由美國通脹數據帶動,金價昨日到達我們早前預期目標,並持續向上。早段亞/歐盤,市場等待美盤數據公佈,價格一直在1943-48區間內窄幅震蕩。到美盤開市,美國通脹進一步放緩,金價先觸及1955(1)區間阻力,隨後買盤繼續,再突破下降通道(2),觸發新一輪買盤入市,升到全日最高1970。全日收市1963,上升17美元。

1小時圖 – 金價在昨日突破下降通道(2)後,源自2004的下跌正式完結。而現時的短線上升趨勢仍在加快,未有轉勢訊號出現。短線阻力在1970,預期上升趨勢最少會持續至今晚美盤,若今晚美國零售數據放緩,價格目標可定在1980(3)或更高。

日線圖 – 未有見頂訊號,趨勢仍以上升為主。短線阻力在20天MA(4)。中線操作區間(5)仍然有效,未來2週可留意下降阻力線(6)。

短線阻力 3

1980

短線阻力 2

1973

短線阻力 1

1970

現價

1968

短線支持 1

1964

短線支持 2

1960

短線阻力 3

1955

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。

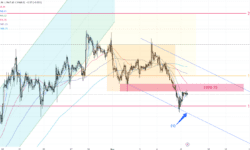

上週二跌穿震盪底1970後,到達4小時圖大位後出現反彈,但反彈的力量未能升穿1970的下跌結構,更在週五美盤時段跌穿1946大位,向下延續的機會增加。 15M圖看到價格曾經在1930做了一個小型的假突破,升穿了前底1944,在下跌通道頂附近。雖然看陽燭的力量似會先升穿通道,但短期趨勢本來向下,而且1946大位已破加上今晚週二美國有重要數據公佈。可先看數據公佈後有沒有方向提示,如向上假突破或直接向下跌穿1930,就大機會延續下跌。就算有力向上建倉,到達1970前橫行底或1990橫行中線時,最好做倉位管理,因為大多數橫行突破後回到頂底或中線都會有較大反應。K.Lam風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。

在MT4手机版中,您可以透过以下步骤下单: 市价单/ Market Execution – 市场成交限价买入/ Buy Limit – 设定在较低价格买入限价卖出/ Sell Limit – 设定在 较高价格卖出止损买入/ Buy Stop – 市价大于设定价格,会在较高价格买入止损卖出 / Sell Stop – 市价 小于设定价格,会在较低价格卖出1. 开启MT4 手机版并登入您的交易帐户。 如果尚未安装,您可在 Apps store / Google play 下载。 并使用您的帐户资讯登录。 2. 在下方的导航栏中,点击底部的”报价”(Quotes)按钮。 3. 在报价列表 中找到您想要交易的货币对或其他金融商品。 点击该货币对的报价,进入交易视窗。 4. 在交易视窗中,点击屏幕 左上角的”交易”(Trade)按钮。 5. 在交易视窗的底部,您会看到四 个不同的下单选项:市场(Market)、限价(Pending)、止损(Stop Loss)和止盈(Take Profit)。 选择”限价”(Pending)。 6. 选择”买入限价”(Buy Limit)。 7. 输入您想要买入的价格水平。 这应该是低于当前市场价格的价格8. 输入您希望交易的交易量(手数)。 9. 确认您的订单 参数,并点击”下单”(Place)。 系统将根据您设定的价格水平在市场价格到达 时自动触发交易。 请注意,市场行情可能会迅速变化,导致您的限价单无法被执行。 因此,请确保在下单前仔细考虑市场条件和风险管理策略。 请记住,具体的步骤可能因MT4手机版的更新而略有不同。 在下单前仔细检查限价订单的参数以确保准确性。

