黃金的價格在森林體系崩潰後表面上已經和美元沒有關系,但是當美元作為國際上最常用的結算貨幣時,國際上絕大部分貿易包括黃金都是使用美元結算的,所以黃金在一定程度上依然受到美元匯率變動的影響,當美元匯率上升時黃金價格有一定機率會受壓下跌;而美元的匯率受到其國內的經濟狀況和國際貨幣市場的影響。美國國內經濟狀況可以透過其公佈的主要經濟指標來了解,公佈的主要經濟指標包括:國民生產及收入,工產生產及訂單,就業與失業等等。各種數據的重要性取決於當前市場的焦點。市場並不會只關注一樣數據,在不同的時間市場的焦點也不相同。在以往的匯率市場一些貿易數據比較受到關注,如凈資本流入、國內生產總值等。但現時部份數據的影響力已經大減,因為美元憑藉自己作為國際結算貨幣來瘋狂印錢,使投資者漸漸發現其實有很多的經濟數據並不會真正影響到市場。屢創新高的貿易赤字和凈資本流入也未能提供炒作的餘地,因為大家都不意外會出來這樣的結果。現在市場上依然有參考價值的指標是與通貨膨脹有關的數據如消費者物價指數、生產者物價指數等。美國非農數據是除了通脹外可以對黃金價格造成最大影響的數據;美國非農業人口就業數據是就業報告的一種,可以反映出當時製造行業和服務行業的發展及其增長。非農與黃金之間存在一定程度的負相關關係,因為數據能夠反映出美國的勞動力增長規模,所以美聯儲在實施貨幣政策時會把這數據作為參考因素之一。此報告會在每月的第一個星期五由勞工部公佈,一般用來當作當月經濟指標的基調。美國非農數據公佈前,市場會在計算後得出下次公佈數據的預期值和有可能的前值修正。在新公佈數據的實際數值是否符合預期以及和前值對比,會對黃金及美元造成不同的影響。以下為各個經濟情景:

情景

美元指數

黃金價格

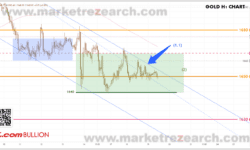

Gold traded in a tight range yesterday. The overall daily movement was pretty much like the day before – pulling back before the day’s end.; the price climbed to the day-high 1660 in the early session and retraced back to the opening price of 1650 before the day’s end.

The S-T trend is still controlled by the S-T downtrend resistance (1.1) that was mentioned yesterday. Overall, the market is bearish. However, the short-selling before 1650 is still relatively weak. Due to the lack of momentum, expect the price to remain within 1640-65(2) until it escapes.

The pullbacks before the day’s end on the second consecutive day have created another bearish signal on the daily chart. Wait for the signal; a new round of selling should only begin if the price close below 1650 on the daily chart; before that, the price should continue to wander around 1650.

S-T Resistances:

1665

1660

1655

Market price: 1651

S-T Supports:

1650

1645

1640

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

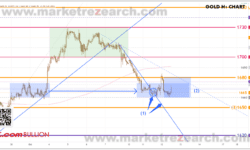

Gold had pullback before the day’s end yesterday. The market opened at 1642 back from the weekend. The price has kept moving higher in the Asian and European sessions. It hit the day-high 1668 at the US session opening, then the price retraced. The day ended at 1650, up by USD8 after all.

The downtrend on the 1-hour chart slowed down yesterday after the price jumped above the trendline(1), shifting the S-T downtrend from (1) to (1.1). Before the next break, expect the price to settle in between 1640-65(2) for now.

Overall the trend is still bearish, and a new bearish signal(3) has appeared after the pullback from 1668 yesterday. The resistance at 1665(4) & the 20 days MA(5) are blocking all the climb for now. Once the price clears the support at 1640, gold should be able to consolidate further.

S-T Resistances:

1670

1665

1660

Market price: 1659

S-T Supports:

1655

1650

1645

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

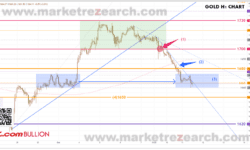

Gold touched a new 1-week low yesterday. The day began at 1667, and the price was traded between 1660-71 throughout the Asian & European sessions. A rapid jump to the day-high 1684 occurred at the US session, but the price got pull-back led to the day ending at 1665, down by USD 2.

The S-T selling trend originated from 1710 has ended yesterday after the price climbed above the downward trendline(1). Waiting for the US Fed. Minutes later today, the price is settling in a tight range between 1660-80(2).

Gold’s pull-back from 1684 yesterday has created a selling signal(4) on the daily chart. The trend on the daily chart remains bearish, and the resistance at the 20-day MA(5) remains in effect.

S-T Resistances:

1680

1676

1670

Market price: 1667

S-T Supports:

1665

1660

1655

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

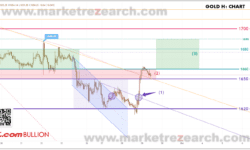

Carried the selling momentum from last Fri., gold sank further yesterday. The market opened at 1694 back from the weekend. After the price briefly touched 1700 during the opening hours, the bearish run began. It cleared the 1680 support in the US opening session and landed at the day-low near 1665. The day ended at 1668, down by USD 25.

