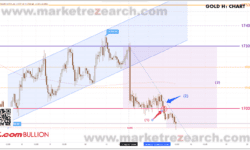

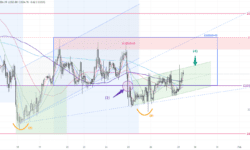

On Thursday (June 3), the price of gold fell by more than 2%. The reason was that better-than-expected U.S. employment and services data pushed the dollar higher and boosted expectations that strong economic data may restart the Fed’s remarks on reducing debt purchases. Investors are now turning their focus to Friday’s U.S. non-agricultural employment report, which is expected to trigger market sentiment again. Spot gold closed at US$1,870.36 per ounce, a sharp drop of US$37.82 or 1.98%. It fell to the lowest level since May 20 at US$1,865.15 per ounce, a sharp drop of US$44 from the daily high of US$1,09.57 per ounce. In addition, the dollar index closed up 0.67% and the U.S. 10-year Treasury bond yield rose 4 basis points to 1.63%, which will put pressure on gold prices and increase the opportunity cost of holding gold.

In the United States, the number of private jobs in the Human Resources Service Company (ADP) surged by 978,000 in May, a record high since June last year. It was also much higher than the previous value of 654,000. The market originally expected 650,000. During the period, 128,000 jobs were created in the commodity manufacturing industry, and 850,000 jobs in the service industry, of which the leisure and hotel industry accounted for more than half. The ideal number of small non-agricultural employment in the United States reflects the gradual recovery of the labor market. In addition, the number of new jobless claims in the United States continued to fall to 385,000 last week, which was the first time since the outbreak of the epidemic that it fell below the 400,000 mark, and was lower than market expectations of 387,000 and the previous value of 405,000. During the period, the number of people who continued to claim unemployment benefits rose to 3.771 million, higher than market expectations of 3.614 million, and the previous value was 3.602 million. This reflects that with more widespread vaccination, restrictions on companies are gradually lifted, and strong consumer spending has promoted corporate recruitment, which will help reduce the rate of layoffs. On the whole, it reflects the obvious recovery of the US economy.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.