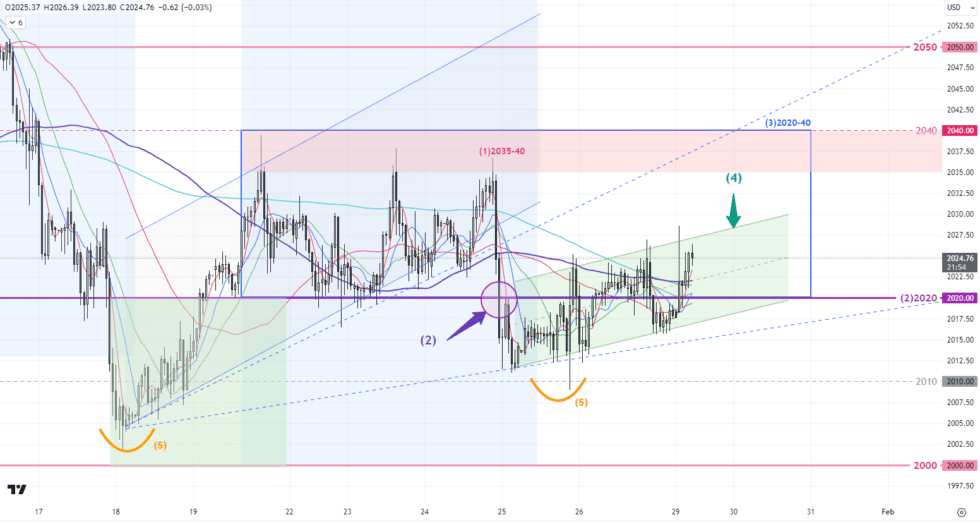

The gold price was moving within a narrow range last week. The price was bounded by 2020-40 until Wednesday’s US better-than-expected GDP data; it cleared the 2020(2) support and dropped to as low as 2010.

There are two major economic events to pay attention to this week. First, we have the Fed. Meeting on Wednesday. There is a 95% chance that the interest rates will remain unchanged (according to CME’s FedWatch)in this week’s meeting. And the statement they release after the meeting…I’m expecting the Fed. is unlikely to make any sudden moves in the next few months, considering the Fed’s habits of slow acting at the beginning of this rate hike cycle and most of the economic figures haven’t shown any dramatic improvement recently. Unless Powell makes some unexpected comments, the chances of a rate cut in March… or even in May, might stay around 50-60% with no major changes afterward. On the other hand, the US employment data at the end of this week is also expected to be in line with expectations, with possibly downward pressure on the price of gold. The price of gold hasn’t shown any signs of a breakout, so it’s still a good idea to continue trading within the established range.

1-Hour Chart – The price of gold dropped below the 2020(2) and rebounded from the lows near 2010. It has failed to reach the previous low point of 2001(5), indicating that buying positions below 2010 have become stronger. Today, in the Asian trading session, the spot gold price has already returned above the 2020 mark. Over the past 48 hours, an S-T upward channel(4) has formed, suggesting the possibility of revisiting the resistance zone of 2035-40(1), likely before the Fed. Meeting.

Daily Chart – Market uncertainty is expected to increase mid to late this week, so it’s crucial to be cautious about potential breakouts in technical patterns. The resistance zone around 2030-40(9) is still cursing the market. In the next two trading days, watch the 20-day MA(8). The upward support line(6) is still holding, and if a breakout occurs, the bottom of the range near 2001 could become the next support level.

|

S-T ressitance 3 |

2040 |

|

S-T ressitance 2 |

2035 |

|

S-T ressitance 1 |

2030 |

|

Market price |

2025 |

|

S-T support 1 |

2020-2 |

|

S-T support 2 |

2015 |

|

S-T support 3 |

2010 |

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.