在MT4手機版中,您可以透過以下步驟下單:市價單 / Market Execution – 市場成交限價買入 / Buy Limit – 設定在較低價格買入限價賣出 / Sell Limit – 設定在較高價格賣出止損買入 / Buy Stop – 市價大於設定價格,會在較高價格買入止損賣出 / Sell Stop – 市價小於設定價格,會在較低價格賣出1. 開啟MT4手機版並登入您的交易帳戶。如果尚未安裝,您可在 Apps store / Google play 下載。並使用您的帳戶資訊登錄。2. 在下方的導航欄中,點擊底部的”報價”(Quotes)按鈕。3. 在報價列表中找到您想要交易的貨幣對或其他金融商品。點擊該貨幣對的報價,進入交易視窗。4. 在交易視窗中,點擊屏幕左上角的”交易”(Trade)按鈕。5. 在交易視窗的底部,您會看到四個不同的下單選項:市場(Market)、限價(Pending)、止損(Stop Loss)和止盈(Take Profit)。選擇”限價”(Pending)。6. 選擇”買入限價”(Buy Limit)。7. 輸入您想要買入的價格水平。這應該是低於當前市場價格的價格8. 輸入您希望交易的交易量(手數)。9. 確認您的訂單參數,並點擊”下單”(Place)。系統將根據您設定的價格水平在市場價格到達時自動觸發交易。請注意,市場行情可能會迅速變化,導致您的限價單無法被執行。因此,請確保在下單前仔細考慮市場條件和風險管理策略。請記住,具體的步驟可能因MT4手機版的更新而略有不同。在下單前仔細檢查限價訂單的參數以確保準確性。

美國通脹數據是否會再次支撐美元?本週的高潮毫無疑問將是10月份的美國通脹數據,該數據將於星期二公佈。如果通脹真的出乎意料地上升,美元很可能再次受益,因為這將使得進一步的美聯儲加息再次成為可能。另一方面,通脹不太可能出現如此明顯的驚喜,以至於進一步的加息成為板上釘釘的事情。在星期二的數據公佈之後,還將有另一份勞工市場報告和新的通脹數據在下一次美聯儲會議之前公佈,這些數據對於整體局勢的判斷也很重要。真實經濟也可能在接下來的幾周開始反映出加息的效應。預計本周三公佈的零售銷售數據可能會拉開序幕,我們的經濟學家預計跌幅將超過彭博社的共識預期。也許超出預期的通脹率可能會主導弱勢的零售銷售數據。然而,在接下來的幾周中,很可能會明顯看出美聯儲不會實施進一步的加息,降息成為更加重要的問題。在那時,美元也很可能再次走軟。

黃金週末前造出一週新低,順利在48小時完成了對上一篇分析的下跌循環。週四早段先升穿早前提及的下降阻力線(1),觸發出一輪短線買盤,反彈到1965附近。隨後下跌正式開始,週五美盤前已跌穿1950支持,美盤一直回落到全週新低1935,一週收市在1938,下跌53美元。

1小時圖 – 下降趨勢仍有加快跡象,早前的下降通道需再次調整,由(2.1)修正到(2.2)。經過今早亞盤開市快閃1928後,短線趨勢暫時以買盤主導,本週早段初步操作區間在1930-55(3)。

日線圖 – 黃金初步已完成由2004開始之調整,暫時支持在50天移動均線(4)。日線圖操作區間在1930-2003(5)。關鍵轉折點會出現在週二美市公佈的美國通脹數據。

短線阻力 3

1950-55

短線阻力 2

1945

短線阻力 1

1940

現價

1939

短線支持 1

1930-32

短線支持 2

1927

短線阻力 3

1920

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。

2023年第三季黄金需求仍高于长期平均水平

中央银行的黄金购买保持高数量,但未能达到去年第三季纪录。 因高黄金价格,珠宝需求稍微减弱,而投资情况则各有不同。

第三季度,黄金需求(不包括OTC 场外交易)比五年平均水平高出8%,但同比下降6%,达到1,147吨。 包括场外交易和库存的总需求同比增长6%,达到1,267吨。 中央银行净购入337吨黄金,尽管没有突破去年第三季的459吨的强劲数字,这季的央行购入是在世界黄金协会数据系列中排名第三的最强季度。 今年至此,中央银行的需求同比增长14%,已达历史纪录的800吨。

