非農影響下跌後,黃金看漲情緒再次上升

上週黃金價格變化較大,由非農數據影響帶來的價格大舉下跌迎來緩和、週五的非農數據較為樂觀,使黃金價格下跌4%至最低1690位置,週一跳空低開後持續上升開始反彈,美國通脹數據以及消費者信心數據,加之德爾塔疫情的惡化,都推動了黃金上漲,本週一直在持續上升,週五以1780收盤,看漲情緒相當濃厚。

上週三的美國7月消費者物價指數增速緩慢,雖然美國經濟在就業層面基本回到了疫情前的水平,但消費依然疲軟不振,也減輕了美聯儲購債步伐。上週五的非農數據十分強勁,嚴重打擊黃金價格,但消費者物價指數漲幅悲觀,提振了金價。

週四公佈的美國消費者信心降至近十年來的最低水平,導致投資者對經濟前景更加擔憂,這可能給美聯儲提供了在更長時間內保持寬鬆政策的空間。週五(8月13日)公佈的一項調查顯示,美國消費者信心在8月初大幅降至十年來最低水平,這對經濟來說是一個令人擔憂的跡象,表明美國民眾認為從個人財務到通脹和就業的一切前景都不太樂觀。如果這一出人意料的數據在未來幾個月轉化為經濟活動放緩,可能讓美聯儲政策制定者暫緩採取下一步行動。

因德爾塔變種病毒情況持續惡化,美國新增病例數達到了新高的水平,亞洲各國也有新增的擔憂,在避險層面給黃金提供了較為強有力的支撐。

據美國媒體報導,佛羅里達、阿肯色、路易斯安那等州因感染新冠病毒需要入院接受治療的人數大幅增加,已創疫情暴發以來最高水平,使得當地醫務人員和醫療資源越發捉襟見肘。在俄克拉何馬州,郊區醫院正面臨”床位危機”,不少重症病人難以及時獲得治療。

東京都知事小池百合子週五警告稱,東京的疫情形勢處於災難級別,當地新增感染病升至創紀錄的5773例,短短三週內增加了兩倍多。

本周可以預想黃金價格將較為樂觀,除了非農的硝煙已經散去之外,其他數據尤其是疫情情況都是推動上漲情緒的推手,可考慮市場行情在本週總體呈現上漲行情。

技術分析:

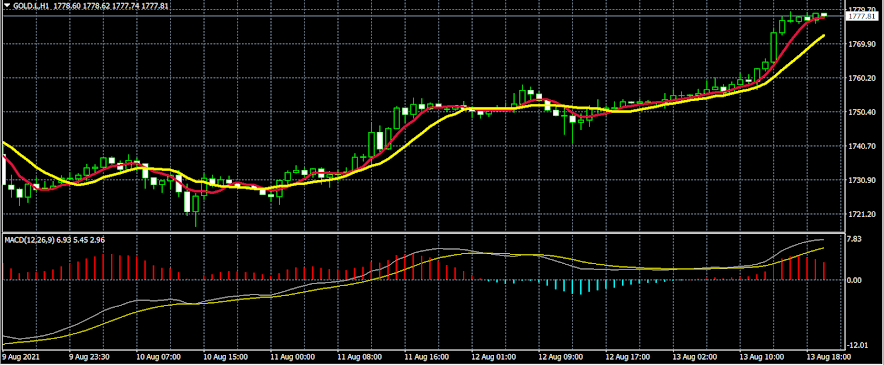

受美國非農數據影響,上週五價格下跌並在周一跳空低開,均線交叉並向下運行,MACD動能向下明顯,但隨後價格上漲,MACD動能反向至零軸以上,其後較為平穩,震盪徘徊,週五再次開啟上升途徑,均線由交叉轉向背離,5日線向上,動能向上,最後以1777.81一周高位收盤。

本周重要信息:

周二: 20:30 美国7月零售销售月率(%)

周三: 01:30 美联储主席鲍威尔发表讲话。

周四: 20:30 美国截至8月14日当周初请失业金人数(万)

立即按此 訂閱 每週黃金走勢分析報告,優先獲取市場最新資訊

場外式黃金/白銀交易的風險:

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.

Service relating to Over-the-counter (OTC) Gold Bullion/Silver trading is provided by MOL. OTC Gold/Silver Bullion trading carries a high degree of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. OTC Gold/Silver Bullion is not regulated by the Securities and Futures Commission (""SFC"") and therefore trading OTC Gold/Silver Bullion will not be subject to rules or regulations promulgated by the SFC. Before deciding to trade OTC Gold/Silver Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain losses in excess of your deposited fund or even more in extreme circumstances and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading OTC Gold/Silver Bullion, and seek advice from an independent financial advisor if you require.