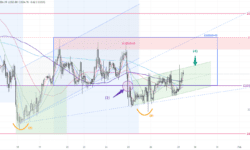

The gold price was under the influence of two major events last week, the FOMC meeting and the non-farm payrolls report, which resulted in significant daily fluctuations; however, the closing price for the entire week resumed its position below 2040, without any clear structural breakthrough. The post-FOMC statement kept the probability of a rate cut in March to a mere 15% (according to CME’s FedWatch Tools). Adding the non-farm payroll data on Fri., once again exceeded the market’s expectation for the second consecutive month and pulled the gold price back below the 2040 range before the week ended.

Although the range trading strategy we’ve been suggesting in recent weeks aligned perfectly with the overall trend in the gold market, and the resistance and support levels performed as expected, last week’s market involved too many uncertain factors. I would say the trading difficulty reached the “Black Diamond” level, with rapid and wide swings in the price movements.

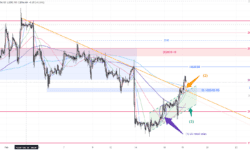

1-Hour Chart – The difficulty of trading should ease down this week as no major economic data is being released, and with the approaching of the CNY holiday. The gold market is expected to resume the range-bound pattern & vibe we saw two weeks ago. After the gold price drops below 2040, we can continue to take advantage of the 2020-40(2)range. The S-T resistance zone remains in 2035-2040(1), nothing new ????????????. However, I believe that in the next 48 hours, we should see the price reaching the bottom of the S-T near 2020.

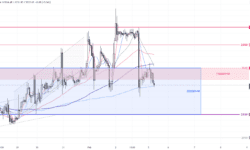

Daily Chart – The range structure we’ve been highlighting in the past few weeks, between 2002-65(3), is still valid. At the moment, the price is trapped within a consolidating triangle pattern(5). For the price to return to the bottom of the range, it needs to break out of the triangle formation. In S-T, keep an eye on the 20-day moving average as a support level.

S-T ressitance 3

2048

S-T ressitance 2

2040

S-T ressitance 1

2030

Market price

2034

S-T support 1

2030

S-T support 2

2027

S-T support 3

2020

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。