要在MT4上查看您的帳戶結餘,請按照以下步驟進行:1. 登錄MT4:啟動MT4平台並使用您的帳戶登錄資訊登錄。2. 查看”對話框”窗口:在MT4頂部菜單中,點擊”視圖”(View) > “對話框”(Terminal)。或者,您也可以使用鍵盤上的 “Ctrl+T” 快捷鍵。3. 打開”帳戶”選項卡:在”對話框”窗口中底部,您將看到多個選項卡。點擊 “Exposure” 選項卡。4. 查看結餘:在”帳戶”選項卡中,您將看到列出的所有帳戶。在每個帳戶的右側,您將看到結餘(Balance)列,顯示該帳戶的可用餘額。5. 您還可以進一步查看帳戶的詳細資訊,權益(Equity)、保證金(Margin)等。這些資訊通常在”帳戶”選項卡的其他列中顯示。請注意,MT4平台的外觀和功能可能因使用的版本而有所不同,但一般來說,您應該能夠在 (Terminal) 找到您的帳戶結餘。

資產分配資產分配是指一種投資策略,意味著您將資金分散在不同的資產類別中,資產類別分為三大類:股票、固定收益和現金及等價物。 這三類之外的任何東西(例如房地產、商品、藝術品)通常被稱為替代資產。 這些中的每一個對市場的不同趨勢都有不同的反應,因此將它們混合到您的投資組合中將幫助您最大限度地降低投資風險。影響資產配置決策的因素在做出投資決策時,投資者的投資組合分佈受到個人目標、風險承受能力和投資期限等因素的影響。1. 目標因素目標因素是個人出於特定原因或願望實現給定回報或儲蓄水平的願望。因此,不同的目標會影響一個人的投資方式和風險。如在年輕時想更快賺取較多的金錢,在年紀漸長時投資轉向保守,確保退休時有相對穩定的收入。2. 風險承受能力風險承受能力是指個人願意和能夠損失一定數量的原始投資以期在未來獲得更高的回報。例如,規避風險的投資者保留其投資組合以支持更安全的資產。相比之下,更激進的投資者為了獲得更高的回報而承擔大部分投資的風險。了解有關風險和回報的更多信息。3. 時間範圍時間範圍因素取決於投資者將要投資的持續時間。大多數時候,這取決於投資的目標。同樣,不同的時間範圍需要不同的風險承受能力。例如,長期投資策略可能會促使投資者投資於波動性更大或風險更高的投資組合,因為經濟動態不確定並且可能會發生有利於投資者的變化。但是,具有短期目標的投資者可能不會投資於風險較高的投資組合。您的目標、時間範圍和風險承受能力將決定您應該使用的模型。 如果你能承受高風險以獲得高回報,你就會更多地投入股票和共同基金。 那些具有低風險承受能力的人將青睞債券。 那些零風險承受能力,或者明年需要錢的人,應該有更多的現金。 資產配置策略在資產配置中,投資者如何投資並沒有固定的規則,每個財務顧問都遵循不同的方法。以下是用於影響投資決策的前兩種策略。1、按年齡劃分的資產配置在基於年齡的資產配置中,投資決策是基於投資者的年齡。因此,大多數財務顧問建議投資者根據從 100的基值中減去他們的年齡來做出股票投資決策。該數字取決於投資者的預期壽命。預期壽命越高,投資於風險較高領域(例如股票市場)的比例就越高。例如,用前面的例子,假設喬現在 50 歲,他期待在 60 歲退休。根據年齡投資法,他的顧問可能會建議他按 50% 的比例投資股票,然後其餘的在其他資產中。這是因為當你從100基值中減去他的年齡 (50) 時,你會得到 50。2、全生命週期基金資產配置在生命週期基金分配或目標日期中,投資者根據投資目標、風險承受能力和年齡等因素最大化投資回報 (ROI)。由於標準化問題,這種投資組合結構很複雜。事實上,每個投資者在這三個因素上都有獨特的差異。假設喬的原始投資組合是 50/50。五年後,他對股票的風險承受能力可能會增加到 15%。因此,他可能會出售其 15% 的債券並將其重新投資於股票。他的新組合將是 65/35。該比率可能會根據以下三個因素隨著時間的推移而繼續變化:投資目標、風險承受能力和年齡。其他策略示例:1. 恆重資產配置恆重資產配置策略基於買入持有策略。也就是說,如果一隻股票貶值,投資者就會買入更多。但是,如果價格上漲,他們會出售更大的比例。目標是確保比例不會偏離原始混合的 5% 以上。2. 戰術資產配置戰術資產配置策略解決了與長期投資政策相關的戰略資產配置帶來的挑戰。因此,戰術資產配置旨在最大化短期投資策略。因此,它在應對市場動態方面增加了更大的靈活性,以便投資者投資於更高回報的資產。3. 保險資產配置對於厭惡風險的投資者來說,保險資產配置是理想的策略。它涉及設定投資組合不應從其下降的基礎資產價值。如果它下降,投資者就會採取必要的行動來規避風險。否則,只要他們能得到略高於基礎資產價值的價值,他們就可以放心地買入、持有,甚至賣出。4. 動態資產配置動態資產配置是最流行的投資策略類型。它使投資者可以根據市場的高低和經濟的得失來調整投資比例。資產配置與多元化儘管資產配置是創建多元化投資組合的關鍵部分,但它與多元化的概念並不完全相同。 您可以將資金分配到多種類型的資產中,而無需適當分散這些投資。 例如,如果您的投資組合中的股票都是少數幾家大型公司的證券,那麼您就不會為了更好的增長而進行多元化。多樣化您的投資組合意味著您的各種投資涵蓋了許多不同的風險和回報水平。 分配是這樣做的一種方式,但您應該始終更進一步,在每個資產類別中實現多樣化。