第三季度的投资需求为157吨,虽然同比增长56%,但相对于五年平均水平315吨还是较弱。 全球黄金ETF持仓量在第三季下跌了139吨,但这已比去年第三季的净流出量(-244吨)要大幅减少。

铸造金条和金币的投资需求同比下降14%,至296吨,尽管仍然高于五年季度平均水平267吨。 同比下降主要是欧洲需求急剧下降。

场外交易的投资需求在第三季度总计为120吨。 尽管ETF流出和COMEX期货净多头头寸下降,场外交易的投资为第三季度的黄金价格提供了支撑。

珠宝消费略微减弱,同比下降2%,至516吨,原因是持续的黄金价格上涨。 珠宝加工略微更具韧性,下降1%,至578吨,这是因为库存的积累。

脆弱的消费电子产品需求继续削弱了黄金在技术中的使用量,同比下降3%,至75吨。

矿业产量在第三季度达到了创纪录的971吨,有助于将总供应量提升至1,267吨(同比增长6%)。 回收量也同比增长8%,达到289吨。

[季度趋势]

第三季度的金需求(不包括场外交易)高于五年平均水平8%,但同比下降6%,达到1,147吨。 包括场外交易和库存流动,总需求同比增长6%,达到1,267吨。

需求趋势

现货金价第三季度价格平均在 1928.5美元/盎司。 尽管比第二季度的历史最高水平低2%,但同比增长12%。 由于很多货币兑美元走弱,地区金价都贴近历史高位,当中包括日本、中国和土耳其在内的一些国家。

本年直至第三季,各国中央银行已经净购入了800吨的黄金,创下该九个月期间的最高纪录。 但最近几个季度增加储备的国家渐趋广泛。

金条和金币的投资整体上与去年第一季度至第三季度相约。 而中东、土耳其和中国上半年的需求强劲。 相反,黄金ETF在今年迄今已经流出了189吨,并且已经连续六个季度出现需求下滑的情况。

供应趋势

2023年第三季创下历史新高之后,矿业产量也达到了今年至今的新高,达到2,744吨。 令2023年的年度记录极有可能创新高。 回收金的年初至今供应量也相对较高,为924吨(+9%)。 尽管高黄金价格支撑了这一供应元素,但仍受制于美国的经济韧性和中东地区的强烈投资动机所影响。

本网站/应用程式包含的内容和信息乃根据公开资料分析和演释,该公开资料,乃从相信属可靠之来源搜集,这些分析和信息并未经独立核实和MAX Online 并不保证 他们的准确性、完整性、实时性或者正确性。 资讯仅作参考使用,在根据资讯执行证券或任何交易前,应咨询独立专业意见,以核实定价资料或获取更详细的市场信息。 MAX Online 不应被视为游说任何读者或访客执行任何交易,阁下须为所有跟随在本网站的资料、评论和购买或出售评分执行的交易负责。

2023年第三季黃金需求仍高於長期平均水平

中央銀行的黃金購買保持高數量,但未能達到去年第三季紀錄。因高黃金價格,珠寶需求稍微減弱,而投資情況則各有不同。

第三季度,黃金需求(不包括 OTC 場外交易)比五年平均水平高出8%,但同比下降6%,達到1,147噸。包括場外交易和庫存的總需求同比增長6%,達到1,267噸。中央銀行淨購入337噸黃金,儘管沒有突破去年第三季的459噸的強勁數字,這季的央行購入是在世界黃金協會數據系列中排名第三的最強季度。今年至此,中央銀行的需求同比增長14%,已達歷史紀錄的800噸。

第三季度的投資需求為157噸,雖然同比增長56%,但相對於五年平均水平315噸還是較弱。全球黃金ETF持倉量在第三季下跌了139噸,但這已比去年第三季的淨流出量(-244噸)要大幅減少。