Selling resumed after the US employment figures last Fri. After it cleared the 1700 support, an S-T resistance line(2) formed in the past 24 hours; the downward trend should continue before the price breakout from this trendline(2). The next critical support is near 1650(4) for now.

A bottoming signal has yet to appear in the daily chart, where the 20-day MA become the upside resistance again. Gold should touch a new weekly low today. Within the next 24 hours, let’s see if the price can resuming its position within its previous 1653-88(5) trading zone.

S-T Resistances:

1676

1670

1665

Market price: 1663

S-T Supports:

1660

1655

1650

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

Gold renewed the 3-weeks high yesterday. Carried the buying momentum from the day before, a new round of buying was triggered after the price cleared the resistance at 1700 early in the Asian session. The bullish trend continued until it touched the day-high near 1729 late in the US session. The day ended at 1725, up by USD 25.

After all the interventions and the news from the BOJ & the BOE, gold is trading above the critical support of 1680(1) again. The S-T trendline(2) can be used as a resistance reference for the current bullish trend. While the market is now shifting its focus to the US employment figures this Friday unless the price can clear the resistance at 1730, expect the price to remain in 1700-30 in the next 48 hours.

Since gold escaped the downtrend channel (4) and broke out from the 20 days MA, a bullish trend has begun on the daily chart. Unless the price can clear the 50-day MA and trigger a new round of buying, 1700-30 should be the range for today.

S-T Resistances:

1730

1725

1720

Market price: 1718

S-T Supports:

1710

1705

1700

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

Gold rebounded from the new 2-year low. The price has been consolidating during the Asian and European sessions after the market opened at 1628 yesterday. Once the news from BOE hit the market, the surge began. At the US session opening, buying came into the market and cleared the resistance at the trendline(1). The price jumped to the day-high at 1662, with the day ending at 1659, up by USD 31.

The S-T bearish trend has ended as the price trades again above the critical 1650 support. Before it clears the current resistnace at 1660, the price is now trapped in the tight range of 1650-60(1). If the market picks up the bullish momentum later in the European and US sessions, the upside target can again be set at the upper limit of the 1660-90 range.

The gain yesterday formed a clear reversal signal. The following key resistance is now sitting at 1665(4); once it’s clear, the upside target can be set at the upper limit of the downtrend channel(5) or the 20-day MA (6).

S-T Resistances:

1676

1665

1660

Market price: 1653

S-T Supports:

1650

1640

1630-28

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

Gold tested a new 2-year low yesterday. Back from the weekend, gold has dropped to the early low near 1626 in the Asian session. However, the price has quickly rebounded. At the European session, it already reached the day-high at near 1649. Selling resumed in the late US session, where the day ended near the day-low at 1622.

The overall trend in the 1-hour chart is now bearish after the price cleared the 1650(1) support last Friday. Selling momentum so far isn’t too strong; an S-T downtrend channel(2) has been formed. Before the price consolidates further, clearing the support at 1620, the downtrend channel(2) can be used as a reference while trading with the 1620-50(3) range.

While the downtrend channel(5) still affects gold’s movement, the price has been moving lower tier by tier(4) on the daily chart. The range for each tier is approximately USD40 in the past 4 weeks. Expect the price to be bounded between 1610-50(4.1) temporary before the next move for now.

S-T Resistances:

1650

1645-46

1638-40

Market price: 1633

S-T Supports:

1630

1624

1620

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

Gold bounced but failed to break out from the range. The day began at 1664 yesterday. The price was bounded by a tight 1660-65 range early in the Asian session. It reached the early peak of 1677 at the EU session after Putin’s speech. At the US Fed. The announcement, gold has rebounded quickly from the 1653 day-low to the weekly high of 1688. The day eventually ended at 1673, up slightly from yesterday.

Market reaction was mixed after the US Fed. Meeting. The price is still controlled by the S-T 1660-80(1) range in the 1-hour chart; v can continue to take advantage of this range before it escapes.

The buying support below 1665(2) remains effective as gold hasn’t been able to close below it in the daily chart. It will be the first sign of the price going down if it closes below 1665 on the daily chart. On the other hand, if the price fails to sink below 1665 in the next 48 hours, a jump toward 1700 may begin.

S-T Resistances:

1680

1670

1665

Market price: 1661

S-T Supports:

1660

1650-52

1640

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。

Awaited Fed. rate decision, gold prices remained stable yesterday. The day began at 1675, where the price overall was trending downward throughout the early Asian and European sessions. It cleared the S-T trendline(1) at the US session and traveled all the way to 1660, the daily low from the day before. The day ended at 1664, down by USD 19.

1660-80(2) can be used as an operating range before the US Fed. An announcement later on today.

Since gold cleared the 1680 support, the downward resistance line(5) is dominating the daily chart trend. The S-T support 1665(4) is still in effect. The Fed. announcement will take over the next major movement.

S-T Resistances:

1687-90

1680

1670

Market price: 1666

S-T Supports:

1665

1660

1650-52

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。