黃金基本面前景:

黃金兩度未能成功站穩2000美元,金價面臨進一步下跌的風險;在美國週五PCE數據出爐前,銀行業恐慌和地緣政治緊張局勢繼續成為黃金走勢的主要因素。

周五,德意志銀行潛在危機的擔憂情緒並沒有令黃金企穩並沖穿2037.5。本日亞太交易時段,消息傳來美國第一公民銀行(First Citizens Bank)達成收購矽谷銀行(SVB)協議的消息。據悉在流動性方面,美國聯邦存款保險公司(FDIC)將為第一公民銀行提供信貸額度,市場情緒得到冷卻。

另外,俄羅斯總統普京表示將在白俄羅斯部署戰術核武器,而北約官員嚴厲回應了普京的聲明稱其評論是非常危險且不負責任的。市場消化這些地緣政治相關消息的方式以及緊張局勢升級或使進一步推動黃金向上。

因此,本週或未來兩週金價出現大型幅動市況的概率較大,暫時是消息主導金價方向。一切安然無恙的話,金價向下壓力較大。

操作上,仍然以1937.5附近作為好淡分水。然而,金價可能出現大型幅動市,無論看升或看跌,都必需放好止損,金價如果波動,幾十蚊價位很快可見。

本週關鍵價位:

1850-1893-1939-1988-2000-2037.5

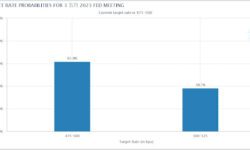

CME FEBWATCH:

銀行危機的影響,市場估計美聯儲5月份加息或會成為最後一次,然而,預期維持利率不變的可能性有61.9%,加息25厘的可能性有38.2%。即目前利率的情況下,可能是終端利率的機率較高,最多也只加息多1碼。

CFTC倉位分析:

由於較早前CFTC遇到駭客攻擊,一直未到及時更新。現時終於更新至最新數據,請注意,此數據只反映上週二晚收盤的持倉,未能及時更新至FOMC開會後。而且,目前每日的情況也可能有變(例如出現黑天鵝事件),因此,是次有1萬6千多張凈長倉未能反映目前情況。

週一:

是日沒有關鍵數據。

週二:

05:00 美联储理事杰斐逊就货币政策发表讲话。

22:00 美国参议院银行委员会就硅谷银行事件举行听证会,美联储理事巴尔将出席。

週三:

22:00 美国联邦存款保险公司高级监管官员就硅谷银行和签名银行倒闭危机在众议院委员会做证词陈述。美联储理事巴尔和FDIC董事长格伦伯格将发表证词。

週四:

20:30 美國至3月25日當周初請失業金人數(萬人)

20:30 美国第四季度实际GDP年化季率终值

20:30 美国第四季度核心PCE物价指数年化季率终值

週五:

20:30 美国2月核心PCE物价指数年率

22:00 美国3月密歇根大学消费者信心指数终值

黃金基本面前景:

在銀行業危機的影響下,黃金市場迎來了一週好表現。市場已不再那麼關注定於週三(3月22日)召開的美聯儲貨幣政策會議,因為估計就算再加,在銀行危機的陰霾下,相信距離終極利率不遠,本週如果再有負面消息傳出,黃金試2000美元大關的可能性很大。估計2000美元時會出現大量回吐。

