Gold has started its rebound after a series of important U.S. economic data went worse than expected since the beginning of this month, and the US inflation data slowed further last week has accelerated the upward momentum. The price rose to a one-month high of 2422 on Friday, with the week ending near 2414. Note that the price of silver also broke through the 2020 high of US$30 on the same day, reflecting that the precious metals market is strengthening and the bullish trend should resume very soon.

1-hr chart – The upward trend accelerated last week from the support line (1) to (1.1). Gold cleared all the short-selling orders near the previous high of 2430 early in the Asian session on Monday reaching a new high of 2440. While the resistance of 2430(2) is cleared, a new round of buying should be triggered in the next 48 hours, and the target in the early part of this week can be set at 2450 or even higher. Notice, the key support is now at 2430. If the gold price returns below 2430, the current upward momentum will slow down, and the trend will reverse.

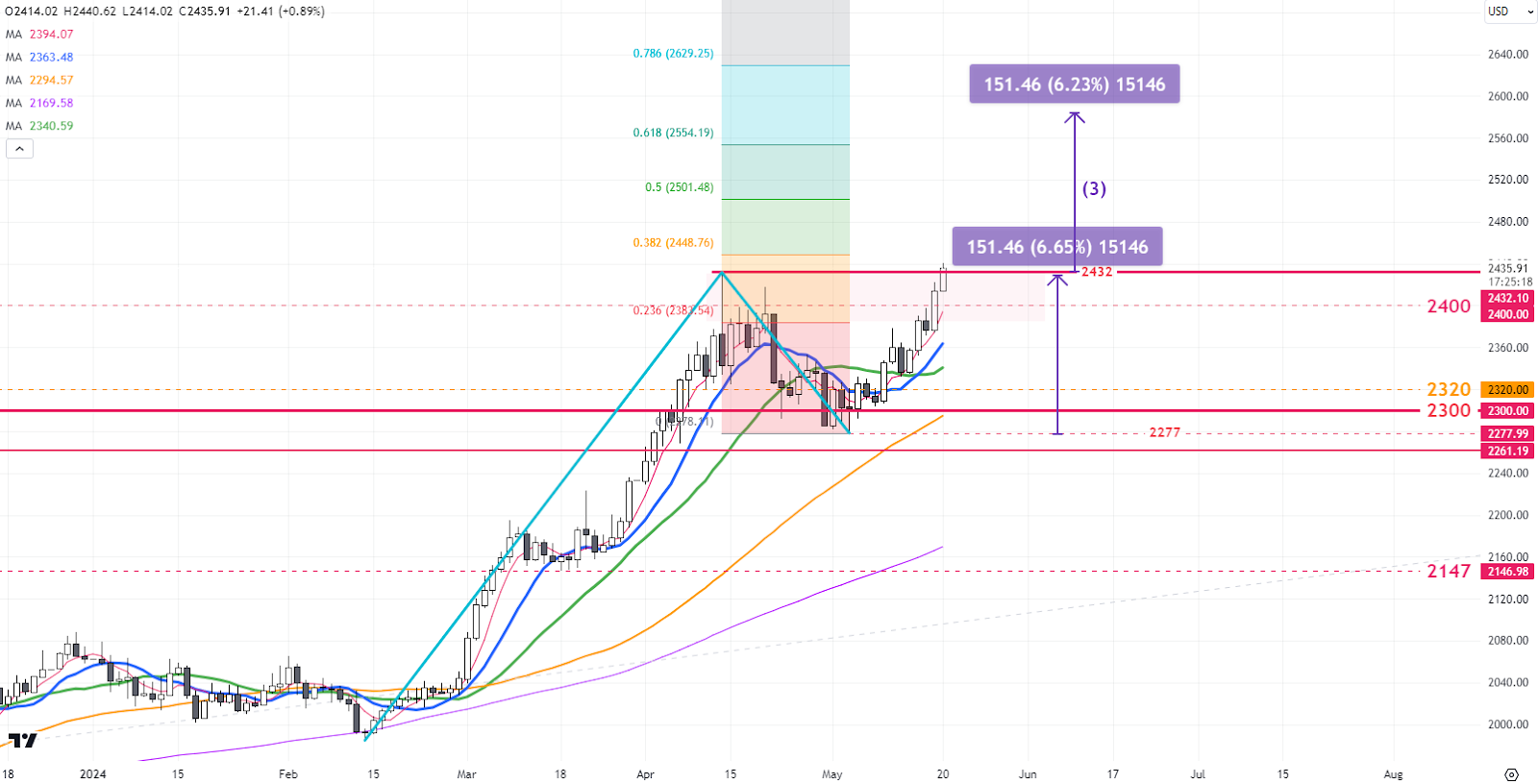

Daily Chart—Last Friday was the first time gold prices closed above 2400, showing that buying orders above 2400 are starting to dominate, the first signal for gold prices to break higher. Gold fluctuated by about US$150 during the consolidation period in the past month(3). The M-T target can be set near 2580(3), a 1:1: ratio. As long as the price stays above 2431 on the daily chart, the S-T target can be set at 2448.

P. To