鑄造金條和金幣的投資需求同比下降14%,至296噸,儘管仍然高於五年季度平均水平267噸。同比下降主要是歐洲需求急劇下降。

場外交易的投資需求在第三季度總計為120噸。儘管ETF流出和COMEX期貨凈多頭頭寸下降,場外交易的投資為第三季度的黃金價格提供了支撐。

珠寶消費略微減弱,同比下降2%,至516噸,原因是持續的黃金價格上漲。珠寶加工略微更具韌性,下降1%,至578噸,這是因為庫存的積累。

脆弱的消費電子產品需求繼續削弱了黃金在技術中的使用量,同比下降3%,至75噸。

礦業產量在第三季度達到了創紀錄的971噸,有助於將總供應量提升至1,267噸(同比增長6%)。回收量也同比增長8%,達到289噸。

[季度趨勢]

第三季度的金需求(不包括場外交易)高於五年平均水平8%,但同比下降6%,達到1,147噸。包括場外交易和庫存流動,總需求同比增長6%,達到1,267噸。

需求趨勢

現貨金價第三季度價格平均在 1928.5美元/盎司。儘管比第二季度的歷史最高水平低2%,但同比增長12%。由於很多貨幣兌美元走弱,地區金價都貼近歷史高位,當中包括日本、中國和土耳其在內的一些國家。

本年直至第三季,各國中央銀行已經淨購入了800噸的黃金,創下該九個月期間的最高紀錄。但最近幾個季度增加儲備的國家漸趨廣泛。

金條和金幣的投資整體上與去年第一季度至第三季度相約。而中東、土耳其和中國上半年的需求強勁。相反,黃金ETF在今年迄今已經流出了189噸,並且已經連續六個季度出現需求下滑的情況。

供應趨勢

2023年第三季創下歷史新高之後,礦業產量也達到了今年至今的新高,達到2,744噸。令2023年的年度記錄極有可能創新高。回收金的年初至今供應量也相對較高,為924噸(+9%)。儘管高黃金價格支撐了這一供應元素,但仍受制於美國的經濟韌性和中東地區的強烈投資動機所影響。

本網站/應用程式包含的內容和信息乃根據公開資料分析和演釋,該公開資料,乃從相信屬可靠之來源搜集,這些分析和信息並未經獨立核實和MAX Online 並不保證他們的準確性、完整性、實時性或者正確性。資訊僅作參考使用,在根據資訊執行證券或任何交易前,應諮詢獨立專業意見,以核實定價資料或獲取更詳細的市場信息。MAX Online 不應被視為游說任何讀者或訪客執行任何交易,閣下須為所有跟隨在本網站的資料、評論和購買或出售評分執行的交易負責。

黃金昨日先橫行後往下,早段亞/歐盤整體在1961-69之內震蕩,直至美盤開市正式推穿1960支持(1),最低觸及1947,全日收市在1949,下跌約20美元。

1小時圖 – 昨日提及的下降通道(2),可微調到(2.1)。下降通道內的反彈仍未出現,短線須留意在剛形成的下降阻力(3).

日線圖 – 昨日收市在1950,早前提及1960以下買盤/1950-55的支持在昨日美盤已差不多全被清除。預期未來48小時金價會再試本週新低。短線目標可留意61.8回吐 – 1934(6)及50天移動均線(5)。

短線阻力 3

1965

短線阻力 2

1960

短線阻力 1

1955

現價

1952

短線支持 1

1950

短線支持 2

1944

短線阻力 3

1938-40

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。

黃金昨日做出近2星期低位。早段亞盤承接前日收市前弱勢一直往下,先試1970的區間底部支持。歐盤跌勢繼續一直回調到全日最低1956,美盤開市反彈正式開始,全日收盤在1969,下跌8美元。

1小時圖 – 短線反彈1970-75會有技術阻力,經過昨日美盤的反彈,短線操作暫時可參考剛形成的短線下降通道(1)。

日線圖 – 昨日美盤開市後的低位反彈,在日線圖畫出相對較長的下移線(2),反映1960以下仍有較強買盤。日內要突破1950-55機會較低,仍須等待突破訊號。之前提及的1953-96(4)區間仍然有效。

短線阻力:

1980

1974

1970

現價:1967

短線支持:

1960

1955

1950

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。