,” which are mostly bearish for gold, pulling the gold price down in S-T.

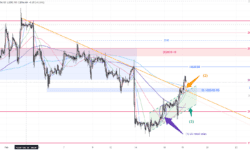

1-hour chart – An S-T upward channel(3) has formed in the past 24 hours. At the Asian session today, the gold price has broken through the previously mentioned downward resistance(2) and resistance zone (2.1). There are signs of accelerating buying pressure, and the price has already moved above the channel(3). The S-T target can be set at last Tue’s high near 2028(4), where the next upside target is at the resistance zone (5). With the US holiday on Monday, the market volume may be reduced. Tentatively, the trading range for this week can be set between 2000-40.

Daily Chart – Last week’s downward channel (7) is still valid, and some S-T resistance from the 20-day MA(6) is expected. The overall structure has transformed from a sideways consolidation (8) to a downward correction (7) after the release of US inflation data last week.

S-T ressitance 3

2030

S-T ressitance 2

2023

S-T ressitance 1

2020

Market price

2018

S-T support 1

2015

S-T support 2

2010

S-T support 3

2002

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

市场受美国数据影响,金价先跌后反弹。早段美国核心通胀月率比预期高,令金价早段失守影响守2000年关键支撑回到贴近1980附近。周四周四美公布倒退的零售销售数据,令金价回到2000(1)以上,2013年全周收盘。本周较重要的消息只有周四凌晨(HKT)的美国议息会议记录…虽然预计不会有任何突破性内容,继续以“观察数据”、“更多证据”及“降息时间表将比市场慢”等利淡主导主导,届时相信将为金价带来短暂下压。

1小时图-自上周四金价重回2000以上,过去24小时刚刚形成了短线的上升通道(3)。中国假期过后今早亚盘开市,金价已突破上周触发的回调(2)及阻力区(2.1)。买盘有加速迹象,现时已上脱通道(3),短线目标可定在上周二高位2028(4),下一日标在阻力区(5)。本周一美国假期,相信市场成交偏静,而本周交易区暂定在2000-40之间。

日线图 – 上周回调的下跌通道(7)仍然有效,上方20MA(6)会有短线阻力。整体结构在上周美国公布的通胀数据后已由横行震荡(8)转为下跌调整(7) 。

短线阻力 3

2030

短线阻力 2

2023

短线阻力 1

2020

现价

2018

短线支持 1

2015

短线支持 2

2010

短线支持 3

2008-10

P. To

风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。高度的杠杆可为阁下带来负面或正面的影响。阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。因此,阁下不应将无法承受损失的资金用于投资。投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。市场资料仅供参考,我们绝不保证分析内容的准确性。

上週市場受美國數據影響,金價先跌後反彈。早段美國核心通脹月率比預期高,令金價早段失守2000關鍵支持回到貼近1980附近。直至週四美公佈倒退的零售銷售數據,令金價回到2000(1)以上,全週收盤在2013。本週較重要的消息只有週四凌晨(HKT)的美國議息會議記錄…雖然不預期會有任何突破性內容,繼續以"觀察數據"、"更多証據"及"減息時間表會比市場預期慢"等利淡因素主導,介時相信會為金價帶來短暫下壓。

1小時圖 – 自從上週四金價重回2000以上,過去24小時剛形成了短線的上升通道(3)。中國假期過後今早亞盤開市,金價已突破上週提及的下降阻力(2)及阻力區(2.1)。買盤有加快跡象,現時已上脫通道(3),短線目標可定在上週二高位2028(4),下一日標在阻力區(5)。本週一美國假期,相信市場成交偏靜,而本週交易區暫定在2000-40之間。

