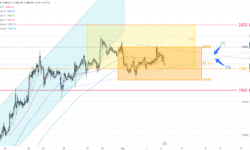

日圖級別可看到自10月初的升段,力量強勁,直接升穿1946的前頂,升勢去到2000齊頭位,亦是5月時的前底阻力位停下。雖然升勢強勁,但如果要長線佈署看漲的話,最好待價格回到有利的位置再出手會較為值博,而且價格剛從2000大位回調,可留意有沒有短線看淡的機會。 從1小時圖看,上週一大陽燭再次挑戰2000大位,但回調後未有動能再次突破前高,反而到了週二美盤時發力向下做了一個雙頂。從圖形上看,當週三晚出了那隻腳後,可以說是做了上行通道或箱型橫行,雖然型態不同但處理方法都是一樣,頂沽底揸或突破後做跟進。 現價已明顯跌穿通道底和橫行底,短線方向較大機會會向下行先,直到1946或日圖升段的0.618位置(1886)時,再觀察陰陽燭的力量變化,看看會否延續大圖的升勢。K.LAM

黃金昨日走勢偏弱,收市在貼近全日低位。早段亞盤先試全日高位1993,隨後一直往下。收市前跌穿短線上升支持線(1),觸發新一輪沽空,收市在最低1977, 全日下跌15美元。

1小時圖 – 金價在跌穿上升支持線(1)後,趨勢轉弱,現時直指昨日提及的1970-2000區間(2)底部,短線1970-74附近會有技術買盤支持。只要跌穿1970,1小時圖上將觸發新一輪跌浪。

日線圖 – 黃金昨日收市貼近全日最低同時1980以下,趨勢開始轉弱。整體走勢在1953-96(3)區間之間。只要1小時圖1970的買盤被清除,下方目標可定在20 MA(4) – 1961。

短線阻力:

1990

1984

1980

現價:1976

短線支持:

1970-74

1967

1960

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Onlime 絕不保証分析內容的準確性。

黃金經過上週2大Events (FOMC議息會議+非農數據後) 走勢上未有出現明顯突破。而局勢消息可預期以/巴局勢對市場影響繼續下降(情況如俄/烏戰事)。

1小時圖 – 過去48小時金價走勢正在收窄(1)。而上週預期的橫行區間(2),經過上週四、五數據公佈後,亦已收窄及下移到1970-2000(2.1)。本週未見有任何重要經濟數據公佈,早段預期可把握(2.1)區間操作。

日線圖 – 上週提及1955-97(3)的區間仍然有效,美聯儲議息會議後1990以上的沽壓明顯較重,本週初步仍可以1955-97為操作藍本。只要日線圖收市價在2000以下,較中線可留意回吐目標在61.8% – 1934(4)。

短線阻力:

2000

1995

1990

現價:1983

短線支持:

1980

1974

1970

P. To

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,MAX Online 絕不保証分析內容的準確性。

The price of gold fluctuated within a narrow range yesterday. It opened at 2006, last Friday’s closing price. In the early Asian session, it had fallen below 2000, and the rest of the day the price stayed within a tight range between 1990 and 2000 throughout the rest of the day.

1-hour chart – The uptrending momentum has slowed down. The price broke out from the upward channel (1) yesterday. Expected the price to fluctuate between 1980 and 2020. Pay close attention to the US Fed meeting meeting, the next major move should occur after the announcement.

Daily Chart – The upward trend that originated from 1809 has slowed down in the last few trading days. Before the breakout, traders can take advantage of the 1955-97(3) range.

