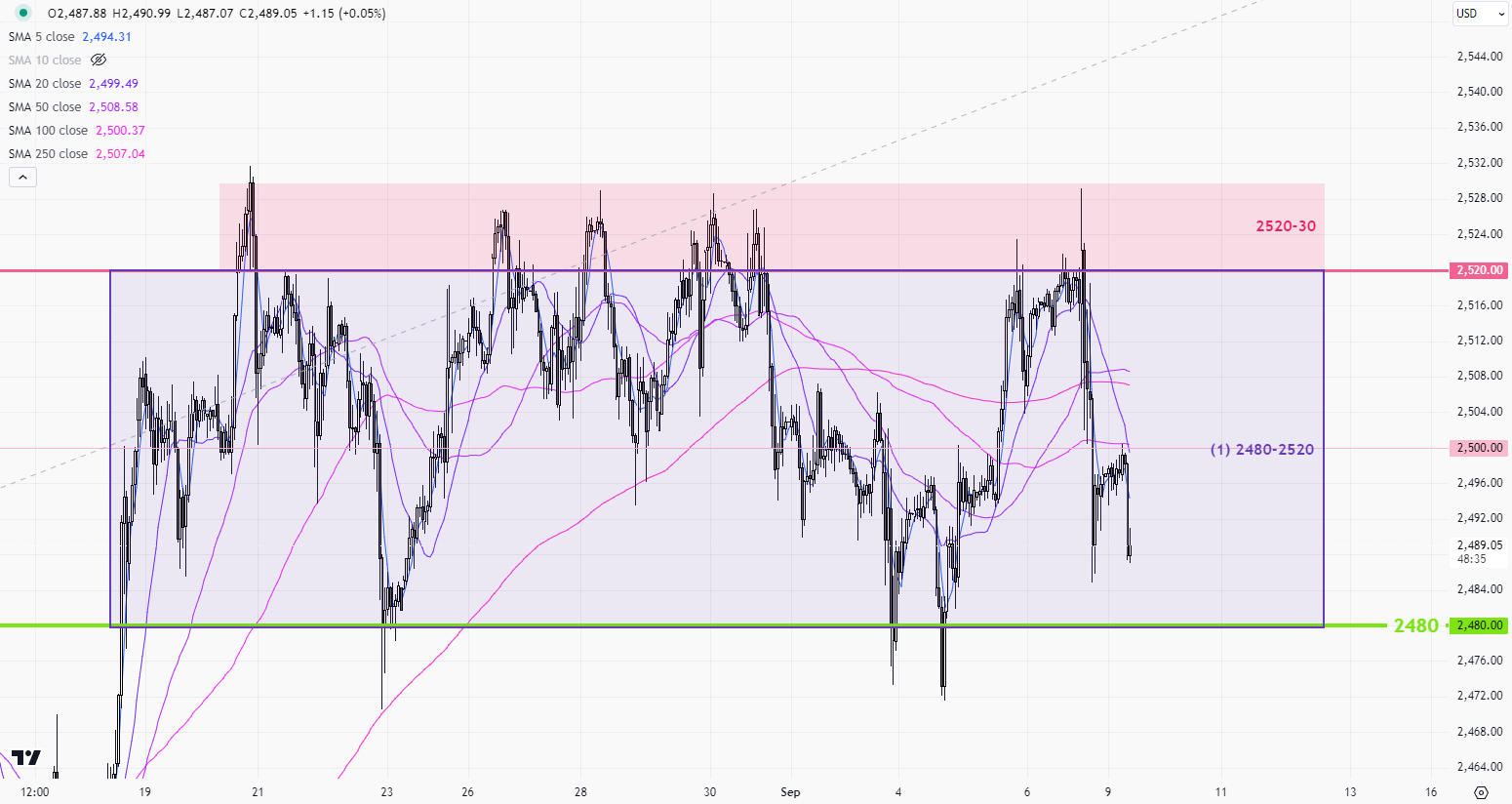

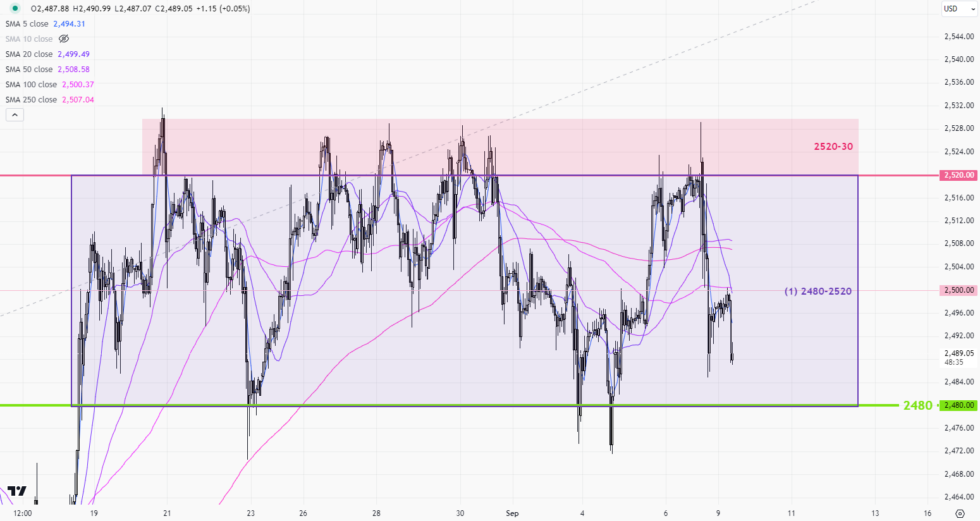

Spot gold price has remained sideway in the past 2 weeks, with both the PCE price index and US employment data failing to bring new momentum to the market. The OI data from CME’s gold futures has stayed at around 510k for a while now, showing no significant changes in the numbers of long/short positions. This week’s focus is on Wednesday’s U.S. inflation data, no matter if it is good or bad, the market reaction should be like those major figures released previously. A week from the US interest rate meeting, it’s not easy for gold to escape the current range without any new stimulus. The market should give us more chances this week to take advantage of the sideways market. Just need to be cautious towards the end of this week, when the market may start to price-in further the US Fed. cut next week, leading to an early breakthrough.

1-hr chart > Continue to operate in the 2480-2520(1) range until the price escape.

Daily chart > The uptrend channel (2) is still dominating the gold market in M-T. S-T range remains in 2480-2530(3). If the price falls below 2480 before/after the Fed. meeting, a major consolidation will begin. a

P. To