Gold trend 2/1

Expect the price to consolidate further in S-T before the trading volume returns from the holiday.

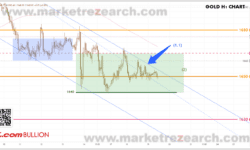

1-hour chart – Gold prices reached a recent high of 2088 in early trading last Thu. However, it failed to hold above 2080. After the price escaped from the uptrend channel(1) at the end of last week, gold formed an S-T downward channel(2) in the past 48 trading hours. The price has departed from the downward trend (2) early in the Asian session today, indicating an S-T rebound. After touching 2070, expect the price to be bounded by 2050-70.

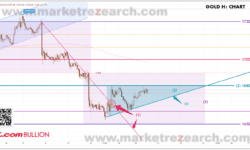

Daily Chart – The overall trading volume in the gold market has been low since Dec. 20th. Without significant trading volume driving, the gold price failed to hold above 2081(4), and experienced a round of profit-taking during this holiday period. The resistance zone remains between 2070-2075. Unless the price can clear this resistance, we can expect the price to consolidate further. Support levels to watch below include the 20-day MA(5) and the support line (6). Gold needs to wait for a high-volume environment in order for it to surge higher. Keeping an eye on the release of US employment data at the end of this week.

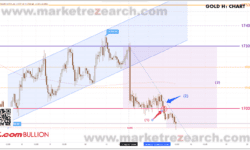

S-T ressitance 3

2080-1

S-T ressitance 2

2075

S-T ressitance 1

2070-72

Market price

2069

S-T support 1

2060

S-T support 2

2055

S-T support 3

2050

P. To

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.

場外式黃金/白銀交易的風險:

場外式黃金/白銀交易由 Max Online 提供。場外式黃金/白銀交易涉及高度風險,未必適合所有投資者。高度的槓桿可為閣下帶來負面或正面的影響。場外式黃金/白銀並非受證券及期貨事務監察委員會(「證監會」)監管,因此買賣場外式黃金/白銀將不會受到證監會所頒布的規則或規例所約束,包括(但不限於)客戶款項規則。閣下在決定買賣場外式黃金/白銀之前應審慎考慮自己的投資目標、交易經驗以及風險接受程度。可能出現的情況包括蒙受部分或全部初始投資額的損失,或在極端情況下(例如相關市場跳空)產生更多的損失。因此,閣下不應將無法承受損失的資金用於投資。投資應知悉買賣場外式黃金/白銀有關的一切風險,如有需要,請向獨立財務顧問尋求意見。