S-T Resistances:

2020

2008-10

2000

Market price: 1995

S-T Supports:

1990

1985

1980

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

我們都知道,心態對一個人的影響有多大,甚至可以決定一切。為甚麼一個好的心態對交易員這麼重要呢?,因為它直接影響了交易者的信念和執行力,會在心態不好時會在該出手時不敢出手,出手後失敗又不停追悔,從而影響下一次的判斷。還有一些心態比較脆弱的交易者,一虧錢就難受,吃不下飯睡不著覺,一賺錢就笑哈哈,恨不得全世界都知道賺錢了。接下來,將會為大家說明在黃金市場虧蝕的陷阱。4個投資者經常犯的誤區1. 過度槓桿任何一家差價合約交易商的平台,通常都有預設一個槓桿倍數,而倍數的高低是根據商品類型而定,例如股票類可能預設是5倍,有些貴金屬類或外匯類可能預設是100倍、甚至400倍。有為數不少的投資者可能初期都只有準備不多的錢及不清楚槓桿原理,例如本金 1000美金。但在交易時,大家交易的倉位通常會一不小心讓部位價值會高達1萬甚至5萬美金,相當於隨時都在融資交易。5萬美金只要波動0.2%,就相當於波動了100美金,佔總資產的10%了,因此他們時常會忽略掉自己正在買賣多大的交易部位。如果真的不幸出現發生突發性劇烈波動,過度槓桿的問題就會體現出來,造成帳戶50%甚至超過100%的虧損,因而被強制平倉。了解更多:投資者必須知的黃金知識(三): 槓桿投資2. 過度堅持一般剛剛加入外匯黃金市場的投資者,對市場只有大概的了解,繼而出現以下的情況。如果他們的交易主要是日內的短線,賺了一點錢便急於平倉,害怕利潤會消失。如果虧蝕了就堅持抱著,想著總有反彈的時候,對的單子拿不住,虧錢的單子死扛,死不認輸。還有的人,在下單的時候,其實他們是知道風險意識的,也有自己的計劃和原則,但是當連續止損幾單的時候,他們就開始焦急了,當在下進去的的買盤就要止損的時候,不想接受被止損的事實,在加上他們對自己的判斷過於自信,以為行情也不會跌到哪裡去了,還是會升的,於是他們就開始調大止損,當行情在跌的時候,這個時候一看都虧那麼多了,更不想接受虧錢的事實,於是又改止損,最後越虧越大,覺得不想承認虧錢的時候,在加上自己幻想的僥倖心理,總以為行情會回調,於是就一直堅持不平倉,就因為過度堅持的陋習而被強制平倉。3. 只看回報而完全忽略風險大家一定經常在身邊聽到別人說自己上星期在黃金市場賺了100%的回報,當下你聽到他們講一週便可賺100%時,大家心裡一定是巴不得想知道如何賺取這麼高的報酬。但是大家想想,在這麼短時間內有這麼高的報酬,通常那個人都是用所有資金進行All in。雖然他們可以在短期賺取100%時,亦可以在短期賠100%,甚至更多。因此,真正的風險管理必須做到不同金融產品的分散風險,而且手上必須要留有「一定比例的資金」,不可以一次把所有資金都丟入投資市場,因為大家不知道什麼時候會出現下跌。了解更多:【精明投資者系列】甚麼的投資組合最適合自己? 資產分配4. 受到新聞左右你投資決策初學的投資者往往很容易受到新聞而影響買賣決策,認為看新聞才不會漏掉世界上第一手消息。但事實上很多新聞是已經過好幾手的過濾,例如首先經過新聞記者、播報記者收集並且撰寫。而且而且很多新聞稿也只是為了衝流量,甚至有的是專門影響散戶決策心理的新聞,目的就是「透過新聞傳播,間接使你想買賣投資某一種產品」。因此,投資市場經常有起有落,投資當然會有風險,不過,作為散戶,其實我們有多很方面,可以把這些風險減低。不問因由、盲目入市,又過於執著、放不低,很多時就是讓自己置身更大投資風險的一些原因。

