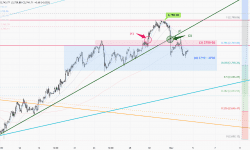

Gold trend 17/2 – Ready to short?

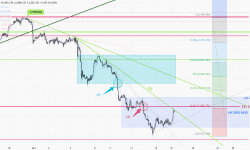

Gold prices continue to fluctuate near record highs. Early last week, the market was again driven by uncertainty over Trump’s tariff policy, hitting a new high of 2942. It was pushed toward 2863 by stronger-than-expected US inflation data on Wednesday, but the price rebounded quickly to 2940 before the U.S. session on Friday. As the peace talks began between Russia and the US, the geopolitical situation eased, profit taking/short-selling hit the market where the gold prices closed below 2900 near 2880.

The gold market will still be under the influence of Trump’s new economic policy this week. However, unless a more aggressive policy is introduced, the market is starting to adapt to the current market condition after nearly four weeks of news turmoil. With the prospect of a truce between Russia and Ukraine, it should be difficult for gold prices to hit a new high in the short term.

>

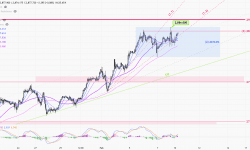

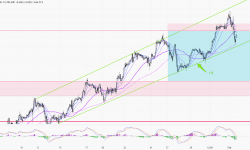

1-hr chart(above) > Monday is a U.S. holiday, the price should be bounded by the range of 2780-2910 (1). Later this week, a wider range can be expected between 2865-and 2942, and wait for the breakout before the next round of major trends.

>

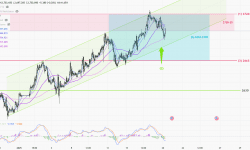

Daily chart(above) > The 10-day moving average (3) dip-buying strategy mentioned last week is still valid. Note that last Friday’s sharp one-day pullback reflects the bear is starting to take control of the market, and it is important to be careful of a significant correction in the market this week. The breakout of the 10 days MA(3) will be the start of a bearish trend on the daily chart.

P. To