According to data released by the cryptocurrency management company CoinShares on Monday, as of June 4, both the Bitcoin fund and the Bitcoin currency themselves have recorded significant net outflows of funds. According to CoinShares, the outflow of funds can be as high as US$141 million, which is equivalent to 8.3% of the total inflow into this market this year. The above news brought a lot of pressure on Bitcoin prices on Monday. The decline of Bitcoin once drove the price of gold back to the $1,900 level.

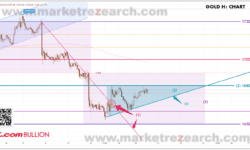

On Tuesday (June 8), the price of gold fell as the yield on the 10-year US Treasury fell by 4 basis points to 1.531%. In addition, the World Bank stated in its semi-annual Global Economic Outlook report that global gross domestic product (GDP) will grow by 5.6% this year, higher than the 4.1% forecast in January. This is mainly due to the growth of 6.8% in the United States and 8.5% in China. The World Bank revised its historical data to reflect the updated GDP weight. After the news came, spot gold fell 20 US dollars in a short-term, and the refresh day was as low as 1883.64 US dollars. The price of gold closed at US$1,892.75/ounce, down US$6.20 or 0.33%. It hit a high of US$1,903.73/ounce during the intraday session, but was subsequently suppressed by huge amounts of funds and refreshed to a daily low of US$1,883.64/ounce.

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。