因此,本週關鍵轉弱位置是1937.5。如果能回到這個價位可以買入。跌穿了可能會跌勢加劇。本週黃金操作上仍然偏向看升,到達2000美元時,可以先行部份平倉。或者在2000美元附近賣出看跌,放一個止蝕。

本週關鍵價位:

1900-1914.7-1937.5-1964-1988.3-2000-2027

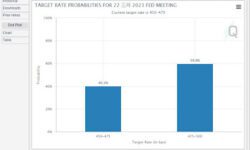

CME FEBWATCH:

由於多家銀行倒閉及財困事件影響,市場悲觀情緒加劇。估計美聯儲3月份加息情況可能會轉變,截止出稿時,預期轉為約6成機率加息0.25%,另約4成機率維持利率不變。

週一:

待定 应俄罗斯联邦总统普京邀请,国家主席习近平将于3月20日至22日对俄罗斯进行国事访问。

週二:

待定 应俄罗斯联邦总统普京邀请,国家主席习近平将于3月20日至22日对俄罗斯进行国事访问。

週三:

待定 应俄罗斯联邦总统普京邀请,国家主席习近平将于3月20日至22日对俄罗斯进行国事访问。

待定 美国财长耶伦与美国国务卿布林肯出席参议院小组委员会听证会。

週四:

02:00 美联储公布利率决议和经济预期摘要。

03:00 美联储主席鲍威尔召开货币政策新闻发布会

20:30 美國至3月18日當周初請失業金人數(萬人)

週五:

21:45 美国3月Markit制造业PMI初值

21:45 美国3月Markit服务业PMI初值

上週三下跌動力未有延續打穿1807,週五數據公報後更發力升到1870闗鍵阻力附近,因當時位置是上升通道頂和大阻力下,未能確認方向。直到本週一開巿出現大陽燭升穿1870,我們從日圖已明顯見到價格在1807關鍵支持位出了雙底更發力向上,延續向上的機會大增。從2H圖來看,價格在1870上方橫行後突破向上,現價到達1910阻力停下並出現震盪。因大圖方向大機會延續向上,本週佈署揾位向上買會較有利和潛在回報可能更大,主要看今日歐美盤力量。1)向上破1910企穩,但從日圖的雙底到現在已升了一百元,會回調再上也好合理。2)1880橫行中軸和1870前關鍵阻力位,留意回調力量和反彈力量。3)短線的話若有力下破1894加回測,可先以1870做目標先,因為大機會係炒回調。近期支持1894188018701860近期阻力191019201950K.Lam

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

黃金基本面前景:

上周二鮑威爾發表鷹派言論,金價從1850上方的水平一路跌至1809,期後矽谷銀行從公布虧損到宣布關閉僅用兩天,亦或是美國非農就業報告出爐後金價飆漲、從1810一線一路狂飆、最高觸及1894。不過,金價從暴跌到暴漲都是有原因的。

周二(3月14日),美國2月消費者價格指數(CPI)。預計2月CPI年率將從6.4%回落至6%,核心CPI年率將從5.6%回落至5.5%。

周三(3月15日),美國公佈生產者價格指數(PPI)和零售銷售月率。

最後,美國財政部對矽谷銀行倒閉的回應以及其對美國其他銀行帶來的影響。

預計本周也將是動盪的一周。。

高盛∶預計美聯儲將在3月會議保持利率不變; 維持美聯儲將在5月、6月和7月加息25個基點的預期不變,現在預計終端利率為5.25-5.5%。

因此,本週黃金以看漲為主。

本週關鍵價位:

1809-1850-1893-1940-1959

CME FEBWATCH:

由於矽谷銀行倒閉事件影響,市場估計美聯儲3月份加息會稍為放寛,預期轉為0.25%。根據芝加哥商品交易所集團(CME Group)的美聯儲觀察工具,市場預期3月22日政策會議後,不加息有5.5%,加息25個基點的概率升至94.5%。加息0.5%不再為選項。

週一:

是日沒有關鍵數據。

週二:

20:30 美国2月未季调CPI年率

週三:

05:20 美联储理事鲍曼就美国银行体系现代化发表讲话

20:30 美国2月PPI年率

週四:

20:30 美國至3月11日當周初請失業金人數(萬人)

待定 美国财长耶伦出席美国参议院财政委员会的预算问题听证会。

週五:

