There Is Hesitation In The Gold Price Trend

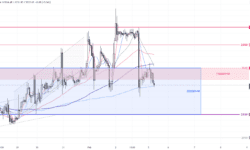

On Friday (July 23) Asian market in early trading, gold is now reported at around US$1,808 per ounce. Gold prices closed at US$1806.50 per ounce on Thursday, an increase of US$3.14 or 0.17%. The European Central Bank’s easing stance has boosted gold prices. Gold prices fell to a low of 1,792.65 US dollars per ounce on Thursday, but then rebounded strongly from the low by more than 15 US dollars to a high of 1808.03 US dollars per ounce. The European Central Bank announced on Thursday that it would maintain its monetary policy unchanged. However, the central bank revised its forward-looking guidance on interest rates and adopted a more dovish stance to achieve its inflation target. An analyst on a well-known financial website wrote an article to analyze the short-term prospects of gold prices. In the article, he explained that the near-term prospects of gold prices remain neutral and have a slight downward trend because gold prices are closer to the key support zone rather than the resistance zone. At the same time, the relative strength index (RSI) on the daily chart continues to be flat around 50, confirming the indecision of gold trend. On the downside, the first support for the price of gold is at the level of $1,800 per ounce, and then at $1,790 per ounce (100-day moving average).

The European Central Bank Keeps The Status Quo Unchanged

The European Central Bank kept the three key interest rates unchanged and revised its forward guidance to reflect expectations of rising inflation, while maintaining the scale of its asset purchase plan. President Lagarde said that the inflation outlook is still far below the target, and the inflation rebound is expected to be temporary; the forward-looking guidelines will be adjusted to emphasize the commitment to maintain an easing stance.

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。