Gold trend 2/1

Expect the price to consolidate further in S-T before the trading volume returns from the holiday.

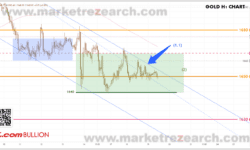

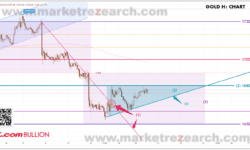

1-hour chart – Gold prices reached a recent high of 2088 in early trading last Thu. However, it failed to hold above 2080. After the price escaped from the uptrend channel(1) at the end of last week, gold formed an S-T downward channel(2) in the past 48 trading hours. The price has departed from the downward trend (2) early in the Asian session today, indicating an S-T rebound. After touching 2070, expect the price to be bounded by 2050-70.

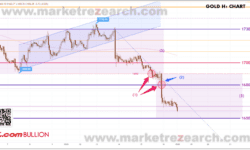

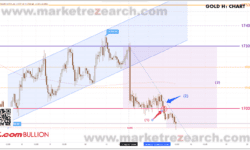

Daily Chart – The overall trading volume in the gold market has been low since Dec. 20th. Without significant trading volume driving, the gold price failed to hold above 2081(4), and experienced a round of profit-taking during this holiday period. The resistance zone remains between 2070-2075. Unless the price can clear this resistance, we can expect the price to consolidate further. Support levels to watch below include the 20-day MA(5) and the support line (6). Gold needs to wait for a high-volume environment in order for it to surge higher. Keeping an eye on the release of US employment data at the end of this week.

S-T ressitance 3

2080-1

S-T ressitance 2

2075

S-T ressitance 1

2070-72

Market price

2069

S-T support 1

2060

S-T support 2

2055

S-T support 3

2050

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.