The UK Extends the Stamp Duty Reduction Plan to Revitalize the Property Market

According to the latest survey report of the British mortgage company Halifax, the local average property prices in March increased by 1.1% and 6.5% respectively month-on-year and year-on-year. Its annual growth in property prices is the strongest in the past 4 months. UK property prices strengthened again in March, mainly because the British Finance Minister announced in his March budget that he extended the stamp duty reduction plan that ended at the end of March to September this year, thus once again stimulating buyers to buy in the market. Building, and pushed up property prices.

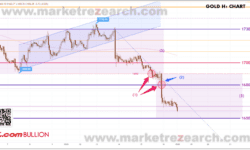

Optimistic Market Conditions Support Gold Prices

Before the end of last week, the price of gold faced setbacks from the stabilization of U.S. bond yields and the U.S. dollar index. The beginning of this week was also determined to be under pressure on a short position. However, as the Federal Reserve continued to release dovish messages, Fed Chairman Powell’s speech again boosted the optimistic fundamentals, emphasizing that the US economy is approaching an inflection point and the job market momentum will increase in the next few months. The geopolitics of China and the United States are showing a brand-new situation. The senior government officials of US President Biden will go to China for the first time to discuss cooperation with their counterparts on climate change issues. The market’s optimism will strongly support gold and avoid the long-lasting and unbearable situation of falling short. As of 08:24 Hong Kong time, the price of gold had fallen by 0.10% to US$1,742.40.

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.