There Is Hesitation In The Gold Price Trend

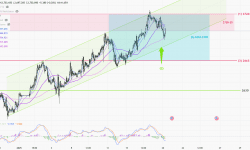

On Friday (July 23) Asian market in early trading, gold is now reported at around US$1,808 per ounce. Gold prices closed at US$1806.50 per ounce on Thursday, an increase of US$3.14 or 0.17%. The European Central Bank’s easing stance has boosted gold prices. Gold prices fell to a low of 1,792.65 US dollars per ounce on Thursday, but then rebounded strongly from the low by more than 15 US dollars to a high of 1808.03 US dollars per ounce. The European Central Bank announced on Thursday that it would maintain its monetary policy unchanged. However, the central bank revised its forward-looking guidance on interest rates and adopted a more dovish stance to achieve its inflation target. An analyst on a well-known financial website wrote an article to analyze the short-term prospects of gold prices. In the article, he explained that the near-term prospects of gold prices remain neutral and have a slight downward trend because gold prices are closer to the key support zone rather than the resistance zone. At the same time, the relative strength index (RSI) on the daily chart continues to be flat around 50, confirming the indecision of gold trend. On the downside, the first support for the price of gold is at the level of $1,800 per ounce, and then at $1,790 per ounce (100-day moving average).

The European Central Bank Keeps The Status Quo Unchanged

The European Central Bank kept the three key interest rates unchanged and revised its forward guidance to reflect expectations of rising inflation, while maintaining the scale of its asset purchase plan. President Lagarde said that the inflation outlook is still far below the target, and the inflation rebound is expected to be temporary; the forward-looking guidelines will be adjusted to emphasize the commitment to maintain an easing stance.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.