Gold prices have retreated from the high over the past two days. Yesterday, after the release of US retail sales data, it broke below last week’s low at 2013 (1), reaching a recent bottom of 2001 and the day ended at 2005.

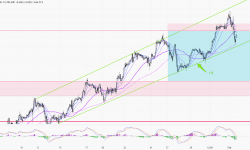

1-hour chart – The trading range mentioned on Monday (2015-2065) was completed before yesterday’s US session. Influenced by the release of US data, prices fell below last week’s low (1). The support at 2000 is still relatively strong. Therefore, I expect the price to be bounded between 2000-20(2) in the next 24 hours. Unless the price breaks below the key support level at 2000, the overall trading pattern will likely be based on the expanded range of 2000-2065 (3).

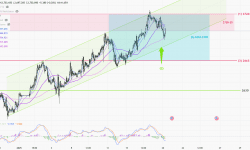

Daily chart – The trend has been weak after a consecutive two-day decline of over $20, and it has breached the support zone of 2015-2022(4). With yesterday’s closing price near the daily low, the price action may suggest that there is still a chance of testing the 2000 level again today. Be alert; if it clears the buying orders at the support of 2000, the next target can be set around 1980 (5).

Weekly chart – The market is still focused on how soon the Fed will begin its first rate cut. According to CME’s FedWatch, the probability of a rate cut in March has dropped from 70% at the beginning of the week to only 60% now. It is important to pay attention to upcoming US data releases and the post-meeting statement from the Federal Reserve in January over the next few weeks. If US data continues to show strength, the timing of a rate cut may be delayed, and there could be a potential adjustment to lower levels in the M-T gold price (6).

|

S-T ressitance 3 |

2030 |

|

S-T ressitance 2 |

2020-22 |

|

S-T ressitance 1 |

2010-13 |

|

Market price |

2008 |

|

S-T support 1 |

2000 |

|

S-T support 2 |

1995 |

|

S-T support 3 |

1990 |

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.