22:00 美国3月密歇根大学消费者信心指数初值

上週三升穿關鍵位1830後回測,最後升到週一的高位1858。從4H圖來看這區域剛好是前跌段的0.618和明顯的阻力位 ,結果價格未能升穿並且在週二美盤時段發力跌穿返1845和1830的支持位,去返前橫行底1807附近。從日圖來看1807都是一個明顯的支持位,但昨天收巿後出的大陰燭有機會延續之前的跌勢,所以最好等今日歐美盤會否有啓示。若果跌穿企穩,價格可能去到下關1735附近,這是升段的0.618和明顯支持位。1H圖,本週佈署都係等1807俾反應,短線可看有否反彈力量向上買,但1830跌穿後已變了阻力,買上最好在這減倉。睇跌的話就等1830和跌穿1807後佈署向下。近期阻力182318301844近期支持180717801765K.Lam

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

黃金基本面前景:

美聯儲主席鮑威爾週二在參議院金融委員會發表半年度貨幣政策證詞,最近美國的強勁經濟數據給予美聯儲壓力,或要求其在貨幣政策方面採取更激進的措施。美聯儲將於3月21日至22日開會確定利率,目前約3/4機會加息0.25%,另1/4機會加息0.5%。在這個半年度貨幣政策證詞中,週五公佈的就業數據,大約可以估計下次議息的水平。因此,本週的金融市場可能較為波動。

本週關鍵價位:

1806.7-1832-1842-1846-1864-1868-1873.8

CME FEBWATCH:

根據芝加哥商品交易所集團(CME Group)的美聯儲觀察工具,市場預期3月22日政策會議後加息25個基點的概率降至75.2%,加息50個基點的概率升至24.7%,跟上週的變化不大。

週一:

是日沒有關鍵數據。

週二:

23:00 美聯儲主席鮑威爾在參議院金融委員會發表半年度貨幣政策證詞。

週三:

21:15 美國2月ADP就業人數(萬人)

23:00 美聯儲主席鮑威爾在眾議院金融服務委員會發表半年度貨幣政策證詞。

週四:

03:00 美聯儲公佈經濟狀況褐皮書。

21:30 美國至3月4日當周初請失業金人數(萬人)

未知 美國白宮發佈2024財年預算提案

週五:

21:30 美國2月失業率

21:30 美國2月季調後非農就業人口(萬人)

上週三預計價格有機會彈高少少先再下跌,結果美盤時段上返去1846的橫行頂後便急速向下,最終去到昨天的低位1804。從1H或4H 圖都可清楚看見下跌通道的斜度明顯改變,下跌的力量再度減弱,而且昨晚美盤時段更爆出明顯的上升力量,現時應暫停看跌先。本週初做了一個小橫行,15M圖可看見昨天歐盤時向下跌穿前底到了通道底又急速拉回形成假突破。美盤時急速的向上突破了橫行頂,到達了現在的關鍵位1830。這是下跌段的0.618加前橫行底再加下跌通道頂。若今日歐美盤時段發力向上破再企穩,有機會向上再回深啲先。本週佈署以揾位買上為主,1830看會否突破企穩,而1815是橫行中軸,亦是現在上升段的0.618。不過要留意會否有下跌力量直接由通道頂向下爆,始終現時仍在關鍵阻力位,一定要留意回調力量。近期阻力183018461860近期支持182518201815K.Lam

風險提示: 場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。市場資料僅供參考,Z.com Bullion 絕不保証分析內容的準確性。

黃金基本面前景:

隨著市場對美聯儲未來幾個月將繼續加息的預期逐漸得到強化,美元與美國國債收益率攀升,令黃金價格承壓。本週大可能延續上週走勢向下,今晚比較關注有耐用品訂單指數,其後週三和週五都有Markit服務業或ISM指數。目前仍然是向下勢頭主導,操作上建議逢高沽空。價位可參考下列關鍵價位。

本週關鍵價位:

1748-1788-1800-1818

CME FEBWATCH:

根據芝加哥商品交易所集團(CME Group)的美聯儲觀察工具,市場預期3月22日政策會議後加息25個基點的概率降至72.3%,加息50個基點的概率升至27.7%。

週一:

21:30 美國1月耐用品訂單月率

23:00 美國1月成屋簽約銷售指數月率

23:30 美聯儲理事傑弗遜就通脹和美聯儲的雙重使命發表講話

週二:

22:45 美國2月芝加哥PMI

週三:

03:00 2023年FOMC票委、芝加哥聯儲主席古爾斯比發表講話。

22:45 美國2月Markit製造業PMI終值

23:00 美國2月ISM製造業PMI

週四:

21:30 美國至2月24日當周初請失業金人數(萬人)

週五:

03:00 美聯儲理事沃勒就美國經濟前景發表講話。

07:00 2023年FOMC票委、明尼阿波利斯聯儲主席卡什卡利發表講話。

22:45 美國2月Markit服務業PMI終值

23:00 美國2月ISM非製造業PMI