After the Bank of New Zealand discussed its interest rate meeting on Wednesday (26th), as expected, it kept all monetary policies unchanged and the interest rate remained at 0.25%. However, in response to economic improvement, for example, the unemployment rate fell to 4.7% and the price of its main export dairy foodstuffs, which accounted for 20%, rose to the highest since January 2014. The bank estimates that its interest rate will have a chance to increase by September 2022. To 0.5%, and have a chance to return to 1.5% by the end of 2023. The New Zealand central bank’s estimate immediately provided support for the New Zealand dollar exchange rate, bringing it close to the important resistance of 73 US cents.

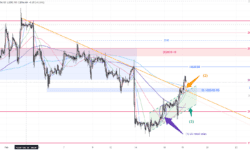

After gold and silver have experienced a surge, the Asian market today is facing profit-taking in early trading. Gold is currently falling below US$1,900 and continues to hover around US$1,894. The same thing happened with silver, which is currently hovering around US$27.67. Randal Quarles, the vice chairman of the Federal Reserve in charge of oversight, once again released a dovish tone, insisting that the Fed’s policy will remain highly accommodative for a period of time. The economic recovery supports industrial demand, and the silver price outlook is expected to rebound and rise.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.