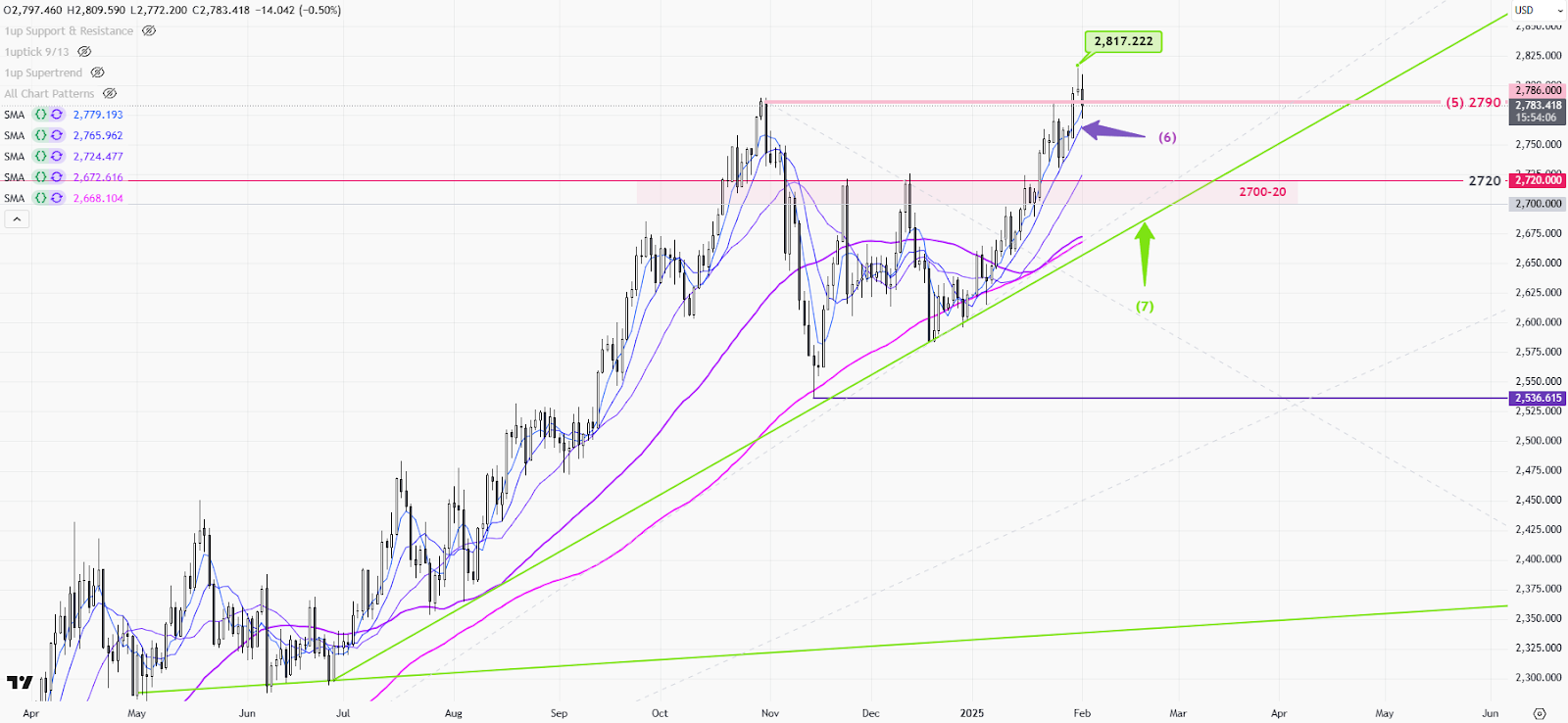

Following the decline from the previous week, the gold price tested the low near 2730 early last week. The market started to focus on the meetings of various central banks, 1st The Bank of Canada cut interest rates by 1/4%, followed by the Federal Reserve keeping interest rates unchanged, and then the ECB cut interest rates by 1/4 percentage point, led the price to rebound. The decline in global interest rates attracted gold buying, causing the gold price to cross the high of 2790. Driven by Trump’s tariff policy, the risk premium surged before the weekend, pushing gold prices to hit a new high of 2,817 during the U.S. session on Friday. But the price fell back to close at 2798, the week was up by $28.

Due to the weekend risk premium, the gold price hit a record high of 2817 on Friday, but the strong US dollar on Monday put pressure on the gold price. Last week’s US GDP and PCE inflation data, both reflected that the US economy keeps going strong, along with the tariff policy introduced by Trump over the weekend has further raised inflation expectations. Interest rates will remain high in the S-T just like Powell declared after the Fed. meeting last week, and gold prices will face pressure on the fundamental side.

In COMEX, the number of open interest(OI) has fallen after it reached 59k contracts on January 24. When gold prices hit a new high last week, both the trading volume and OI have reduced, reflecting investors are cautious in long-buying at current levels. The focus this week will be Friday’s U.S. employment data, as long as the numbers remain strong, gold prices will be under pressure once again.

