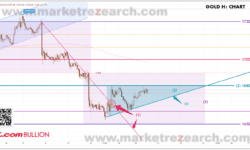

On Monday (June 7) in the Asian market in early trading, spot gold fell slightly and is now at around US$1891 per ounce. Some financial analysts analyze the technical prospects of gold prices. He pointed out that from the daily chart, the relative strength index (RSI) finally fell below 70 after the sharp drop last Thursday, indicating that the price of gold has corrected its overbought level. At the same time, the upward trend line that began in early April constituted support last Friday, and gold closed above the 20-day moving average, indicating that investors viewed the recent decline as a buying opportunity. As the US non-agricultural employment data increased less than expected, the price of gold rose sharply last Friday. The yellow price closed at US$1891.03 per ounce, a sharp increase of US$20.67 or 1.11%, and the highest intraday hit US$1896.13 per ounce.

On Wednesday and Thursday, the Bank of Canada and the European Central Bank are discussing interest rates, and both central banks are worth paying attention to. The market estimates that the increase in the central bank will be faster in July, and the slower in October will further reduce the scale of debt purchases. Whether this is the case, it is expected that this week’s meeting of interest rates will give the market enlightenment. As for the European Central Bank’s interest rate meeting on Thursday, it is more important. This is because the minutes of the May interest rate meeting published at the end of last month showed that the ECB members had discussed whether to tighten monetary policy as soon as possible. But the discussion at that time was inconclusive. I believe this meeting will give the market an answer.

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。