以下是使用MT4(MetaTrader 4)下單限價訂單的步驟指南:1. 開啟MT4:在電腦上啟動MT4平台。如果尚未安裝,您可以從 MAX Online 的官網下載並使用您的帳戶資訊登錄。2. 選擇市場:在左側的 “市場觀察 (Market Watch) “窗口中,找到您想交易的金融工具或貨幣對。右鍵點擊,從上下文菜單中選擇”新訂單 (New Order) ” 或 快速鍵 “F9″。3. 選擇訂單類型:在出現的”訂單 (Order) “視窗中,選擇” 待成交訂單 (Pending Order)”作為訂單類型。這將允許您設定特定價格,以便在該價格達到時執行交易。4. 設置訂單參數:在”待成交訂單 / Pending Order”部分,根據您要下單的買入或賣出限價單選擇”買進限價”或”賣出限價”。買入限價單 (Buy Limit)賣出限價單 (Selll Limit) 買入止損單 (Buy Stop)出止損單 (Sell Stop)5. 指定價格和數量:在”限價”欄位中輸入您希望訂單觸發的目標價格。設置您希望交易的數量或手數。6. 設置到期日期和時間(可選):如果您希望限價訂單在一定時間後到期,可以設定到期日期和時間。否則,您可以將其設置為”撤銷前有效”(GTC)。7. 下單:填寫必要欄位後,點擊”下單 (Place)”或”買入”(買進限價)/ “賣出”(賣出限價)按鈕以提交限價訂單。8. 監控訂單:您可以在MT4平台底部的”交易 (Trade) “選項卡中追蹤待成交限價訂單的狀態。它將出現在”待成交訂單”部分,直到觸發或取消。請記住,在下單前仔細檢查限價訂單的參數以確保準確性。這裡提供的步驟可能因您使用的MT4版本所做的自定義而略有不同。

以下是使用MT4(MetaTrader 4) 下单限价订单的步骤指南:1. 开启MT4:在电脑上启动MT4平台。 如果尚未安装,您可以从 MAX Online 的官网下载并 使用您的帐户资讯登录。 2. 选择市场:在左侧的”市场观察(Market Watch) “窗口中,找到您想交易的金融工具 或货币对。 右键点击,从上下文菜单中选择”新订单 (New Order) ” 或 快速键 “F9″。 3. 选择订单类型:在出现的”订单(Order) “视窗中 ,选择” 待成交订单(Pending Order)”作为订单类型。 这将允许您设定特定价格,以便在该价格达到时执行交易。 4. 设置订单参数:在”待成交订单/ Pending Order”部分, 根据您要下单的买入或卖出限价单选择”买进限价”或”卖出限价”。 买入限价单(Buy Limit)卖出限价单(Selll Limit) 买入止损单(Buy Stop)出止损单(Sell Stop) 5. 指定价格和数量:在”限价”栏位中输入您希望订单触发的目标价格。 设置您希望交易的数量或手数。 6. 设置到期日期和时间(可选):如果您希望限价订单在一定时间后到期, 可以设定到期日期和时间。 否则,您可以将其设置为”撤销前有效”(GTC)。 7. 下单:填写必要栏位后,点击”下单(Place)”或”买入”(买 进限价)/ “卖出”(卖出限价)按钮以提交限价订单。8. 监控订单:您可以在MT4平台底部的” 交易(Trade) “选项卡中追踪待成交限价订单的状态。 它将出现在”待成交订单”部分,直到触发或取消。 请记住,在下单前仔细检查限价订单的参数以确保准确性。 这里提供的步骤可能因您使用的MT4版本所做的自定义而略有不同。