日線圖 – 上週提及的下降通道(7)仍然有效,上方20MA(6)會有短線阻力。整體結構在上週美國公佈通脹數據後已由橫行震蕩(8)轉為下降調整(7),

短線阻力 3

2030

短線阻力 2

2023

短線阻力 1

2020

現價

2018

短線支持 1

2015

短線支持 2

2010

短線阻力 3

2002-5

P. To

澳洲1月份就業出乎意料地疲軟,失業率攀升至兩年高點,這再次表明勞動力市場在經濟放緩和消費需求低迷的情況下正在放鬆。 澳洲統計局週四公佈的數據顯示,1 月淨就業人數僅比 12 月的 62,800 人增加 500 人。 市場預測增幅約為 30,000,但近幾個月該系列波動非常大。 繼上月下滑後,1 月全職就業人數增加 11,100 人。 失業率升至 4.1%,高於預期的 4.0%,為 2022 年 1 月以來的最高水準。參與率維持在 66.8%,而工作時間大幅下降 2.5%。

日本股市週二觸及34年新高,而歐洲股市和標準普爾500指數期貨下跌,因投資者等待可能影響聯準會政策的美國通膨報告。在通膨數據公佈之前,美國國債和美元幾乎沒有變化。 由於資金流入加密貨幣支持的交易所交易基金,比特幣在兩年多來首次突破門檻後仍保持在 5 萬美元左右。 日本日經指數 (.N225) 週二開盤攀升至 38,010 點,距離 1989 年觸及的歷史高點 38,957 點不遠。繼 2023 年上漲 28% 後,今年迄今已上漲超過 13%。匯豐銀行首席多元資產策略師馬克斯·凱特納表示:“今年迄今為止,美國國債收益率有所上升。” “在日本央行沒有採取任何真正損害日圓的有意義的緊縮措施的情況下,這有助於對出口敏感的日本股市。”由於投資者在美國數據公佈前變得謹慎,歐洲股市下跌,歐洲斯托克 600 指數 (.STOXX) 在周一上漲 0.54% 後開盤下跌 0.51%。德國 DAX (.GDAXI) 打開新標籤股票指數下跌 0.57%。 由於降息希望推動投資者情緒改善,該指數週一升至略低於歷史新高的水平。美國標普 500 指數期貨下跌 0.41%,那斯達克指數期貨下跌 0.69%。 受降息押注和少數科技股的提振,標準普爾 500 指數週一再創新高,突破 5,000 點。 英國富時 100 指數 (.FTSE) 下跌 0.29%,而在數據顯示 2023 年最後三個月薪資成長強於預期後,英鎊兌歐元升至 8 月以來最高水準。格林尼治標準時間 1330 點(美國東部時間上午 8 點 30 分)公佈的 1 月美國通膨數據可能會震動市場。 路透社調查的經濟學家預計,消費者物價指數(CPI)較去年同期上漲2.9%,低於上月的3.4%。 由於美國數據強於預期,投資人最近幾週降低了對各大央行降息的押注。 他們現在預計到今年底將降息約 110 個基點,低於 2 月初的約 145 個基點。10年期公債殖利率維持在4.166%不變。 衡量美元兌六種貨幣的美元指數幾乎沒有變化,為 104.13,而歐元則大致持平,為 1.0774 美元。對美國利率敏感的日圓最新報1美元兌149.4,距離備受關注的150水平不遠,分析師稱該水平可能會引發日本官員進一步發表評論,試圖支撐日元。由於投資者推遲了對日本央行何時結束超寬鬆貨幣政策的預期,今年日圓兌美元匯率已下跌約 6%。大宗商品方面,布蘭特原油期貨報82.56美元,當日上漲0.68%。