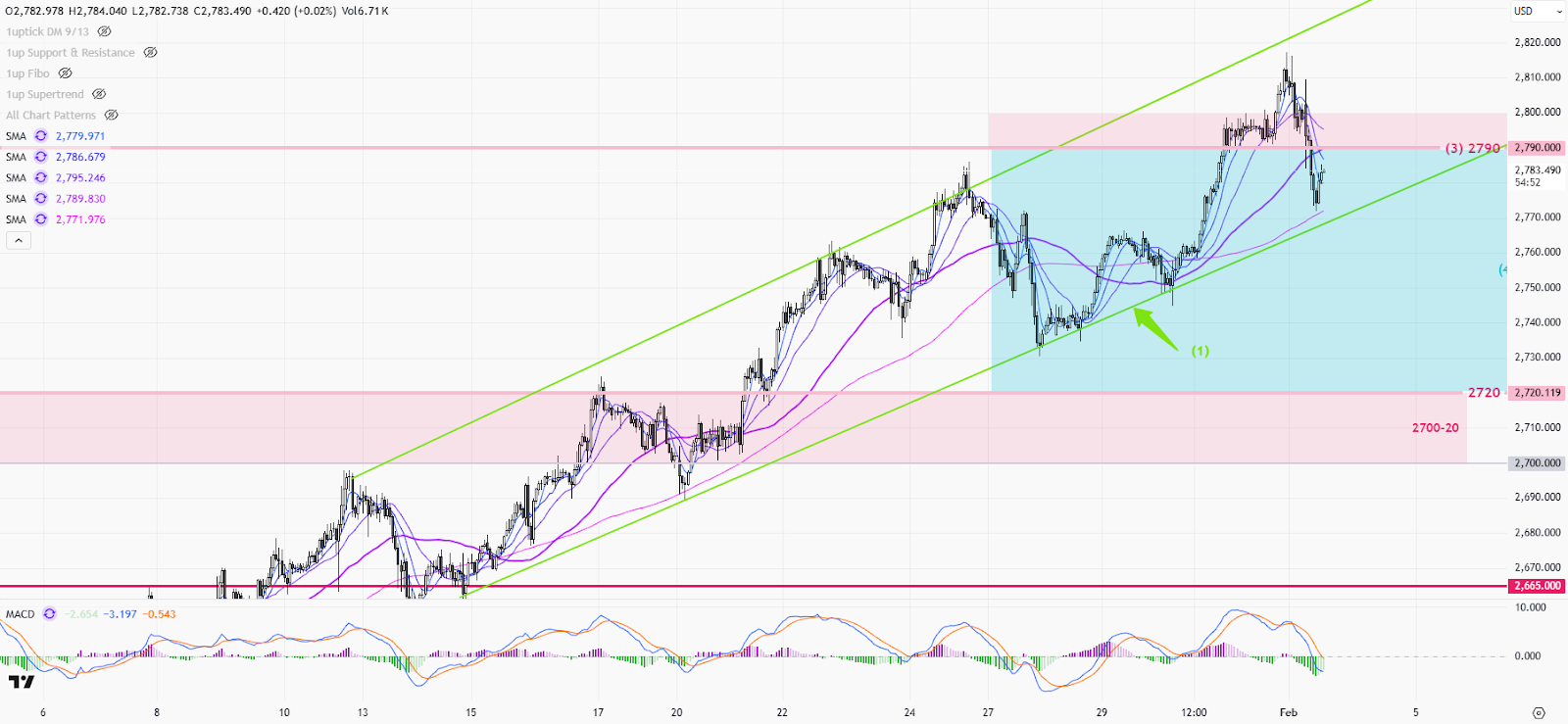

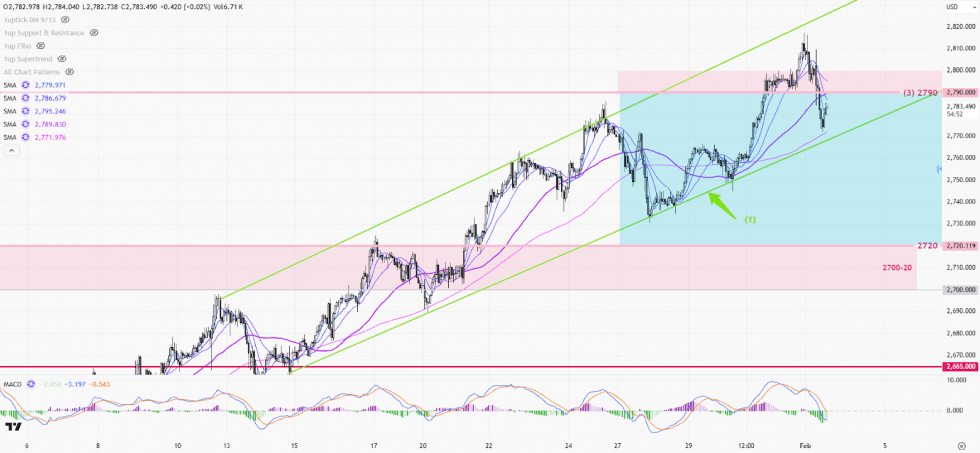

1-hour chart(above) > The resistance above 2790 is still strong as the gold price failed to stabilize above 2790 back from the weekend. However, gold prices are still in the S-T rising channel(1). The price action will change to sideway only if the price falls below the support line(1). Notice that the upper resistance area is now at 2790-2800(5).

Daily chart > Although there was a clear selling before the market closed last Friday, the reversal signal has not yet appeared. Gold is still running in an upward trend along with the 10-day ma(6), wait for it to break where the bear will kick in.

P. To