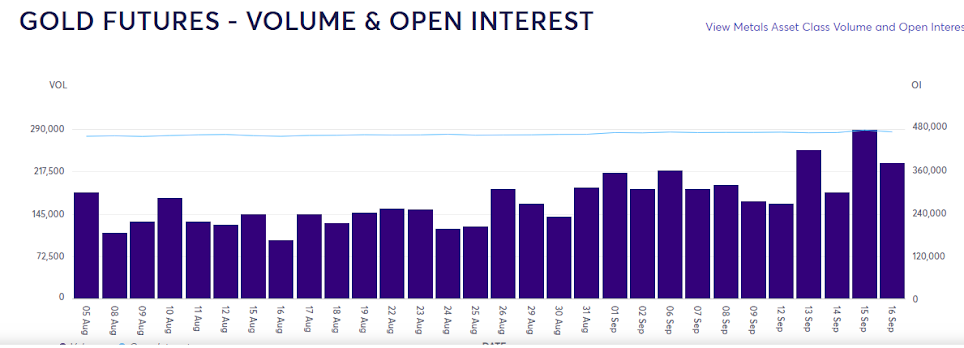

上週二(9月13日)美國公佈通脹數據,其中美國未季調核心通脹數據為6.3%,結束了連續4個月來回落的走勢。市場在數據公佈後中止反彈趨勢轉跌,因核心通脹上升意味著美聯儲在下次議息會議有機會增加加息幅度到0.75%至1%不等,而加大加息力度的可能性造成美元指數再次走高,當日金價下跌約23$收1701.56。其後在次日金價失守1700關口,導致在週四有新資金再度進場沽空,有關開倉數據可參考芝加哥商品交易所(圖2),金價在上週二至週四收市一共下跌超過60$。週五部份沽空獲利盤平倉暫時穩定跌勢。

本週一開市(9月19日)金價在亞歐盤時間下跌約18$後在1660找到支撐,暫時未走出方向,本週是否抄底或追沽需要看本週四美國議息會議結果。

本週的美國議息會議後美聯儲會給出未來對經濟的預期及指標,市場走向將取決於大機構對未來美聯儲加息的力度及對經濟預期的反應決定,金價已經回落到2020年中的位置,在上星期跌穿1683的支撐後金價有機會再試1642支持位。

技術分析:

金價現時位於三月以來的下降通道中線位,主要呈現區間下跌走勢,目前價格在1673位置。日線圖上的5天平均線及10天平均線曾在上週一二嘗試反轉下跌趨勢,但未能成功,一般出現反轉失敗的情況是走勢加速的先兆,現時日線圖上平均線指標示意下跌趨勢。下一道支撐線在1642和1573區間,阻力位在1683及1697區間。

本週重要信息:

週三 22:30 EIA 原油庫存變化

週四:02:00 美聯儲利率決定

週四:02:30 聯邦公開市場委員會新聞發布會

週四:20:30初請失業金人數

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.