日本股市周二触及34年新高,而欧洲股市和标准普尔500指数期货下跌,因投资者等待可能影响联准 会政策的美国通膨报告。 在通膨数据公布之前,美国国债和美元几乎没有变化。 由于资金流入加密货币支持的交易所交易基金,比特币在两年多来首次突破门槛后仍保持在 5 万美元左右。 日本日经指数 (.N225) 周二开盘攀升至 38,010 点,距离 1989 年触及的历史高点 38,957 点不远。 继 2023 年上涨 28% 后,今年迄今已上涨超过 13%。 汇丰银行首席多元资产策略师马克斯·凯特纳表示:“今年迄今为止,美国国债收益率有所上升。” “在日本央行没有采取任何真正损害日圆的有意义的紧缩措施的情况下,这有助于 对出口敏感的日本股市。”由于投资者在美国数据公布前变得谨慎,欧洲股市下跌,欧洲斯托克600 指数(.STOXX) 在周一上涨0.54% 后开盘下跌0.51%。 德国 DAX (.GDAXI) 打开新标签股票指数下跌 0.57%。 由于降息希望推动投资者情绪改善,该指数周一升至略低于历史新高的水平。 美国标普 500 指数期货下跌 0.41%,那斯达克指数期货下跌 0.69%。 受降息押注和少数科技股的提振,标准普尔 500 指数周一再创新高,突破 5,000 点。 英国富时100 指数(.FTSE) 下跌0.29%,而在数据显示2023 年最后三个月薪资成长强于预期后,英镑兑欧元升至 8 月以来最高水准。 格林尼治标准时间 1330 点(美国东部时间上午 8 点 30 分)公布的 1 月美国通膨数据可能会震动市场。 路透社调查的经济学家预计,消费者物价指数(CPI)较去年同期上涨2.9%,低于上月的3.4%。 由于美国数据强于预期,投资人最近几周降低了对各大央行降息的押注。 他们现在预计到今年底将降息约 110 个基点,低于 2 月初的约 145 个基点。 10年期公债殖利率维持在4.166%不变。 衡量美元兑六种货币的美元指数几乎没有变化,为 104.13,而欧元则大致持平,为 1.0774 美元。 对美国利率敏感的日圆最新报1美元兑149.4,距离备受关注的150水平不远,分析师称该水平可能会引发日本官员进一步发表评论,试图支撑日元。 由于投资者推迟了对日本央行何时结束超宽松货币政策的预期,今年日圆兑美元汇率已下跌约 6%。 大宗商品方面,布兰特原油期货报82.56美元,当日上涨0.68%。

Keep an eye on the gold price for a downward adjustment after the US CPI this week.

The gold market was relatively calm last week; the trading volume of COMEX gold futures noticeably declined, dropping from an average daily volume of over 200,000 contracts in Jan. to only 140,000 since the beginning of the week. Adding that no significant economic data was being released, the price mainly bounced within the range of 2020-2040(1). As expected, we hope everyone took advantage of the situation✊. The trend hasn’t changed much after a week of sideways movement. The key focus this week, without a doubt, is the US CPI data on Tuesday. I expect the data to push the gold price higher towards the resistance zone around 2035-2040(3). Whether it can jump across 2050 will very much depend on whether the data release brings any surprises. On the other hand, according to CME’s FedWatch, the probability of a rate cut in March has decreased to around 60%, so the chances of gold reaching new highs in the S-T are slim. The S-T price will likely continue oscillating within the sideway range… but still be mindful of a potential deeper consolidating cycle.

1-hour chart – We can continue utilizing the 2020-40(1) range for S-T. Keep an eye on the downward resistance line formed last week(2). If the price breaks above this resistance line within the next 48 hours, it will trigger a round of buying orders, and the price may reach once again the 2040 resistance zone (3). The key support level below is at 2015.

Daily chart – Although the upward trendline (4) is still valid, the probability of a rate cut in May is declining. Unless US inflation significantly slows down in the next two weeks, it will be difficult for the gold price to maintain its current upward movement above the trendline(4). If the gold price falls below the support line (4) in this week, it will trigger a round of selling, and the price is likely to test the bottom of the 2002-2065 range (5) again.