要在MT4上查看您的帐户结余,请按照以下步骤 进行:1. 登录MT4:启动MT4平台并使用您的帐户登录资讯登录。 2. 选择市场:在左侧的 “市场观察 (Market Watch)” 窗口中,找到您想交易的金融工具或货币对。 右键点击该金融工具,然后从上下文菜单中选择”新订单(New Order)” 快速键”F9″。 3. 选择订单类型:在出现的”订单”视窗中,确保”即时成交(Instant Execution)” 被选中。 4. 设置交易参数:在”订单”视窗中,您需要填写以下信息: “交易量”(Volume ):输入您希望交易的数量或手数。 “停损”(Stop Loss)和”止盈”(Take Profit):如果您希望设置停损和/或止盈水平,您可以在这两个栏位中输入相应的 价格。 这是可选的。 “注释”(Comment):如果您想添加任何注释或标记,您可以在这个栏位中输入相关信息。 这也是可选的。 5. 下单 :因订单在发出后到达市场会有时间差,若在这极短时间内价格出现变化,成交的价格会出现滑点,可选择”最大滑点(Maximum Deviation) ” 以控制可接受的最大成交偏差 。 6. 下单:填写完所需的信息后,点击”买入”(Buy)或”卖出”(Sell)按钮来下单。 7. 监控订单:您可以在MT4平台底部的”交易”选项卡中追踪您的市价单的状态。 一旦市价单执行,它将出现在”交易”选项卡的”交易”部分。 请注意,下即时单意味着您希望以当前 市场价格立即进行交易,因此您不需要指定特定的价格。 在下单前仔细检查交易参数,以确保准确性。 MT4平台的外观和功能可能因使用的版本商而有所不同。

要在MT4上查看您的帳戶結餘,請按照以下步驟進行:1. 登錄MT4:啟動MT4平台並使用您的帳戶登錄資訊登錄。2. 選擇市場:在左側的 “市場觀察 (Market Watch)” 窗口中,找到您想交易的金融工具或貨幣對。右鍵點擊該金融工具,然後從上下文菜單中選擇”新訂單 (New Order)” 快速鍵 “F9″。3. 選擇訂單類型:在出現的”訂單”視窗中,確保 “即時成交 (Instant Execution)” 被選中。4. 設置交易參數:在”訂單”視窗中,您需要填寫以下信息: “交易量”(Volume):輸入您希望交易的數量或手數。”停損”(Stop Loss)和”止盈”(Take Profit):如果您希望設置停損和/或止盈水平,您可以在這兩個欄位中輸入相應的價格。這是可選的。”註釋”(Comment):如果您想添加任何註釋或標記,您可以在這個欄位中輸入相關信息。這也是可選的。5. 下單:因訂單在發出後到達市場會有時間差,若在這極短時間內價格出現變化,成交的價格會出現滑點,可選擇 “最大滑點 (Maximum Deviation) ” 以控制可接受的最大成交偏差。6. 下單:填寫完所需的信息後,點擊”買入”(Buy)或”賣出”(Sell)按鈕來下單。7. 監控訂單:您可以在MT4平台底部的”交易”選項卡中追蹤您的市價單的狀態。一旦市價單執行,它將出現在”交易”選項卡的”交易”部分。請注意,下即時單意味著您希望以當前市場價格立即進行交易,因此您不需要指定特定的價格。在下單前仔細檢查交易參數,以確保準確性。MT4平台的外觀和功能可能因使用的版本商而有所不同。

要在MT4上查看您的帐户结余,请按照以下步骤进行:1. 登录MT4:启动MT4平台 并使用您的帐户登录资讯登录。 2. 查看”对话框”窗口:在MT4顶部菜单中,点击”视图”(View) > “对话框”(Terminal)。 或者,您也可以使用键盘上的 “Ctrl+T” 快捷键。 3. 打开”帐户”选项卡 :在”对话框”窗口中底部,您将看到多个选项卡。 点击 “Exposure” 选项卡。 4. 查看结余:在”帐户”选项卡中,您将看到列出的所有 帐户。 在每个帐户的右侧,您将看到结余(Balance)列,显示该帐户的可用余额。 5. 您还可以进一步查看帐户的详细资讯,权益(Equity)、保证金(Margin)等。 这些资讯通常在”帐户”选项卡的其他列中显示。 请注意,MT4平台的外观和功能可能因使用的版本而有所不同,但一般来说,您应该能够在( Terminal) 找到您的帐户结余。