S-T ressitance 3

2040

S-T ressitance 2

2035

S-T ressitance 1

2030

Market price

2024

S-T support 1

2020

S-T support 2

2015

S-T support 3

2008-10

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

上周国际金市相对平静,COMEX期金成交量自周二开始明显回落,由一月每日平均20万张以上成交量,下跌至每日只有14万张。配合完全没有重要经济数据公布的一星期,金价基本上只在2020-40(1)区间内震荡。合付我们预期,希望大家都有好好把握✊。经过一周的横行,整体趋势未有太大变化,本周重点是周二公布的美国CPI通胀数字,初步预期数据应能将金价推高回到区间阻力2035-40(3)附近,能否再试2050之上就要看数字公布是否有惊喜。但自从CME FedWatch 3月减息的基会率回落后,黄金短期内再试历史高位的机会率偏低。短线价格偏向继续区间震荡,留意价格往下调整,中/长线减息前再往上弹高。

1小时图- 现时可继续把握2020-40(1)区间操作,留意上周形成的下降阻力线(2),未来48小时内只要上破阻力线(2)会触发一轮买盘,价格会回到2040(3)阻力区。下方关键短线支持在2015。

日线图- 虽然上升趋势线(4)仍然有效,但现时5月减息的机会率只有60%左右,除非美国通胀在未来2周明显回落,否则金价要守住现时上升趋势(4)会有难度。未来1周若金价跌穿支持线(4),短期内会触发一轮沽盘,价格应会再试2002-65(5)区间的底部。

短线阻力 3

2040

短线阻力 2

2035

短线阻力 1

2027

现价

2024

短线支持 1

2020

短线支持 2

2015

短线支持 3

2008-10

P. To

风险提示: 场外式黄金/白银交易涉及高度风险,未必适合所有投资者。高度的杠杆可为阁下带来负面或正面的影响。阁下在决定买卖场外式黄金/白银之前应审慎考虑自己的投资目标、交易经验以及风险接受程度。可能出现的情况包括蒙受部分或全部初始投资额的损失,或在极端情况下(例如相关市场跳空)产生更多的损失。因此,阁下不应将无法承受损失的资金用于投资。投资应知悉买卖场外式黄金/白银有关的一切风险,如有需要,请向独立财务顾问寻求意见。市场资料仅供参考,我们绝不保证分析内容的准确性。

上週國際金市相對平靜,COMEX期金成交量自週二開始明顯回落,由一月每日平均20萬張以上成交量,下跌至每日只有14萬張。配合完全沒有重要經濟數據公佈的一星期,金價基本上只在2020-40(1)區間內震蕩。合付我們預期,希望大家都有好好把握✊。經過一週的橫行,整體趨勢未有太大變化,本週重點是週二公佈的美國CPI通脹數字,初步預期數據應能將金價推高回到區間阻力2035-40(3)附近,能否再試2050之上就要看數字公佈是否有驚喜。但自從CME FedWatch 3月減息的基會率回落後,黃金短期內再試歷史高位的機會率偏低。短線價格偏向繼續區間震蕩,留意價格往下調整,中/長線減息前再往上彈高。

1小時圖 – 現時可繼續把握2020-40(1)區間操作,留意上週形成的下降阻力線(2),未來48小時內只要上破阻力線(2)會觸發一輪買盤,價格會回到2040(3)阻力區。下方關鍵短線支持在2015。

日線圖 – 雖然上升趨勢線(4)仍然有效,但現時5月減息的機會率只有60%左右,除非美國通脹在未來2週明顯回落,否則金價要守住現時上升趨勢(4)會有難度。未來1週若金價跌穿支持線(4),短期內會觸發一輪沽盤,價格應會再試2002-65(5)區間的底部。

短線阻力 3

2040

短線阻力 2

2035

短線阻力 1

2027-30

現價

2024

短線支持 1

2020

短線支持 2

2015

短線阻力 3

2008-10

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,我們絕不保証分析內容的準確性。

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

黃金價格自上月中從2000反彈向上後,一直未有明顯的趨勢,但從1H看就明顯見到價格由下行震盪變成上行震盪,開始出現HIGHER LOW。雖然上週五未能升穿2063的前雙頂,而且更發力向下爆,不過最後趨勢沒有延續向下和做成LOWER LOW,所以價格走勢仍會先看震盪和有機會向上壓縮。操作上仍是短線會較有優勢,因為現時的區間是2063至上升趨勢線大約40蚊左右,可能仍會向上收窄,所以在頂底範圍才出手會較好。K.LAM風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。